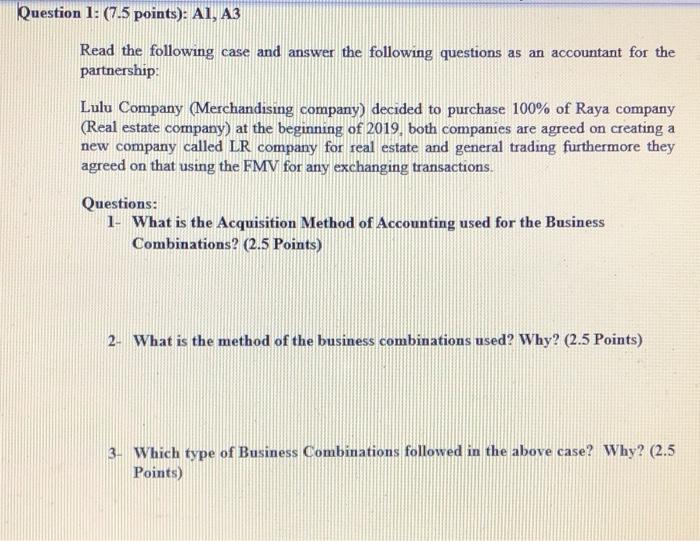

Question: Question 1: (7.5 points): A1, A3 Read the following case and answer the following questions as an accountant for the partnership: Lulu Company (Merchandising company)

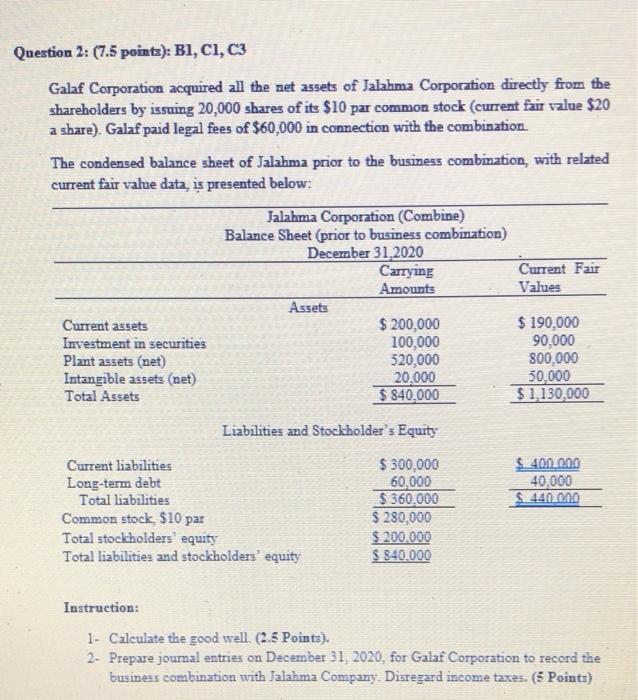

Question 1: (7.5 points): A1, A3 Read the following case and answer the following questions as an accountant for the partnership: Lulu Company (Merchandising company) decided to purchase 100% of Raya company (Real estate company) at the beginning of 2019, both companies are agreed on creating a new company called LR company for real estate and general trading furthermore they agreed on that using the FMV for any exchanging transactions. Questions: 1- What is the Acquisition Method of Accounting used for the Business Combinations? (2.5 Points) 2- What is the method of the business combinations used? Why? (2.5 Points) 3. Which type of Business Combinations followed in the above case? Why? (2.5 Points) Question 2: (7.5 points): B1, C1, C3 Galaf Corporation acquired all the net assets of Jalahma Corporation directly from the shareholders by issuing 20,000 shares of its $10 par common stock (current fair value $20 a share). Galaf paid legal fees of $60,000 in connection with the combination The condensed balance sheet of Jalahma prior to the business combination, with related current fair value data is presented below: Jalahma Corporation (Combine) Balance Sheet (prior to business combination) December 31, 2020 Carrying Current Fair Amounts Values Assets Current assets $ 200,000 $ 190,000 Investment in securities 100,000 90,000 Plant assets (net) 520,000 800,000 Intangible assets (net) 20,000 50,000 Total Assets $ $40.000 $ 1.130,000 Liabilities and Stockholder's Equity $ 400.000 40,000 $ 440 000 Current liabilities Long-term debt Total liabilities Common stock $10 par Total stockholders' equity Total liabilities and stockholders equity $ 300,000 60.000 $360,000 $ 280,000 $ 200.000 $ 840.000 Instruction: 1- Calculate the good well. (2.5 Points), 2. Prepare journal entries on December 31, 2020, for Galaf Corporation to record the business combination with Jalahma Company. Disregard income taxes. (6 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts