Question: Question 1 (7 marks) (Note this question is from the Week 4 Tutorial) Imagine that you are a manager in a large entity and need

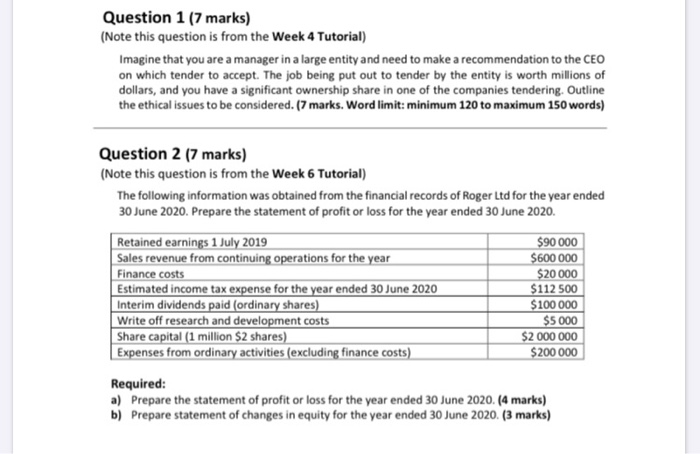

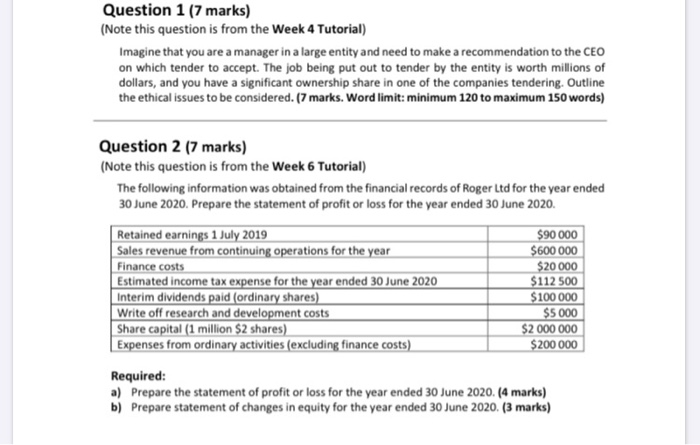

Question 1 (7 marks) (Note this question is from the Week 4 Tutorial) Imagine that you are a manager in a large entity and need to make a recommendation to the CEO on which tender to accept. The job being put out to tender by the entity is worth millions of dollars, and you have a significant ownership share in one of the companies tendering. Outline the ethical issues to be considered. (7 marks. Word limit: minimum 120 to maximum 150 words) Question 2 (7 marks) (Note this question is from the Week 6 Tutorial) The following information was obtained from the financial records of Roger Ltd for the year ended 30 June 2020. Prepare the statement of profit or loss for the year ended 30 June 2020. Retained earnings 1 July 2019 $90 000 Sales revenue from continuing operations for the year $600 000 Finance costs $20 000 Estimated income tax expense for the year ended 30 June 2020 $112 500 Interim dividends paid (ordinary shares) $ 100 000 Write off research and development costs $5 000 Share capital (1 million $2 shares) $2 000 000 Expenses from ordinary activities (excluding finance costs) $200 000 Required: a) Prepare the statement of profit or loss for the year ended 30 June 2020. (4 marks) b) Prepare statement of changes in equity for the year ended 30 June 2020. (3 marks) Question 1 (7 marks) (Note this question is from the Week 4 Tutorial) Imagine that you are a manager in a large entity and need to make a recommendation to the CEO on which tender to accept. The job being put out to tender by the entity is worth millions of dollars, and you have a significant ownership share in one of the companies tendering. Outline the ethical issues to be considered. (7 marks. Word limit: minimum 120 to maximum 150 words) Question 2 (7 marks) (Note this question is from the Week 6 Tutorial) The following information was obtained from the financial records of Roger Ltd for the year ended 30 June 2020. Prepare the statement of profit or loss for the year ended 30 June 2020. Retained earnings 1 July 2019 $90 000 Sales revenue from continuing operations for the year $600 000 Finance costs $20 000 Estimated income tax expense for the year ended 30 June 2020 $112 500 Interim dividends paid (ordinary shares) $100 000 Write off research and development costs $5 000 Share capital (1 million $2 shares) $2 000 000 Expenses from ordinary activities (excluding finance costs) $200 000 Required: a) Prepare the statement of profit or loss for the year ended 30 June 2020. (4 marks) b) Prepare statement of changes in equity for the year ended 30 June 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts