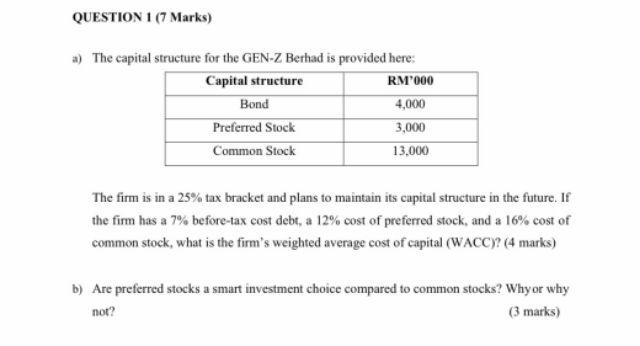

Question: QUESTION 1 (7 Marks) a) The capital structure for the GEN-Z Berhad is provided here Capital structure RM'000 Bond 4,000 Preferred Stock 3,000 Common Stock

QUESTION 1 (7 Marks) a) The capital structure for the GEN-Z Berhad is provided here Capital structure RM'000 Bond 4,000 Preferred Stock 3,000 Common Stock 13,000 The firm is in a 25% tax bracket and plans to maintain its capital structure in the future. If the firm has a 7% before-tax cost debt, a 12% cost of preferred stock, and a 16% cost of common stock, what is the firm's weighted average cost of capital (WACC)? (4 marks) b) Are preferred stocks a smart investment choice compared to common stocks? Whyor why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts