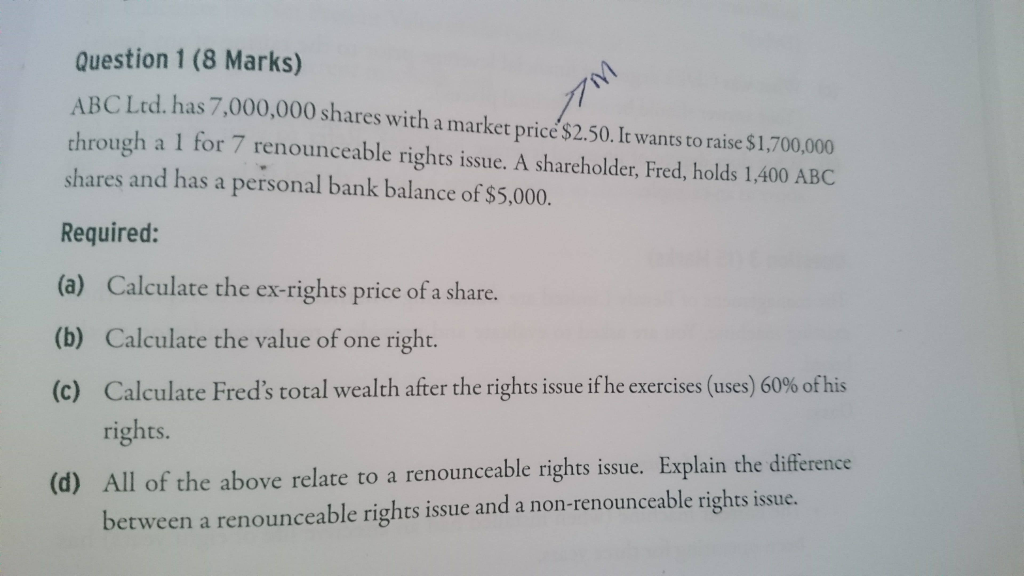

Question: Question 1 (8 Marks) ABC Ltd.has 7,000,000 shares with a market prices2.50.I wants to raise S1. 00,000 chrough a 1 for 7 renounceable rights issue.

Question 1 (8 Marks) ABC Ltd.has 7,000,000 shares with a market prices2.50.I wants to raise S1. 00,000 chrough a 1 for 7 renounceable rights issue. A shareholder, Fred, holds 1,400 ABC shares and has a personal bank balance of $5,000. t wants to raise $1,700,00 Required: Calculate the ex-rights price of a share. Calculate the value of one right. Calculate Fred's total wealth after the rights issue ifhe exercises (uses) 60% ofhis rights. (a) (b) (c) (d) All of the above relate to a renounceable rights issue. Explain the diference between a renounceable rights issue and a non-renounceable rights issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts