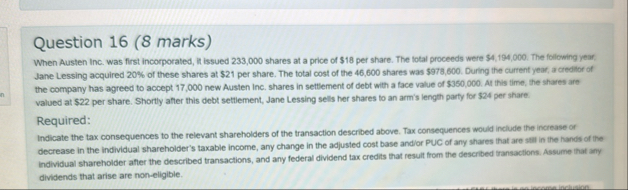

Question: Question 1 6 ( 8 marks ) When Austen inc. was first incorporated, it issued 2 3 3 , 0 0 0 shares at a

Question marks

When Austen inc. was first incorporated, it issued shares at a price of $ per share. The total proceeds were $ The following year Jane Lessing acquired of these shares at $ per share. The total cost of the shares was $ During the current year, a creditor of the company has agreed to accept new Austen inc. shares in settlement of debt with a face value of $ At this time, the shares are valued at $ per share. Shortly after this debt settlement, Jane Lessing sells her shares to an arm's length party for $ per share.

Required:

Indicate the tax consequences to the relevant shareholders of the transaction described above. Tax consequences would include the increase or decrease in the individual shareholder's taxable income, any change in the adjusted cost base andor PUC of any shares that are sill in the hands of the Individual shareholder after the described transactions, and any federal dividend tax credits that result from the described transactions. Assume that ary dividends that arise are noneligible.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock