Question: QUESTION # 1 ( 6 0 Marks ) Poplar Tree Inc. ( PTI ) is a Canadian company. Its functional and reporting currency is the

QUESTION # Marks

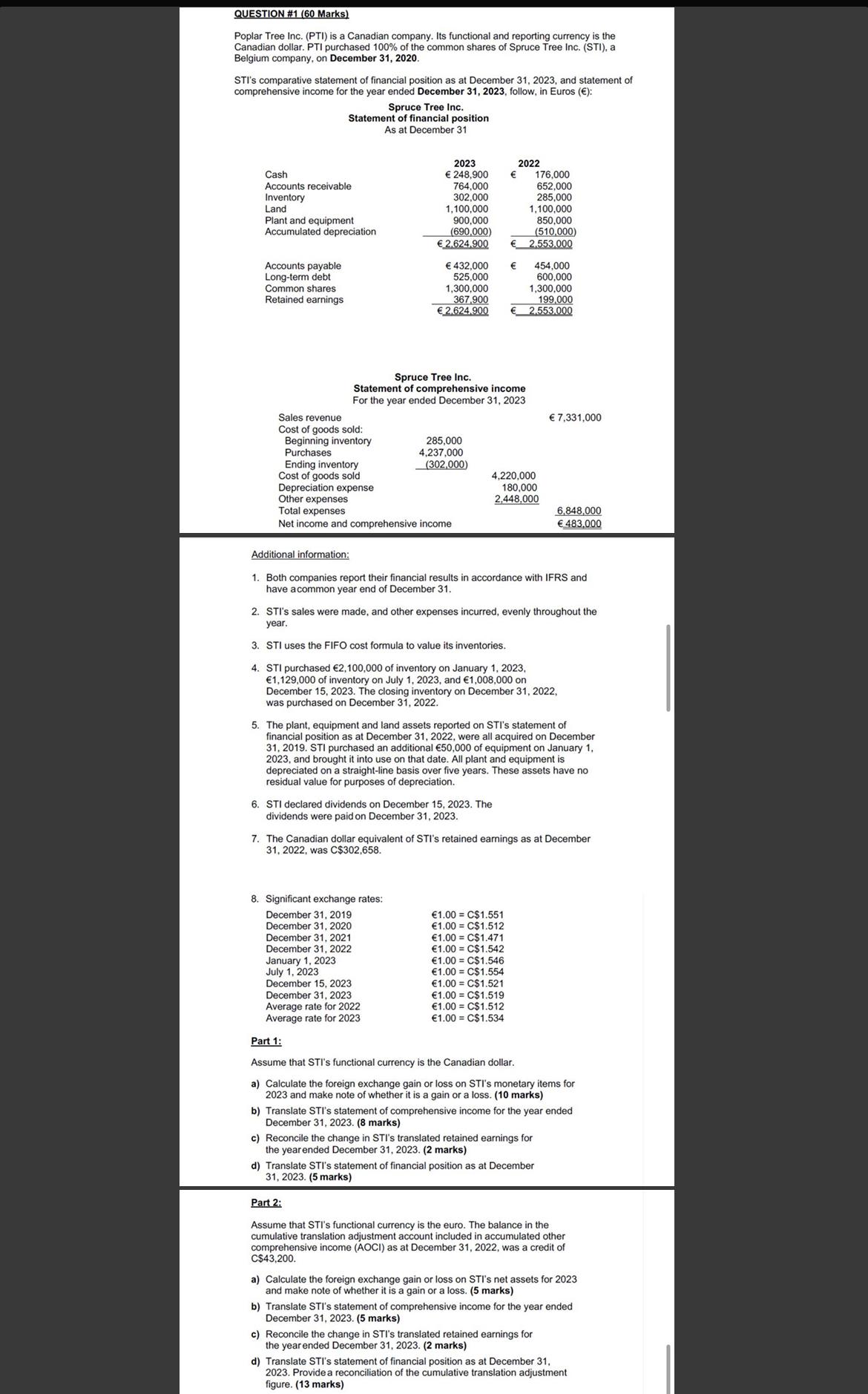

Poplar Tree Inc. PTI is a Canadian company. Its functional and reporting currency is the Canadian dollar. PTI purchased of the common shares of Spruce Tree Inc. STI a Belgium company, on December

STI's comparative statement of financial position as at December and statement of comprehensive income for the year ended December follow, in Euros :

Spruce Tree Inc.

Statement of financial position As at December

Additional information:

Both companies report their financial results in accordance with IFRS and have acommon year end of December

STI's sales were made, and other expenses incurred, evenly throughout the year.

STI uses the FIFO cost formula to value its inventories.

STI purchased of inventory on January of inventory on July and on December The closing inventory on December was purchased on December

The plant, equipment and land assets reported on STI's statement of financial position as at December were all acquired on December STI purchased an additional of equipment on January and brought it into use on that date. All plant and equipment is depreciated on a straightline basis over five years. These assets have no residual value for purposes of depreciation.

STI declared dividends on December The dividends were paid on December

The Canadian dollar equivalent of STI's retained earnings as at December was $

Significant exchange rates:

December

December

December

December

January

July

December

December

Average rate for

Average rate for

Part :

Assume that STI's functional currency is the Canadian dollar.

a Calculate the foreign exchange gain or loss on STI's monetary items for and make note of whether it is a gain or a loss. marks

b Translate STI's statement of comprehensive income for the year ended December marks

c Reconcile the change in STI's translated retained earnings for the year ended December marks

d Translate STI's statement of financial position as at December marks

Part :

Assume that STI's functional currency is the euro. The balance in the cumulative translation adjustment account included in accumulated other comprehensive income AOCI as at December was a credit of C $

a Calculate the foreign exchange gain or loss on STI's net assets for and make note of whether it is a gain or a loss. marks

b Translate STI's statement of comprehensive income for the year ended December marks

c Reconcile the change in STI's translated retained earnings for the year ended December marks

d Translate STI's statement of financial position as at December Providea reconciliation of the cumulative translation adjustment figure. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock