Question: Question 1 6 Five years ago, Tom loaned his son John $ 2 0 , 0 0 0 to start a business. A note was

Question

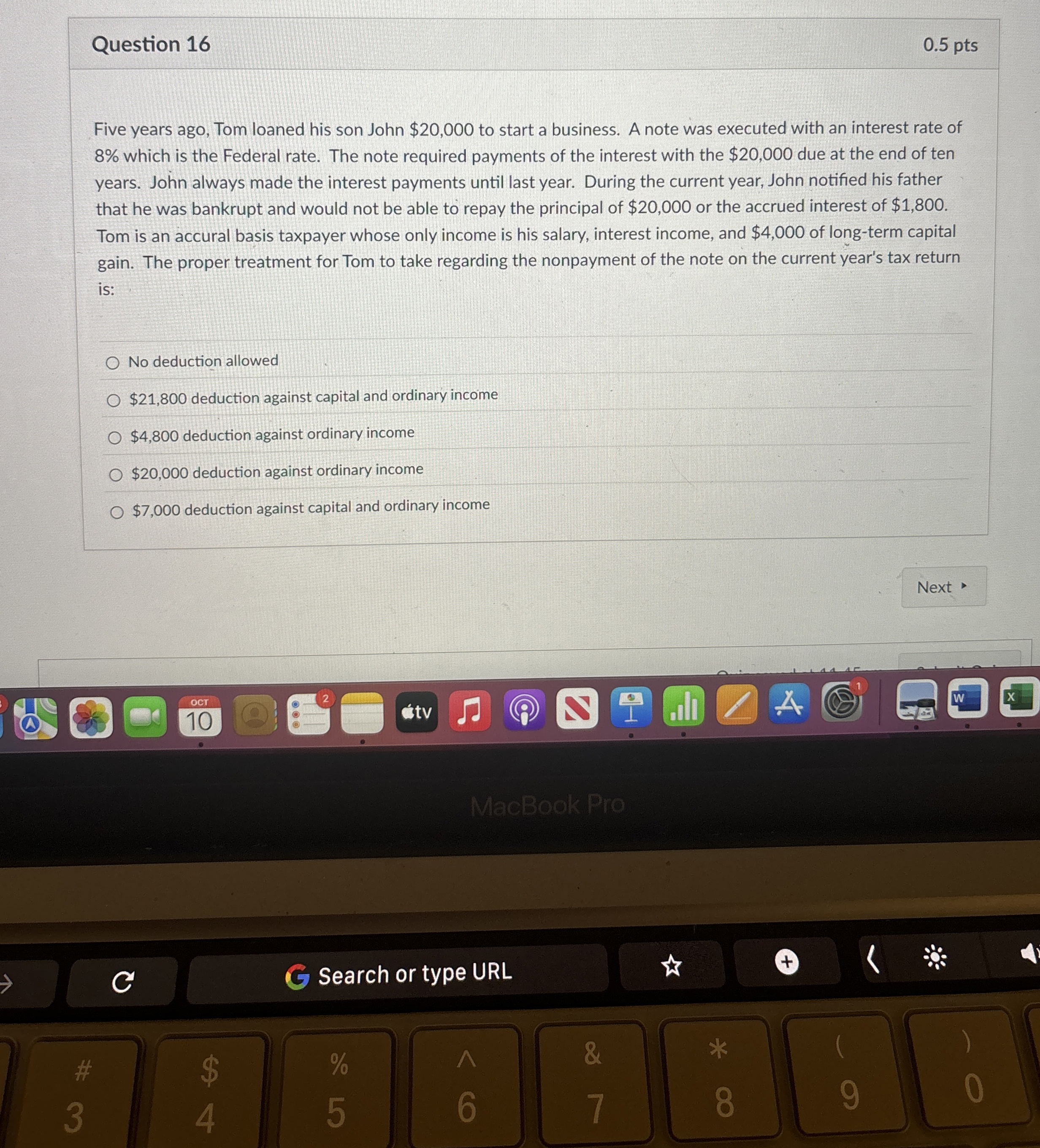

Five years ago, Tom loaned his son John $ to start a business. A note was executed with an interest rate of

which is the Federal rate. The note required payments of the interest with the $ due at the end of ten

years. John always made the interest payments until last year. During the current year, John notified his father

that he was bankrupt and would not be able to repay the principal of $ or the accrued interest of $

Tom is an accural basis taxpayer whose only income is his salary, interest income, and $ of longterm capital

gain. The proper treatment for Tom to take regarding the nonpayment of the note on the current year's tax return

is:

No deduction allowed

$ deduction against capital and ordinary income

$ deduction against ordinary income

$ deduction against ordinary income

$ deduction against capital and ordinary income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock