Question: Question 1 (5 points) You managed a risky portfolio with an expected rate of return of 8% and a standard deviation of 28%. The T-bill

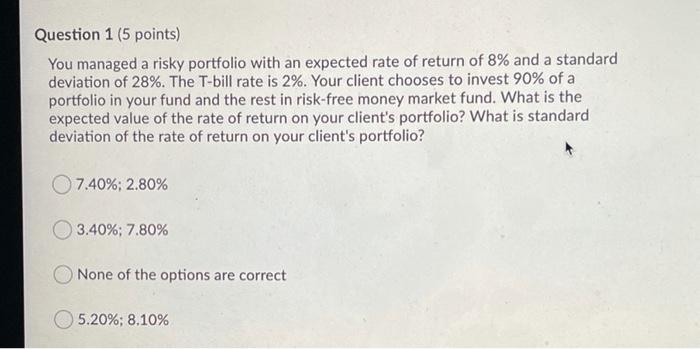

Question 1 (5 points) You managed a risky portfolio with an expected rate of return of 8% and a standard deviation of 28%. The T-bill rate is 2%. Your client chooses to invest 90% of a portfolio in your fund and the rest in risk-free money market fund. What is the expected value of the rate of return on your client's portfolio? What is standard deviation of the rate of return on your client's portfolio? 7.40%: 2.80% 3.40%: 7.80% None of the options are correct 5.20%; 8.10%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock