Question: Question 1 7 of 8 5 . Which of the following taxpayers qualifies for the Child Tax Crodit? Bruce has a daughter, Kala, who was

Question of

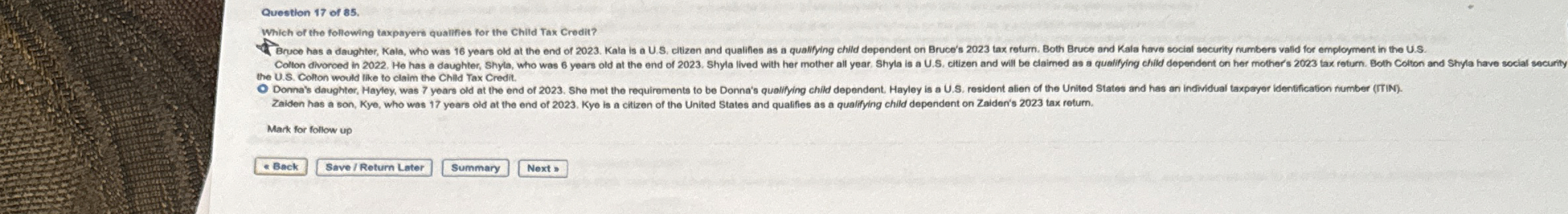

Which of the following taxpayers qualifies for the Child Tax Crodit?

Bruce has a daughter, Kala, who was years old at the end of Kala is a US cilizen and qualilies as a quallying child dependent on Bruce's tax roturn. Both Bruces and Kala have social security numbers vald for emplorment in the US Colton divorced in He has a daughter, Shyta, who was years old at the end of Shyla lived with her mother all year. Shyla is a US citizen and will be claimed as a quatifying child dependent on her mothers lax retum. Both Colton and Shyla have social security the US Collon would like to daim the Chid Tax Credit. Zaiden has a son, Kye, who was years old at the end of Kyo is a citizen of the United States and qualfies as a qualifying child dependent on Zaiden's tax returm.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock