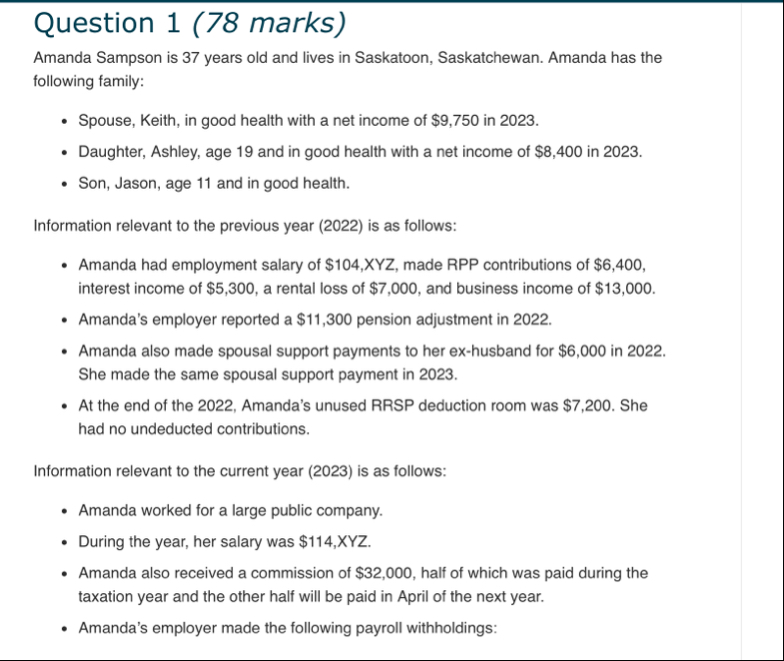

Question: Question 1 ( 7 8 marks ) Amanda Sampson is 3 7 years old and lives in Saskatoon, Saskatchewan. Amanda has the following family: Spouse,

Question marks

Amanda Sampson is years old and lives in Saskatoon, Saskatchewan. Amanda has the following family:

Spouse, Keith, in good health with a net income of $ in

Daughter, Ashley, age and in good health with a net income of $ in

Son, Jason, age and in good health.

Information relevant to the previous year is as follows:

Amanda had employment salary of $XYZ made RPP contributions of $ interest income of $ a rental loss of $ and business income of $

Amanda's employer reported a $ pension adjustment in

Amanda also made spousal support payments to her exhusband for $ in She made the same spousal support payment in

At the end of the Amanda's unused RRSP deduction room was $ She had no undeducted contributions.

Information relevant to the current year is as follows:

Amanda worked for a large public company.

During the year, her salary was $

Amanda also received a commission of $ half of which was paid during the taxation year and the other half will be paid in April of the next year.

Amanda's employer made the following payroll withholdings:tableRPP contributions,$CPP contributions,El Premiums,Donations to registered charities,Union dues,Payments for personal use of company car,Premiums to company's disability insurance plan,

Other relevant information includes the following:

Amanda's employer makes a matching contribution to the company's RPP on behalf of Amanda.

Amanda's employer makes a matching contribution to the company's disability insurance plan on behalf of Amanda. The comprehensive disability insurance plan provides periodic benefits during any period of disability to compensate for lost employment income. Due to a month sick leave, Amanda receives disability insurance benefits of $ Amanda has been making the same contribution each year since She has had no disability insurance claims in any of the calendar years to

Amanda's employer provides her with an automobile that was purchased in for $ Her employer pays all of the operating expenses, which totalled $ During the year, Amanda drove the car a total of kilometers, of which were for employment use with for personal use. The automobile was available to Amanda for months of the year.Amanda is required to maintain an office in her home without reimbursement from her employer. Her employer provides the required T form. She uses of the home's usable floor space for her office. The home office expenses are:

tableUtilities and maintenance,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock