Question: Question 1 (8 points) (8 Points Total; 4 each). A share of common stock is expected to pay a dividend of $5.50 in one year

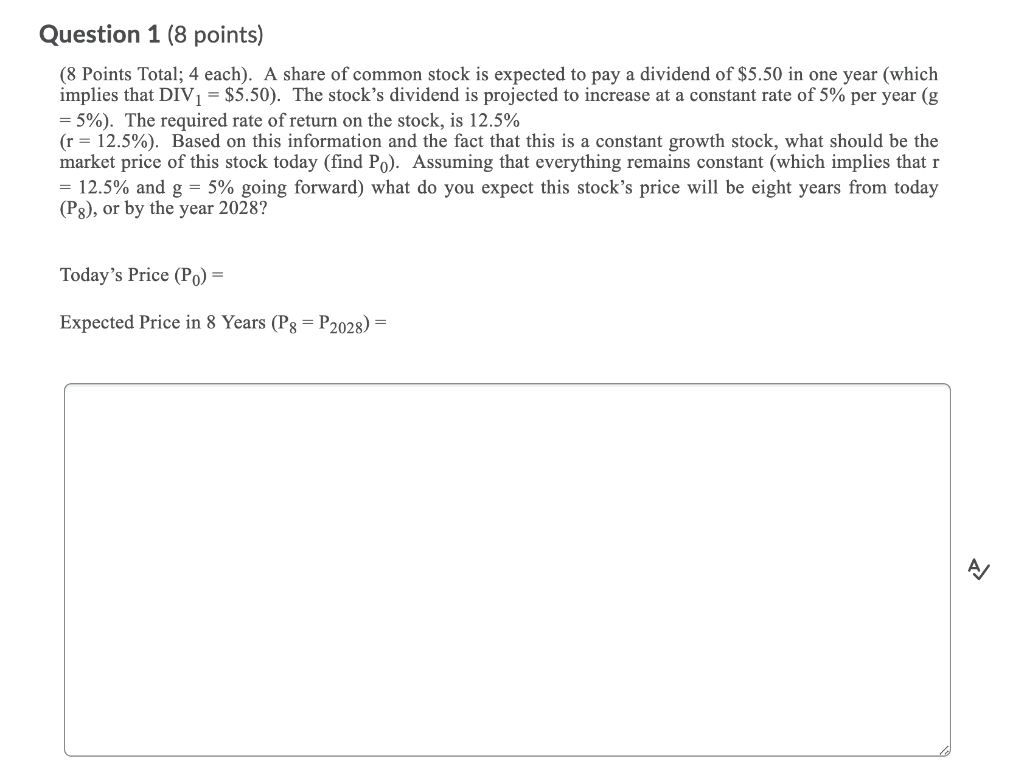

Question 1 (8 points) (8 Points Total; 4 each). A share of common stock is expected to pay a dividend of $5.50 in one year (which implies that DIV1 = $5.50). The stock's dividend is projected to increase at a constant rate of 5% per year (g = 5%). The required rate of return on the stock, is 12.5% (r = 12.5%). Based on this information and the fact that this is a constant growth stock, what should be the market price of this stock today (find Po). Assuming that everything remains constant (which implies that r = 12.5% and g = 5% going forward) what do you expect this stock's price will be eight years from today (P8), or by the year 2028? Today's Price (P.) = Expected Price in 8 Years (Pg = P2028) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts