Question: QUESTION 1 5 points EXTRA CREDIT - SAVE THIS QUESTION FOR LAST - YOUR WORK ON A SIMILAR QUESTION MAY HELP WITH YOUR ANSWER Ann

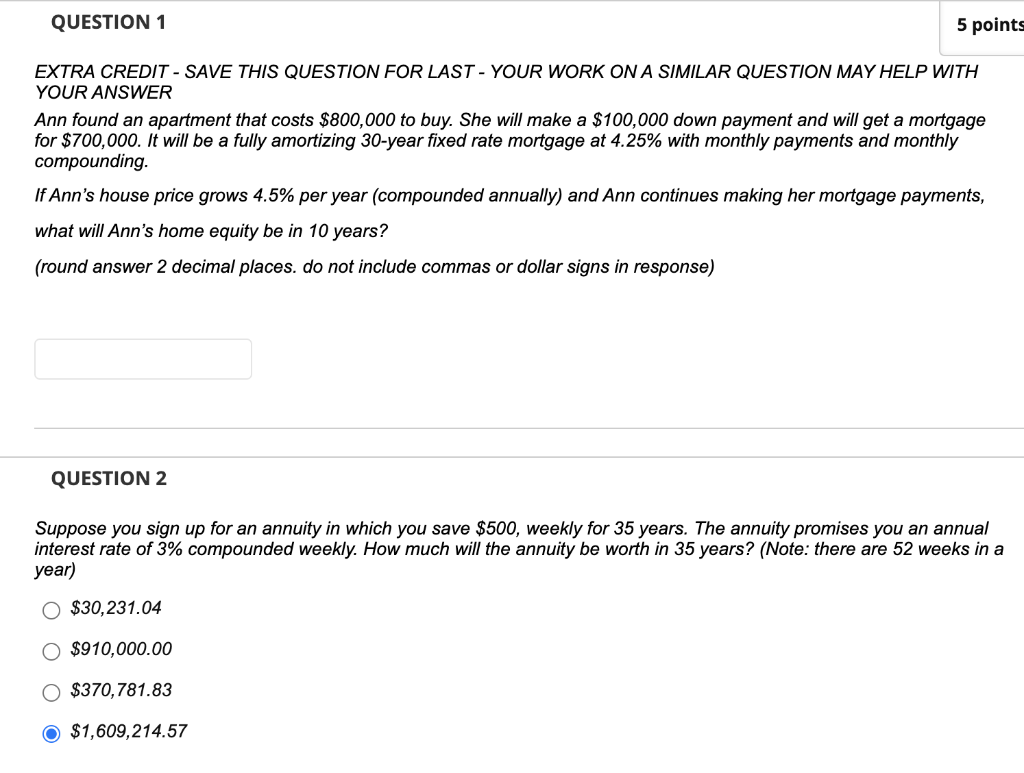

QUESTION 1 5 points EXTRA CREDIT - SAVE THIS QUESTION FOR LAST - YOUR WORK ON A SIMILAR QUESTION MAY HELP WITH YOUR ANSWER Ann found an apartment that costs $800,000 to buy. She will make a $100,000 down payment and will get a mortgage for $700,000. It will be a fully amortizing 30-year fixed rate mortgage at 4.25% with monthly payments and monthly compounding. If Ann's house price grows 4.5% per year (compounded annually) and Ann continues making her mortgage payments, what will Ann's home equity be in 10 years? (round answer 2 decimal places. do not include commas or dollar signs in response) QUESTION 2 Suppose you sign up for an annuity in which you save $500, weekly for 35 years. The annuity promises you an annual interest rate of 3% compounded weekly. How much will the annuity be worth in 35 years? (Note: there are 52 weeks in a year) $30,231.04 $910,000.00 $370,781.83 $1,609,214.57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts