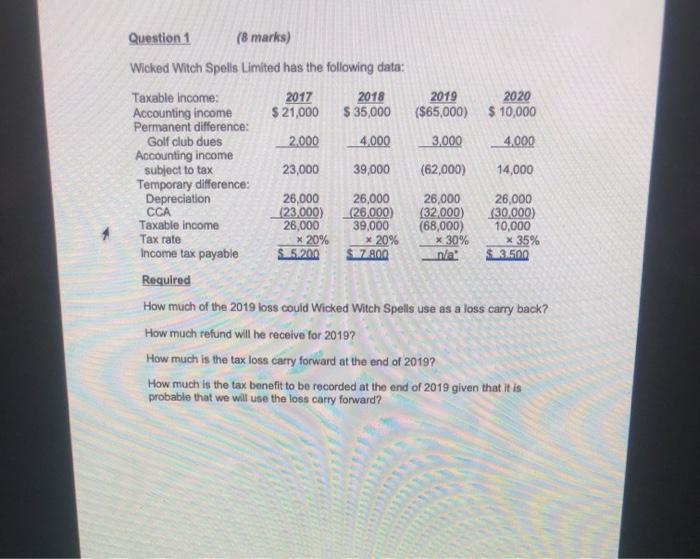

Question: Question 1 (8 marks) Wicked Witch Spells Limited has the following data: Taxable income 2017 2018 2019 2020 Accounting income $ 21,000 $ 35,000 ($65,000)

Question 1 (8 marks) Wicked Witch Spells Limited has the following data: Taxable income 2017 2018 2019 2020 Accounting income $ 21,000 $ 35,000 ($65,000) $ 10,000 Permanent difference: Golf club dues 2,000 4.000 3,000 ___ 4,000 Accounting income subject to tax 23,000 39,000 (62,000) 14,000 Temporary difference: Depreciation 26,000 26,000 26,000 26,000 CCA (23.000) (26.000) (32.000) (30.000) Taxable income 26,000 39,000 (68,000) 10,000 Tax rate X 20% x 20% * 30% x 35% Income tax payable $1.5.200 $ 7.800 unla $3.500 Required How much of the 2019 loss could Wicked Witch Spells use as a loss carry back? How much refund will be receive for 2019? How much is the tax loss carry forward at the end of 2019? How much is the tax benefit to be recorded at the end of 2019 given that it is probable that we will use the loss carry forward

Step by Step Solution

There are 3 Steps involved in it

Given Data Year Accounting Income Permanent Differences Accounting Income Subject to Tax Temporary D... View full answer

Get step-by-step solutions from verified subject matter experts