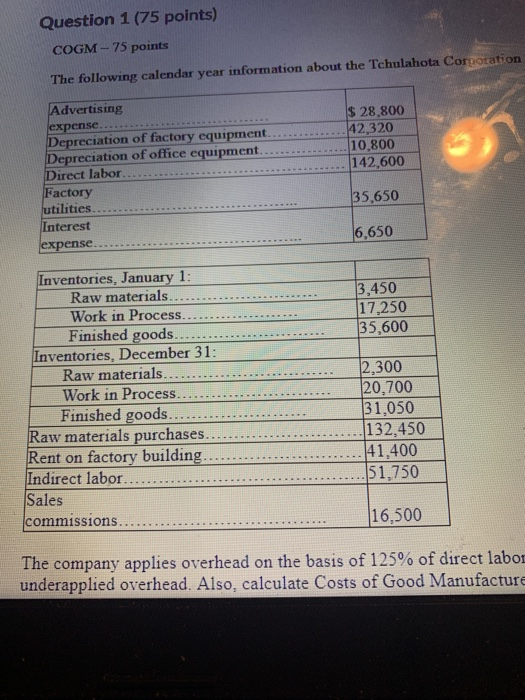

Question: Question 1 (75 points) COGM-75 points The following calendar year information about the Tchulahota Corporation $ 28,800 42,320 10,800 142,600 Advertising expense Depreciation of factory

Question 1 (75 points) COGM-75 points The following calendar year information about the Tchulahota Corporation $ 28,800 42,320 10,800 142,600 Advertising expense Depreciation of factory equipment Depreciation of office equipment. Direct labor Factory utilities Interest expense. 35,650 6,650 3,450 17,250 35,600 Inventories, January 1: Raw materials. Work in Process. Finished goods. Inventories, December 31: Raw materials. Work in Process. Finished goods. Raw materials purchases. Rent on factory building. Indirect labor Sales commissions. 2.300 20,700 31,050 132,450 41,400 51,750 (16,500 The company applies overhead on the basis of 125% of direct labor underapplied overhead. Also, calculate Costs of Good Manufacture Raw materials purchases Rent on factory building Indirect labor Sales commissions 132.450 41,400 $1,750 16,500 The company applies overhead on the basis of 125% of direct labor costs. Calculate the amount of over- or underapplied overhead. Also, calculate Costs of Good Manufactured, WIP Inventory, and FG inventory balances at the end of the period, Extra Credit - 20 points Create an income statement for the period. Format V I U AJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts