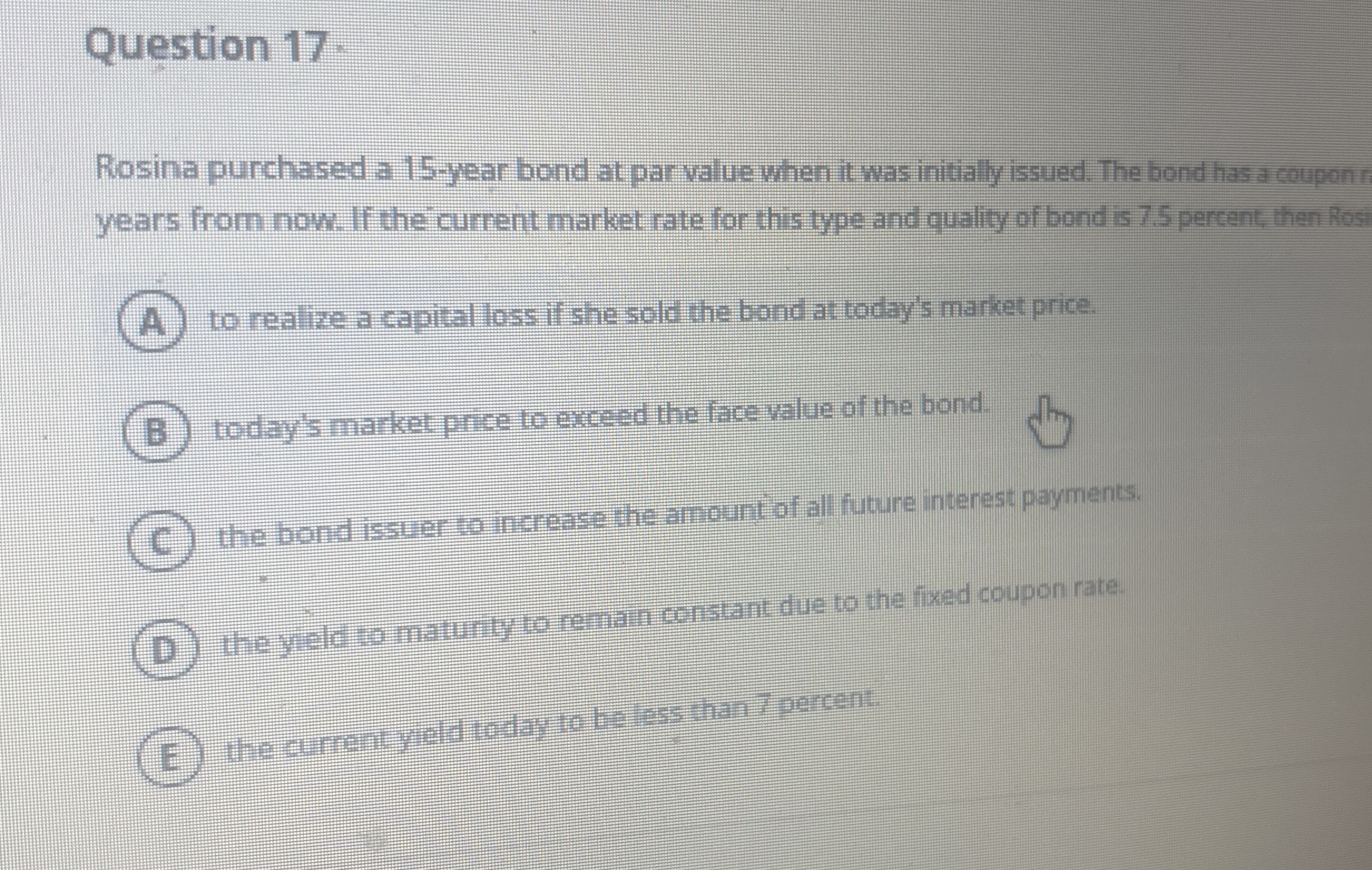

Question: Question 1 7 . Rosina purchased a 1 5 - year bond at par value when it was initially issued. The bond has a couponr

Question

Rosina purchased a year bond at par value when it was initially issued. The bond has a couponr years from now. If the current market rate for this type and quality of bond is percent, then Ros

to realize a capital loss if she sold the bond at today's market price.

today's market price to exceed the face value of the bond.

the bond issuer to increase the amount of all future interest piyments.

the yold to maturty to remain constant due to the fixed coupon rate.

the cirrent yeld today to lie tese than percent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock