Question: Question 1 (5 points) Texfinity would like to raise $10 million in 5 years from now to replace aging technology. How much money must the

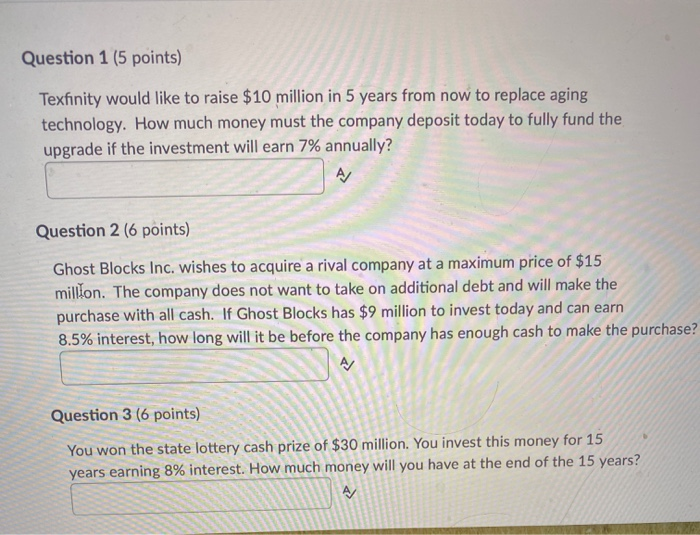

Question 1 (5 points) Texfinity would like to raise $10 million in 5 years from now to replace aging technology. How much money must the company deposit today to fully fund the upgrade if the investment will earn 7% annually? AJ Question 2 (6 points) Ghost Blocks Inc. wishes to acquire a rival company at a maximum price of $15 million. The company does not want to take on additional debt and will make the purchase with all cash. If Ghost Blocks has $9 million to invest today and can earn 8.5% interest, how long will it be before the company has enough cash to make the purchase? Question 3 (6 points) You won the state lottery cash prize of $30 million. You invest this money for 15 years earning 8% interest. How much money will you have at the end of the 15 years? A/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts