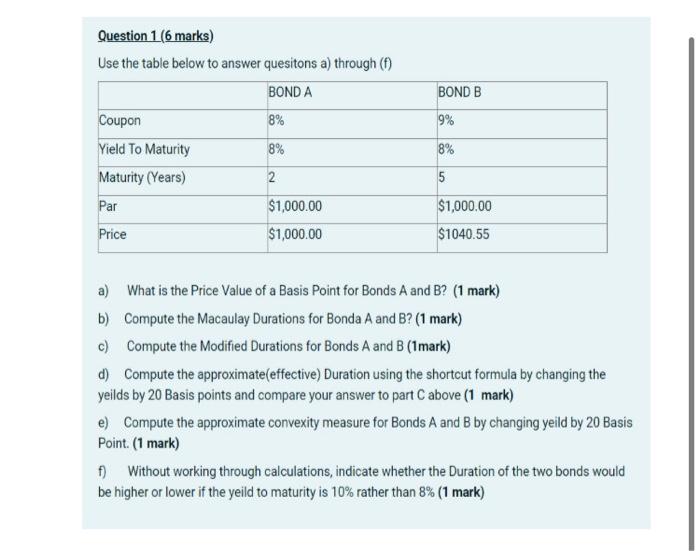

Question: Question 1 (6 marks) Use the table below to answer quesitons a) through (f) BOND A BOND B Coupon 8% 9% Yield To Maturity

Question 1 (6 marks) Use the table below to answer quesitons a) through (f) BOND A BOND B Coupon 8% 9% Yield To Maturity 8% 8% Maturity (Years) 2 5 Par $1,000.00 $1,000.00 Price $1,000.00 $1040.55 a) What is the Price Value of a Basis Point for Bonds A and B? (1 mark) b) Compute the Macaulay Durations for Bonda A and B? (1 mark) c) Compute the Modified Durations for Bonds A and B (1mark) d) Compute the approximate(effective) Duration using the shortcut formula by changing the yeilds by 20 Basis points and compare your answer to part C above (1 mark) e) Compute the approximate convexity measure for Bonds A and B by changing yeild by 20 Basis Point. (1 mark) f) Without working through calculations, indicate whether the Duration of the two bonds would be higher or lower if the yeild to maturity is 10% rather than 8% (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts