Question: Question 1 50 Points Suppose that a U.S. Fl has the following assets and liabilities: Assets $10 million cash (in dollars) $100 million U.S. loans

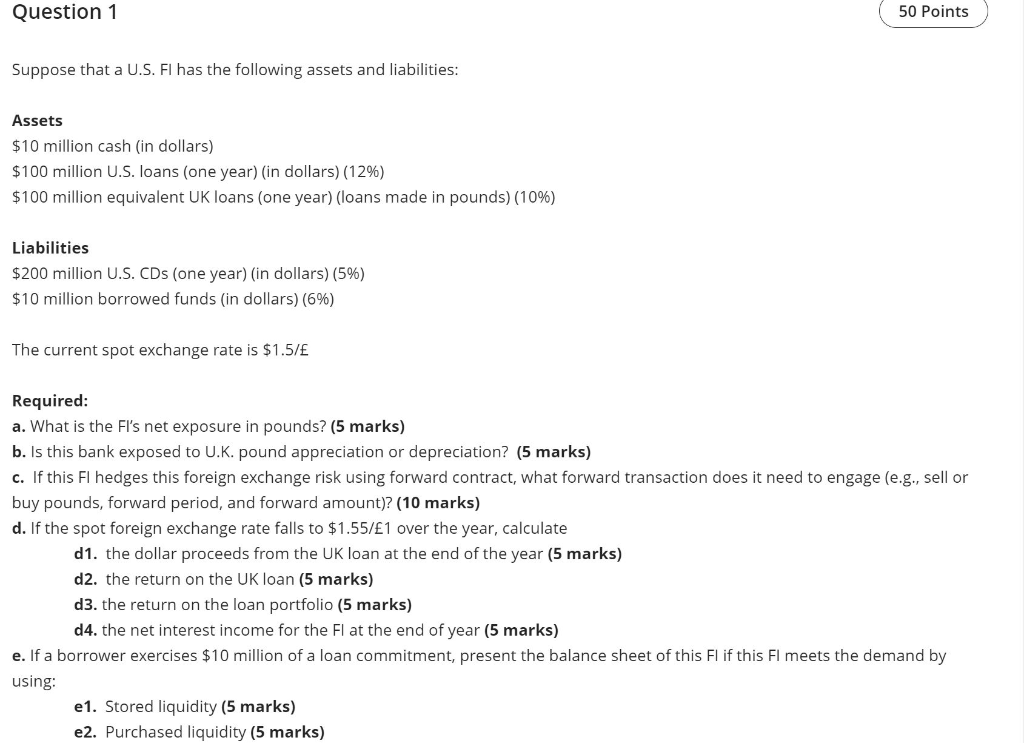

Question 1 50 Points Suppose that a U.S. Fl has the following assets and liabilities: Assets $10 million cash (in dollars) $100 million U.S. loans (one year) (in dollars) (12%) $100 million equivalent UK loans (one year) (loans made in pounds) (10%) Liabilities $200 million U.S. CDs (one year) (in dollars) (5%) $10 million borrowed funds (in dollars) (6%) The current spot exchange rate is $1.5/ Required: a. What is the Fl's net exposure in pounds? (5 marks) b. Is this bank exposed to U.K. pound appreciation or depreciation? (5 marks) c. If this Fl hedges this foreign exchange risk using forward contract, what forward transaction does it need to engage (e.g., sell or buy pounds, forward period, and forward amount)? (10 marks) d. If the spot foreign exchange rate falls to $1.55/1 over the year, calculate d1. the dollar proceeds from the UK loan at the end of the year (5 marks) d2. the return on the UK loan (5 marks) d3. the return on the loan portfolio (5 marks) d4. the net interest income for the Fl at the end of year (5 marks) e. If a borrower exercises $10 million of a loan commitment, present the balance sheet of this Fl if this Fl meets the demand by using: e1. Stored liquidity (5 marks) e2. Purchased liquidity (5 marks) Question 1 50 Points Suppose that a U.S. Fl has the following assets and liabilities: Assets $10 million cash (in dollars) $100 million U.S. loans (one year) (in dollars) (12%) $100 million equivalent UK loans (one year) (loans made in pounds) (10%) Liabilities $200 million U.S. CDs (one year) (in dollars) (5%) $10 million borrowed funds (in dollars) (6%) The current spot exchange rate is $1.5/ Required: a. What is the Fl's net exposure in pounds? (5 marks) b. Is this bank exposed to U.K. pound appreciation or depreciation? (5 marks) c. If this Fl hedges this foreign exchange risk using forward contract, what forward transaction does it need to engage (e.g., sell or buy pounds, forward period, and forward amount)? (10 marks) d. If the spot foreign exchange rate falls to $1.55/1 over the year, calculate d1. the dollar proceeds from the UK loan at the end of the year (5 marks) d2. the return on the UK loan (5 marks) d3. the return on the loan portfolio (5 marks) d4. the net interest income for the Fl at the end of year (5 marks) e. If a borrower exercises $10 million of a loan commitment, present the balance sheet of this Fl if this Fl meets the demand by using: e1. Stored liquidity (5 marks) e2. Purchased liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts