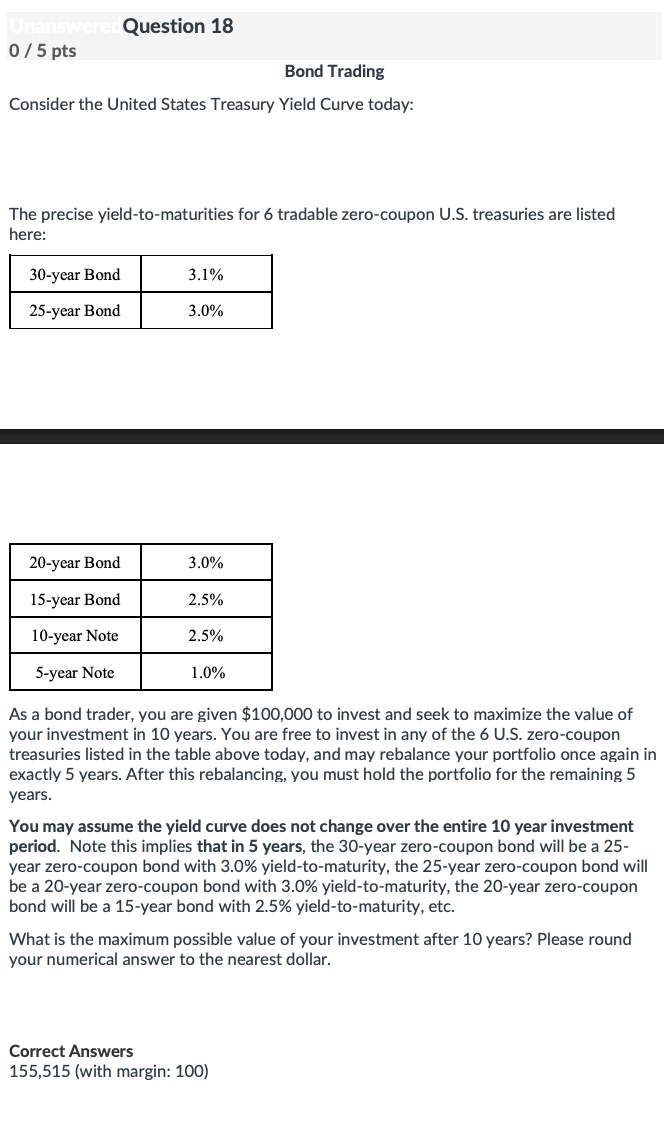

Question: Question 1 8 0 / 5 pts Bond Trading Consider the United States Treasury Yield Curve today: The precise yield - to - maturities for

Question pts Bond Trading Consider the United States Treasury Yield Curve today: The precise yieldtomaturities for tradable zerocoupon US treasuries are listed here: As a bond trader, you are given $ to invest and seek to maximize the value of your investment in years. You are free to invest in any of the US zerocoupon treasuries listed in the table above today, and may rebalance your portfolio once again in exactly years. After this rebalancing, you must hold the portfolio for the remaining years. You may assume the yield curve does not change over the entire year investment period. Note this implies that in years, the year zerocoupon bond will be a year zerocoupon bond with yieldtomaturity, the year zerocoupon bond will be a year zerocoupon bond with yieldtomaturity, the year zerocoupon bond will be a year bond with yieldtomaturity, etc. What is the maximum possible value of your investment after years? Please round your numerical answer to the nearest dollar. Correct Answers with margin:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock