Question: Question 1 [5 marks] You have been asked to select one of the three market views developed by your group in stage 1. Using this

![Question 1 [5 marks] You have been asked to select one](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f70831bfd73_52166f708313d582.jpg)

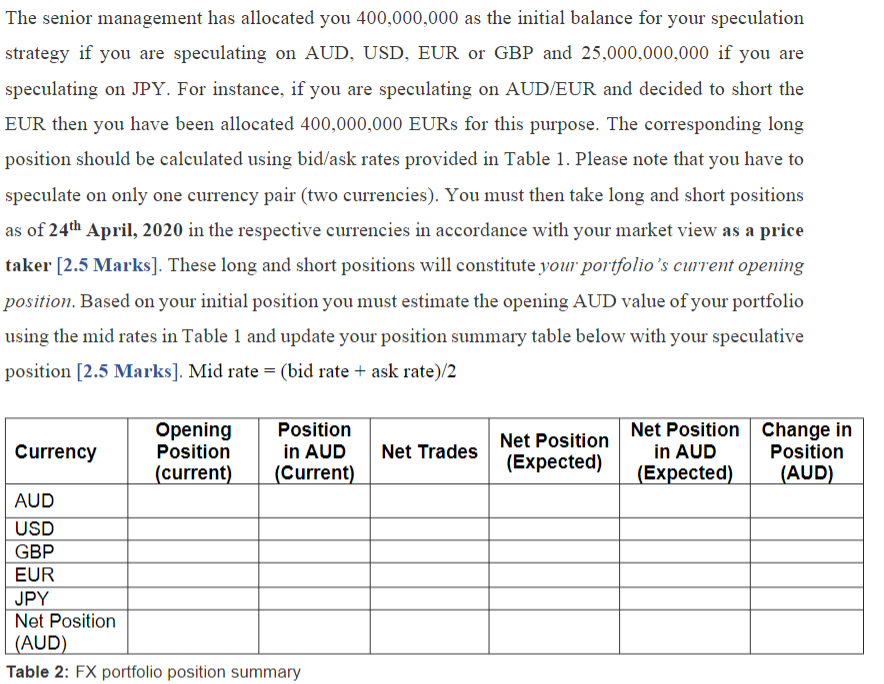

Question 1 [5 marks] You have been asked to select one of the three market views developed by your group in stage 1. Using this market view, devise a speculation strategy that enables your organisation to take advantage of your predicted changes in the exchange rates. You should specify which currencies you will buy or sell. As part of your strategy you must create a portfolio as of 24th of April, 2020. This portfolio will comprise of the currency pair analysed in your market view. Comm / Terms Bid Ask Mid AUD/USD 0.5741 0.5743 0.5742 AUD/EUR 0.5378 0.5381 0.5380 EUR/AUD 1.8588 1.8591 1.8590 AUD/GBP 0.4956 0.4960 0.4958 GBP/AUD 2.0169 2.0174 2.0172 AUD/JPY 63.48 63.52 63.5 EUR/USD 1.0673 1.0675 1.0674 GBP/USD 1.1580 1.1584 1.1582 USD/JPY 110.62 110.64 110.63 EUR/GBP 0.9214 0.9218 0.9216 EUR/JPY 118.05 118.10 118.08 GBP/JPY 128.09 128.14 128.12 Table 1: Exchange rates for April 24, 2020. Mid rate = (bid rate + ask rate)/2 The senior management has allocated you 400,000,000 as the initial balance for your speculation strategy if you are speculating on AUD, USD, EUR or GBP and 25,000,000,000 if you are speculating on JPY. For instance, if you are speculating on AUD/EUR and decided to short the EUR then you have been allocated 400,000,000 EURs for this purpose. The corresponding long position should be calculated using bid/ask rates provided in Table 1. Please note that you have to speculate on only one currency pair (two currencies). You must then take long and short positions as of 24th April, 2020 in the respective currencies in accordance with your market view as a price taker [2.5 Marks]. These long and short positions will constitute your portfolio's current opening position. Based on your initial position you must estimate the opening AUD value of your portfolio using the mid rates in Table 1 and update your position summary table below with your speculative position [2.5 Marks]. Mid rate = (bid rate + ask rate)/2 Net Trades Net Position (Expected) Net Position Change in in AUD Position (Expected) (AUD) Opening Position Currency Position in AUD (current) (Current) AUD USD GBP EUR JPY Net Position (AUD) Table 2: FX portfolio position summary Question 1 [5 marks] You have been asked to select one of the three market views developed by your group in stage 1. Using this market view, devise a speculation strategy that enables your organisation to take advantage of your predicted changes in the exchange rates. You should specify which currencies you will buy or sell. As part of your strategy you must create a portfolio as of 24th of April, 2020. This portfolio will comprise of the currency pair analysed in your market view. Comm / Terms Bid Ask Mid AUD/USD 0.5741 0.5743 0.5742 AUD/EUR 0.5378 0.5381 0.5380 EUR/AUD 1.8588 1.8591 1.8590 AUD/GBP 0.4956 0.4960 0.4958 GBP/AUD 2.0169 2.0174 2.0172 AUD/JPY 63.48 63.52 63.5 EUR/USD 1.0673 1.0675 1.0674 GBP/USD 1.1580 1.1584 1.1582 USD/JPY 110.62 110.64 110.63 EUR/GBP 0.9214 0.9218 0.9216 EUR/JPY 118.05 118.10 118.08 GBP/JPY 128.09 128.14 128.12 Table 1: Exchange rates for April 24, 2020. Mid rate = (bid rate + ask rate)/2 The senior management has allocated you 400,000,000 as the initial balance for your speculation strategy if you are speculating on AUD, USD, EUR or GBP and 25,000,000,000 if you are speculating on JPY. For instance, if you are speculating on AUD/EUR and decided to short the EUR then you have been allocated 400,000,000 EURs for this purpose. The corresponding long position should be calculated using bid/ask rates provided in Table 1. Please note that you have to speculate on only one currency pair (two currencies). You must then take long and short positions as of 24th April, 2020 in the respective currencies in accordance with your market view as a price taker [2.5 Marks]. These long and short positions will constitute your portfolio's current opening position. Based on your initial position you must estimate the opening AUD value of your portfolio using the mid rates in Table 1 and update your position summary table below with your speculative position [2.5 Marks]. Mid rate = (bid rate + ask rate)/2 Net Trades Net Position (Expected) Net Position Change in in AUD Position (Expected) (AUD) Opening Position Currency Position in AUD (current) (Current) AUD USD GBP EUR JPY Net Position (AUD) Table 2: FX portfolio position summary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts