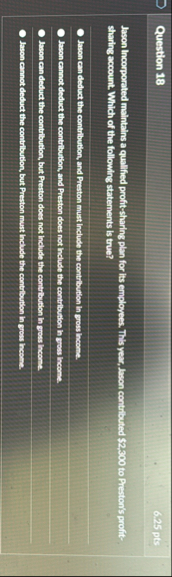

Question: Question 1 8 6 . 2 5 pts Jason Incorporated maintains a qualified profit - sharing plan for its employees. Thas year, Jason contributed $

Question

pts

Jason Incorporated maintains a qualified profitsharing plan for its employees. Thas year, Jason contributed $ to Preton's profitsharing account. Which of the following statements is true?

Jason can deduct the contribution, and Preston must Incluse the contribution In gross Incame.

Jason cannot deduct the contribution, and Preston does not Include the contribution ho grows hearse.

Jason can defuct the contribution, but Preston does not helude the contribution in gross hearse

Jason cannot deduct the contribution, but Preston must hachude the cantibuten in grow hasery.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock