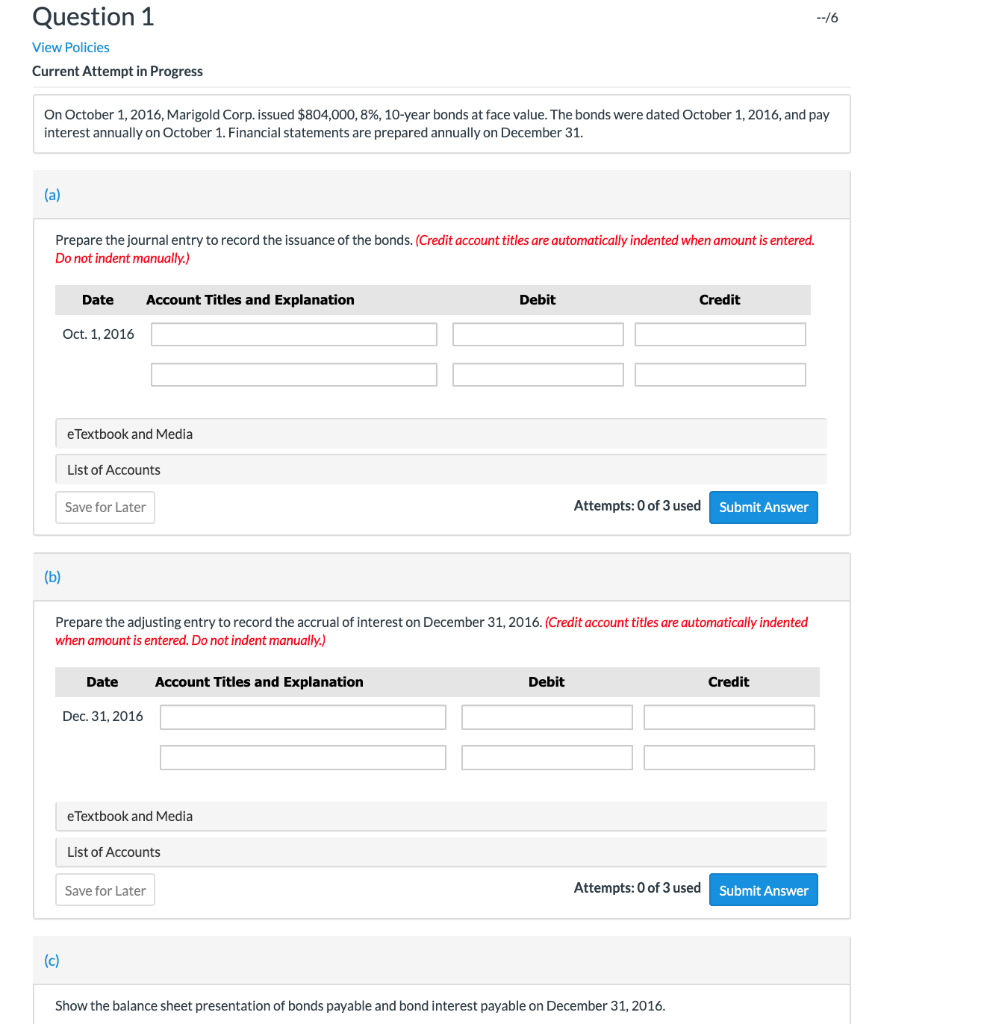

Question: Question 1 --/6 View Policies Current Attempt in Progress On October 1, 2016, Marigold Corp. issued $804,000, 8%, 10-year bonds at face value. The bonds

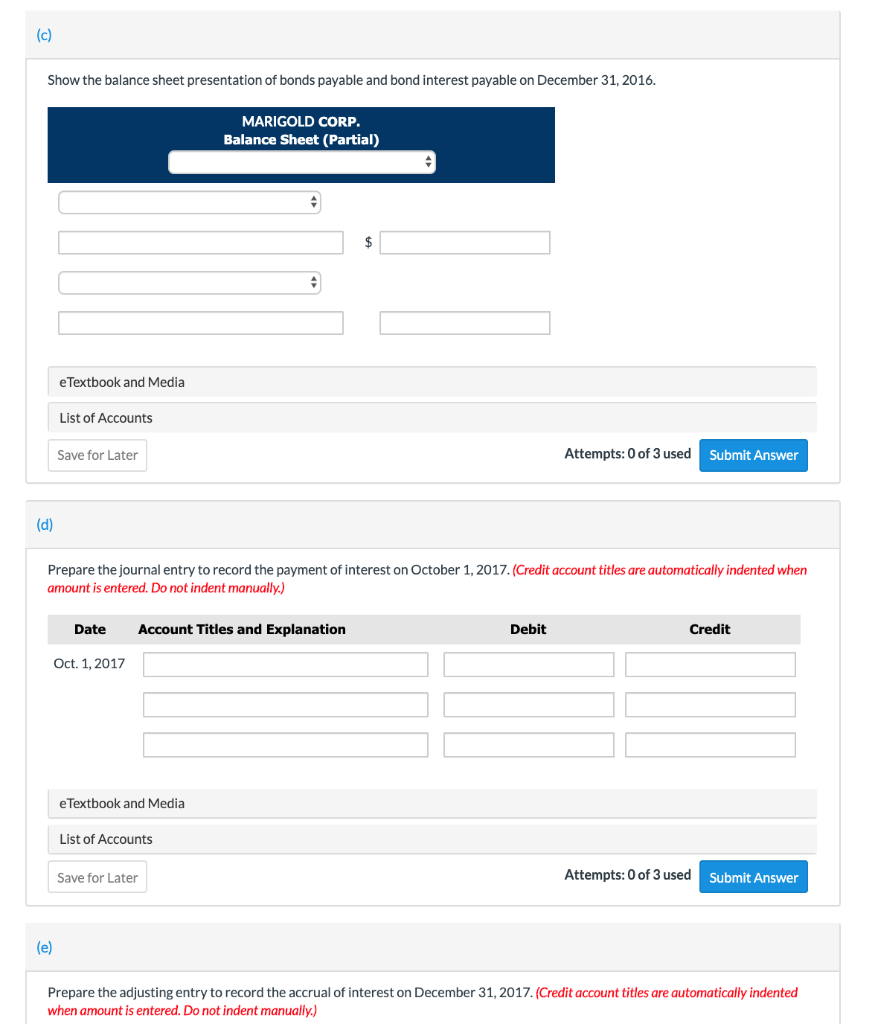

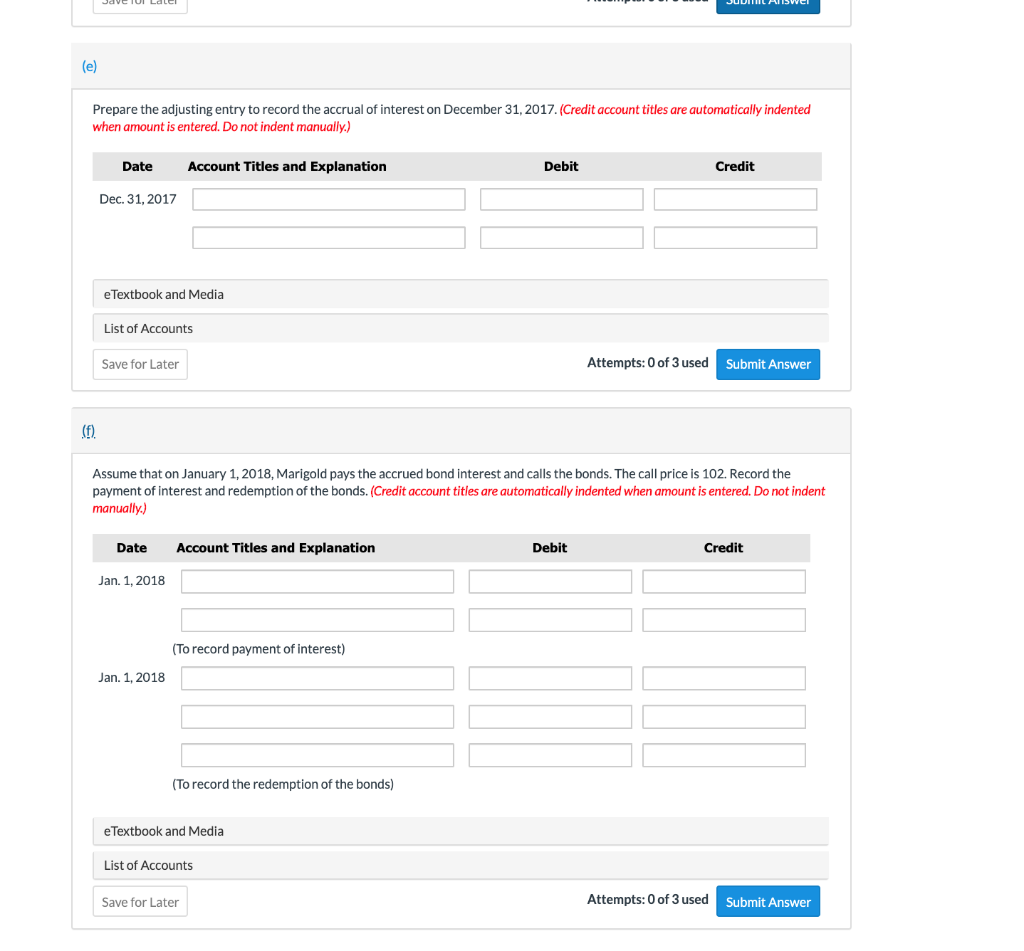

Question 1 --/6 View Policies Current Attempt in Progress On October 1, 2016, Marigold Corp. issued $804,000, 8%, 10-year bonds at face value. The bonds were dated October 1, 2016, and pay interest annually on October 1. Financial statements are prepared annually on December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Oct. 1, 2016 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer Prepare the adjusting entry to record the accrual of interest on December 31, 2016. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec 31, 2016 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer Show the balance sheet presentation of bonds payable and bond interest payable on December 31, 2016. Show the balance sheet presentation of bonds payable and bond interest payable on December 31, 2016. MARIGOLD CORP. Balance Sheet (Partial) $ e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer Prepare the journal entry to record the payment of interest on October 1, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Oct. 1, 2017 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer Prepare the adjusting entry to record the accrual of interest on December 31, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Jave IUI Lalel Prepare the adjusting entry to record the accrual of interest on December 31, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2017 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer Assume that on January 1, 2018, Marigold pays the accrued bond interest and calls the bonds. The call price is 102. Record the payment of interest and redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1, 2018 (To record payment of interest) Jan. 1, 2018 (To record the redemption of the bonds) e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts