Question: Question 1 (75 marks in total) You have been asked to prepare a report to Management on the current risk profile of the bank. (a)

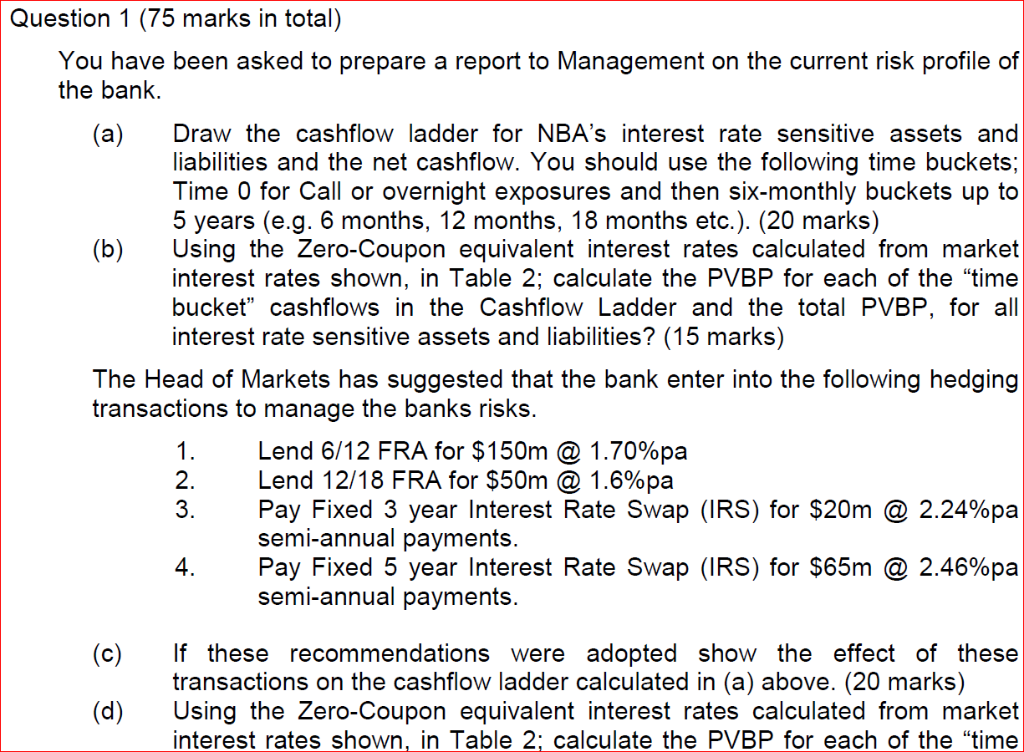

Question 1 (75 marks in total) You have been asked to prepare a report to Management on the current risk profile of the bank. (a) Draw the cashflow ladder for NBAs interest rate sensitive assets and liabilities and the net cashflow. You should use the following time buckets; Time 0 for Call or overnight exposures and then six-monthly buckets up to 5 years (e.g. 6 months, 12 months, 18 months etc.). (20 marks) (b) Using the Zero-Coupon equivalent interest rates calculated from market interest rates shown, in Table 2; calculate the PVBP for each of the time bucket cashflows in the Cashflow Ladder and the total PVBP, for all interest rate sensitive assets and liabilities? (15 marks) The Head of Markets has suggested that the bank enter into the following hedging transactions to manage the banks risks. 1. Lend 6/12 FRA for $150m @ 1.70%pa 2. Lend 12/18 FRA for $50m @ 1.6%pa 3. Pay Fixed 3 year Interest Rate Swap (IRS) for $20m @ 2.24%pa semi-annual payments. 4. Pay Fixed 5 year Interest Rate Swap (IRS) for $65m @ 2.46%pa semi-annual payments. (c) If these recommendations were adopted show the effect of these transactions on the cashflow ladder calculated in (a) above. (20 marks) (d) Using the Zero-Coupon equivalent interest rates calculated from market interest rates shown, in Table 2; calculate the PVBP for each of the time bucket cashflows in the Cashflow Ladder and the total PVBP, for all interest rate sensitive assets and liabilities? (10 marks) (e) What do the results from the analysis in (c) and (d) tell you about the banks risk profile if the hedges were undertaken? (10 marks)

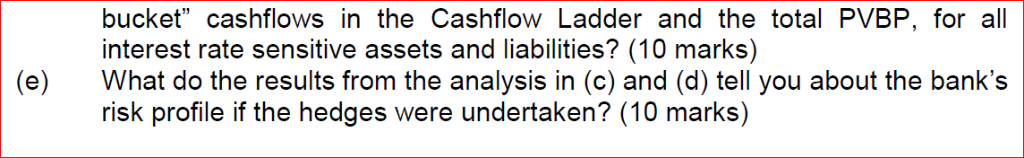

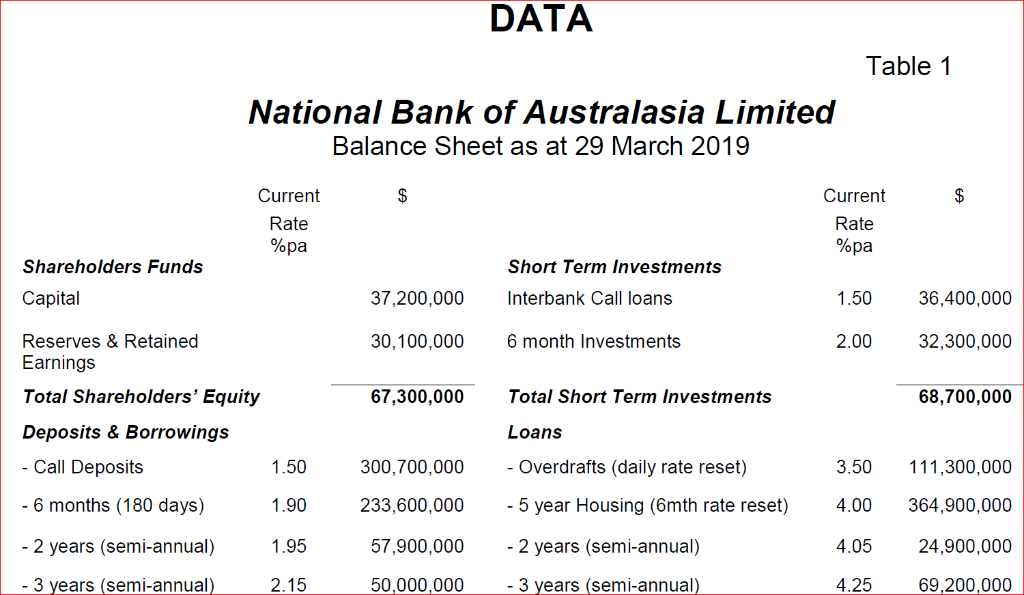

Question 1 (75 marks in total) You have been asked to prepare a report to Management on the current risk profile of the bank. Draw the cashflow ladder for NBA's interest rate sensitive assets and iabilities and the net cashflow. You should use the following time buckets; Time 0 for Call or overnight exposures and then six-monthly buckets up to 5 years (e.g. 6 months, 12 months, 18 months etc.). (20 marks) Using the Zero-Coupon equivalent interest rates calculated from market interest rates shown, in Table 2; calculate the PVBP for each of the "time bucket" cashflows in the Cashflow Ladder and the total PVBP, for all interest rate sensitive assets and liabilities? (15 marks) (a) (b) The Head of Markets has suggested that the bank enter into the following hedging transactions to manage the banks risks. Lend 6/12FRA for $150m @ 1.70%pa Lend 12/18 FRA for $50m @ 1.6%pa Pay Fixed 3 year Interest Rate Swap (IRS) for $20m @ 2.24%pa semi-annual payments. Pay Fixed 5 year Interest Rate Swap (IRS) for $65m @ 2.46%pa semi-annual payments. 1. 2. 3. 4. (c) If these recommendations were adopted show the effect of these transactions on the cashflow ladder calculated in (a) above. (20 marks) Using the Zero-Coupon equivalent interest rates calculated from market interest rates shown, in Table 2; calculate the PVBP for each of the "time (d) bucket" cashflows in the Cashflow Ladder and the total PVBP, for all interest rate sensitive assets and liabilities? (10 marks) What do the results from the analysis in (c) and (d) tell you about the bank's risk profile if the hedges were undertaken? (10 marks) (e) DATA Table 1 National Bank of Australasia Limited Balance Sheet as at 29 March 2019 Current Rate %pa Current Rate %pa Shareholders Funds Capital Reserves & Retained Earnings Total Shareholders' Equity Deposits & Borrowings Short Term Investments 1.50 36,400,000 32,300,000 68,700,000 37,200,000 Interbank Call loans 30,100,0006 month Investments 67,300,000 2.00 Total Short Term Investments Loans - Overdrafts (daily rate reset) Call Deposits 6 months (180 days) 2 years (semi-annual) 3 years (semi-annual) 1.50 1.90 1.95 2.15 300,700,000 233,600,000 57,900,000 50,000,000 3.50111,300,000 5 year Housing (6mth rate reset)4.00364,900,000 24,900,000 69,200,000 4.05 2 years (semi-annual) 4.25 3 years (semi-annual) 20,300.000 85,400,000 655,700,000 5,400,000 729,800,000 - 5years (semi-annual) 2.25 5 years semi-annual Total Loans Property, plant and equipment 4.35 Total 662,500,000 729,800,000 Table 2 1 year 1.5 Call 4.5 2.5 3.5 4 %pa Par Zero months 1.84 1.84 yearsyears years years years yearsyears years 1.50 1.50 1.40 1.40 1.41 1.41 1.721.601.491.44 1.711.601.491.44 1.42 1.431.44 1.421.431.44 Additional Information 1. You have noted that the zero-coupon equivalent interest rates are similar to the PAR rates because the yield curve is relatively flat over the period to 5 years. All of the above interest rates, except Call, are semi-annually compounding interest rates 2. The interest rates shown in the balance sheet are the average interest rates applicable to each of the instrument types and each maturity band in the balance sheet as at the date of the balance sheet. You have assumed for the purposes of the calculations that these rates represent the cost or revenue (as the case may be) for the purposes of calculating cashflows and returns 3. NBA Bank's marginal borrowing and lending rates for terms of 6 months are priced or set by reference to the Australian Bank Accepted Bill (BAB) interest rate and at the Commonwealth Government Security (CGS) rate for terns of one year and longer These underlying interest rates are reflected in the interest rates set out in Table 2 above. Question 1 (75 marks in total) You have been asked to prepare a report to Management on the current risk profile of the bank. Draw the cashflow ladder for NBA's interest rate sensitive assets and iabilities and the net cashflow. You should use the following time buckets; Time 0 for Call or overnight exposures and then six-monthly buckets up to 5 years (e.g. 6 months, 12 months, 18 months etc.). (20 marks) Using the Zero-Coupon equivalent interest rates calculated from market interest rates shown, in Table 2; calculate the PVBP for each of the "time bucket" cashflows in the Cashflow Ladder and the total PVBP, for all interest rate sensitive assets and liabilities? (15 marks) (a) (b) The Head of Markets has suggested that the bank enter into the following hedging transactions to manage the banks risks. Lend 6/12FRA for $150m @ 1.70%pa Lend 12/18 FRA for $50m @ 1.6%pa Pay Fixed 3 year Interest Rate Swap (IRS) for $20m @ 2.24%pa semi-annual payments. Pay Fixed 5 year Interest Rate Swap (IRS) for $65m @ 2.46%pa semi-annual payments. 1. 2. 3. 4. (c) If these recommendations were adopted show the effect of these transactions on the cashflow ladder calculated in (a) above. (20 marks) Using the Zero-Coupon equivalent interest rates calculated from market interest rates shown, in Table 2; calculate the PVBP for each of the "time (d) bucket" cashflows in the Cashflow Ladder and the total PVBP, for all interest rate sensitive assets and liabilities? (10 marks) What do the results from the analysis in (c) and (d) tell you about the bank's risk profile if the hedges were undertaken? (10 marks) (e) DATA Table 1 National Bank of Australasia Limited Balance Sheet as at 29 March 2019 Current Rate %pa Current Rate %pa Shareholders Funds Capital Reserves & Retained Earnings Total Shareholders' Equity Deposits & Borrowings Short Term Investments 1.50 36,400,000 32,300,000 68,700,000 37,200,000 Interbank Call loans 30,100,0006 month Investments 67,300,000 2.00 Total Short Term Investments Loans - Overdrafts (daily rate reset) Call Deposits 6 months (180 days) 2 years (semi-annual) 3 years (semi-annual) 1.50 1.90 1.95 2.15 300,700,000 233,600,000 57,900,000 50,000,000 3.50111,300,000 5 year Housing (6mth rate reset)4.00364,900,000 24,900,000 69,200,000 4.05 2 years (semi-annual) 4.25 3 years (semi-annual) 20,300.000 85,400,000 655,700,000 5,400,000 729,800,000 - 5years (semi-annual) 2.25 5 years semi-annual Total Loans Property, plant and equipment 4.35 Total 662,500,000 729,800,000 Table 2 1 year 1.5 Call 4.5 2.5 3.5 4 %pa Par Zero months 1.84 1.84 yearsyears years years years yearsyears years 1.50 1.50 1.40 1.40 1.41 1.41 1.721.601.491.44 1.711.601.491.44 1.42 1.431.44 1.421.431.44 Additional Information 1. You have noted that the zero-coupon equivalent interest rates are similar to the PAR rates because the yield curve is relatively flat over the period to 5 years. All of the above interest rates, except Call, are semi-annually compounding interest rates 2. The interest rates shown in the balance sheet are the average interest rates applicable to each of the instrument types and each maturity band in the balance sheet as at the date of the balance sheet. You have assumed for the purposes of the calculations that these rates represent the cost or revenue (as the case may be) for the purposes of calculating cashflows and returns 3. NBA Bank's marginal borrowing and lending rates for terms of 6 months are priced or set by reference to the Australian Bank Accepted Bill (BAB) interest rate and at the Commonwealth Government Security (CGS) rate for terns of one year and longer These underlying interest rates are reflected in the interest rates set out in Table 2 above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts