Question: QUESTION 1 7 1 2 points Show - Your - Work 1 . A company wishes to hedge its exposure to a new fuel whose

QUESTION

points

ShowYourWork A company wishes to hedge its exposure to a new fuel whose price changes have a correlation with gasoline futures price changes. The company has an exposure to the price of million gallons of the new fuel. The new fuel's price change has a standard deviation of and the price change in gasoline futures prices has a standard deviation of The company decides to minimize the risk by using gasoline futures, though the variance of the change in new fuel's price cannot be completely eliminated by hedging. Each gasoline futures contract is on gallons. Ignore daily settlement.

a What should be the hedge ratio?

b What position measured in gallons should the company take in gasoline futures?

c How many gasoline futures contracts should be traded?

d What is the hedging effectiveness? Interpret this number in words.

Note: Write down your answers along with your work to this problem in the box provided bel

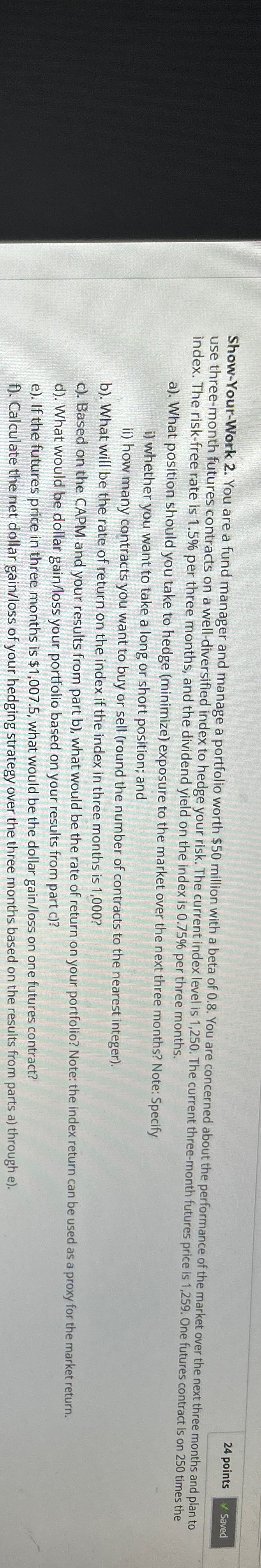

ShowYourWork You are a fund manager and manage a portfolio worth $ million with a beta of You are concerned about the performance of the market over the next three mon use threemonth futures contracts on a welldiversified index to hedge your risk. The current index level is The current threemonth futures price is One futures contract is on times the index. The riskfree rate is per three months, and the dividend yield on the index is per three months.

a What position should you take to hedge minimize exposure to the market over the next three months? Note: Specify

i whether you want to take a long or short position; and

ii how many contracts you want to buy or sell round the number of contracts to the nearest integer

b What will be the rate of return on the index if the index in three months is

c Based on the CAPM and your results from part b what would be the rate of return on your portfolio? Note: the index return can be used as a proxy for the market return.

d What would be dollar gainloss your portfolio based on your results from part c

e If the futures price in three months is $ what would be the dollar gainloss on one futures contract?

f Calculate the net dollar gainloss of your hedging strategy over the three months based on the results from parts a through e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock