Question: Question 1 7 ( Mandatory ) ( 1 point ) Given the financial data for three mutually exclusive alternatives in the table below, determine the

Question Mandatory point

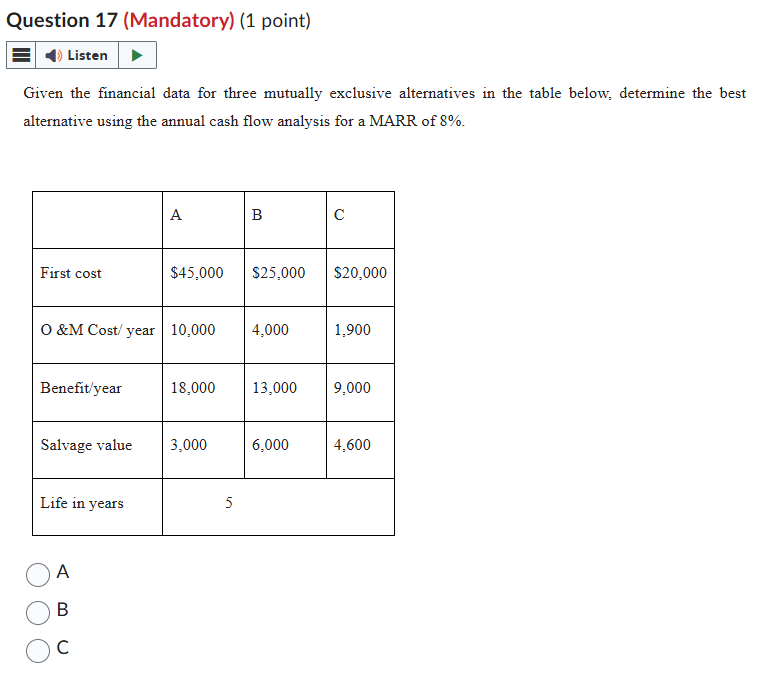

Given the financial data for three mutually exclusive alternatives in the table below, determine the best alternative using the annual cash flow analysis for a MARR of

begintabularllll

hline & A & B & C

hline First cost & $ & $ & $

hline O &M Cost year & & &

hline Benefityear & & &

hline Salvage value & & &

hline Life in years & multicolumnc

hline

endtabular

A

B

C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock