Question: Question 1 7 4 pts ABC Partnership is taking on D as a new 2 5 % capital partner in return for her ongoing marketing

Question

pts

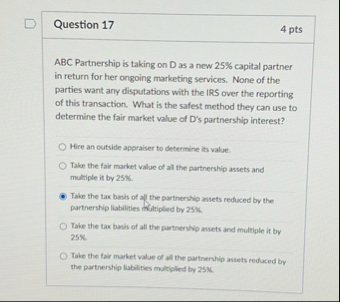

ABC Partnership is taking on D as a new capital partner in return for her ongoing marketing services. None of the parties want any disputations with the IRS over the reporting of this transaction. What is the safest method they can use to determine the fair market value of Ds partnership interest?

Hire an outside appraiser to determine its value.

Take the fair market value of all the putreeship assets and multiple it by

Take the tax basis of alf the partnership assets reduced by the partnership liabilities multiplied by

Take the tax basis of all the partnerslip assets and multiple it by

Take the tair market value of all the partnership assets reduced by the partnership liabilities multiplied by

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock