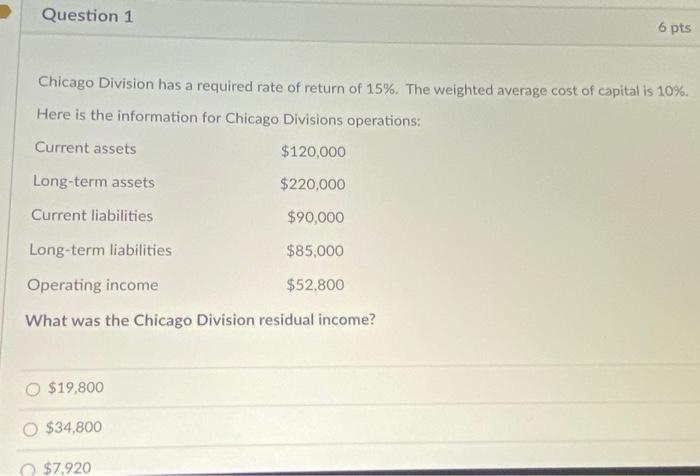

Question: Question 1 6 pts Chicago Division has a required rate of return of 15%. The weighted average cost of capital is 10%. Here is the

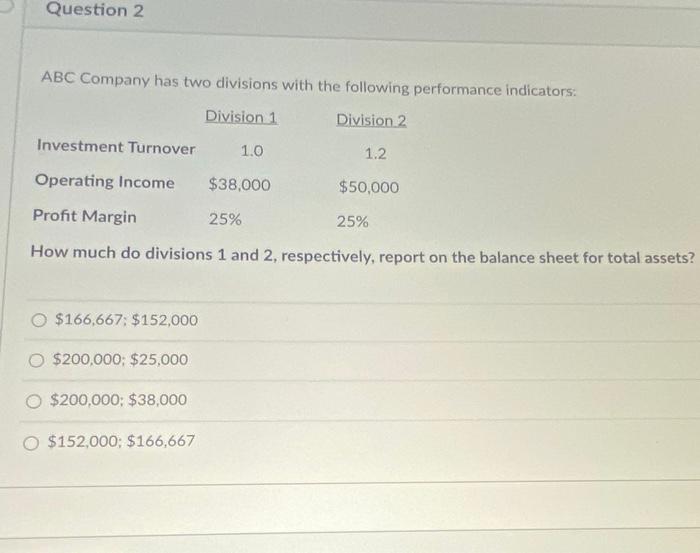

Question 1 6 pts Chicago Division has a required rate of return of 15%. The weighted average cost of capital is 10%. Here is the information for Chicago Divisions operations: Current assets $120,000 Long-term assets $220,000 Current liabilities $90,000 Long-term liabilities $85,000 Operating income $52,800 What was the Chicago Division residual income? $19,800 $34,800 $7.920 Question 2 ABC Company has two divisions with the following performance indicators: Division 1 Division 2 Investment Turnover 1.0 1.2 Operating Income $38,000 $50,000 Profit Margin 25% 25% How much do divisions 1 and 2, respectively, report on the balance sheet for total assets? O $166,667: $152,000 O $200,000 $25,000 O $200,000: $38,000 $152,000; $166,667

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts