Question: Question 1 6 points Save Answer DD Food complex has the following information on its financial statements as of March 31, 2021. The company has

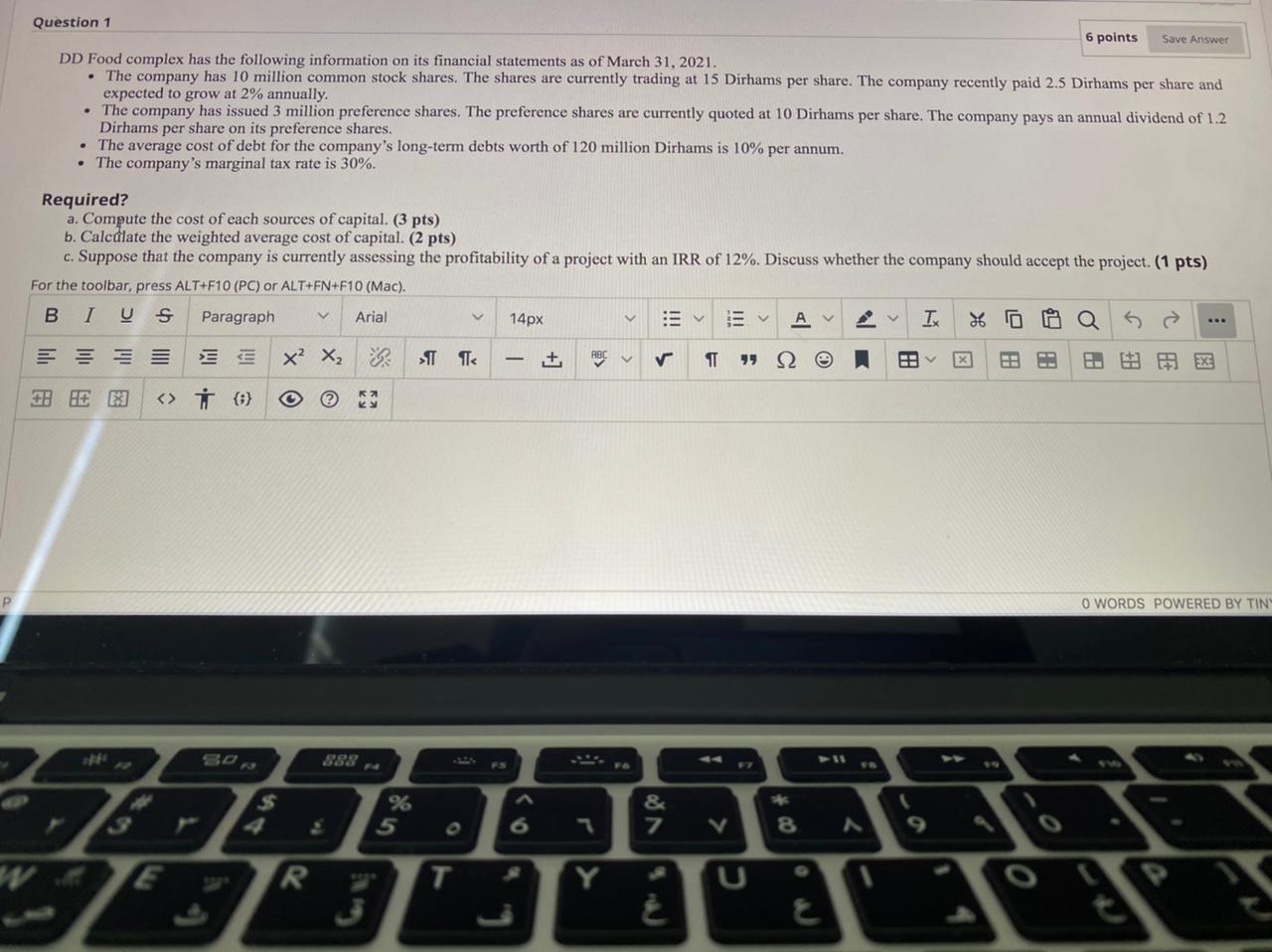

Question 1 6 points Save Answer DD Food complex has the following information on its financial statements as of March 31, 2021. The company has 10 million common stock shares. The shares are currently trading at 15 Dirhams per share. The company recently paid 2.5 Dirhams per share and expected to grow at 2% annually. The company has issued 3 million preference shares. The preference shares are currently quoted at 10 Dirhams per share. The company pays an annual dividend of 1.2 Dirhams per share on its preference shares. The average cost of debt for the company's long-term debts worth of 120 million Dirhams is 10% per annum. The company's marginal tax rate is 30%. Required? a. Compute the cost of each sources of capital. (3 pts) b. Calcdlate the weighted average cost of capital. (2 pts) c. Suppose that the company is currently assessing the profitability of a project with an IRR of 12%. Discuss whether the company should accept the project. (1 pts) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI U S Paragraph Arial 14px A IK ==== X2 X > Tc - +] ABC 199 12 EU E EX H HE E () O WORDS POWERED BY TIN % & 7 1 8 R T +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts