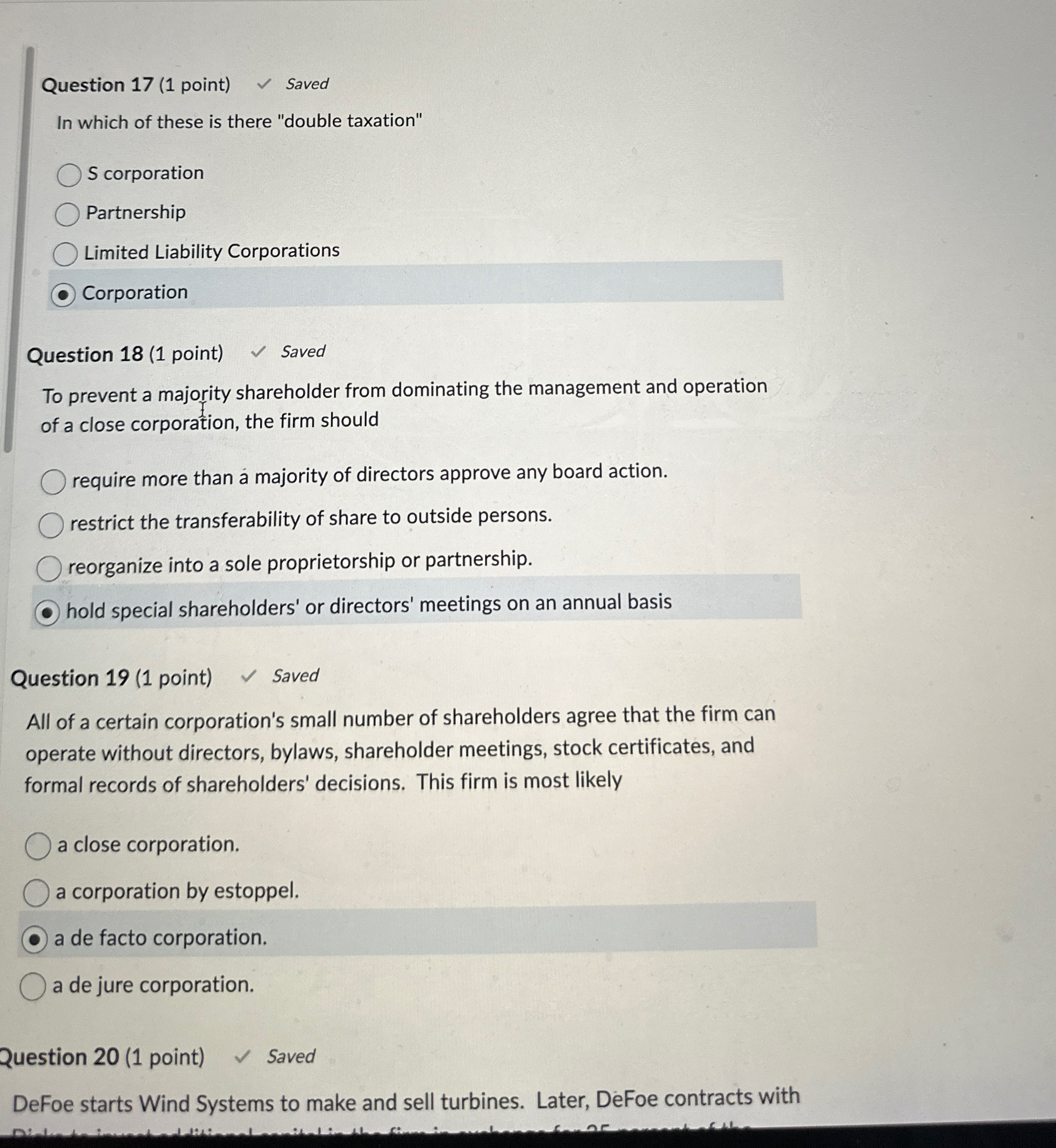

Question: Question 1 7 ( 1 point ) Saved In which of these is there double taxation S corporation Partnership Limited Liability Corporations Corporation Question 1

Question point

Saved

In which of these is there "double taxation"

S corporation

Partnership

Limited Liability Corporations

Corporation

Question point

Saved

To prevent a majority shareholder from dominating the management and operation of a close corporation, the firm should

require more than majority of directors approve any board action.

restrict the transferability of share to outside persons.

reorganize into a sole proprietorship or partnership.

hold special shareholders' or directors' meetings on an annual basis

Question point

Saved

All of a certain corporation's small number of shareholders agree that the firm can operate without directors, bylaws, shareholder meetings, stock certificates, and formal records of shareholders' decisions. This firm is most likely

a close corporation.

a corporation by estoppel.

a de facto corporation.

a de jure corporation.

Question point

Saved

DeFoe starts Wind Systems to make and sell turbines. Later, DeFoe contracts with

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock