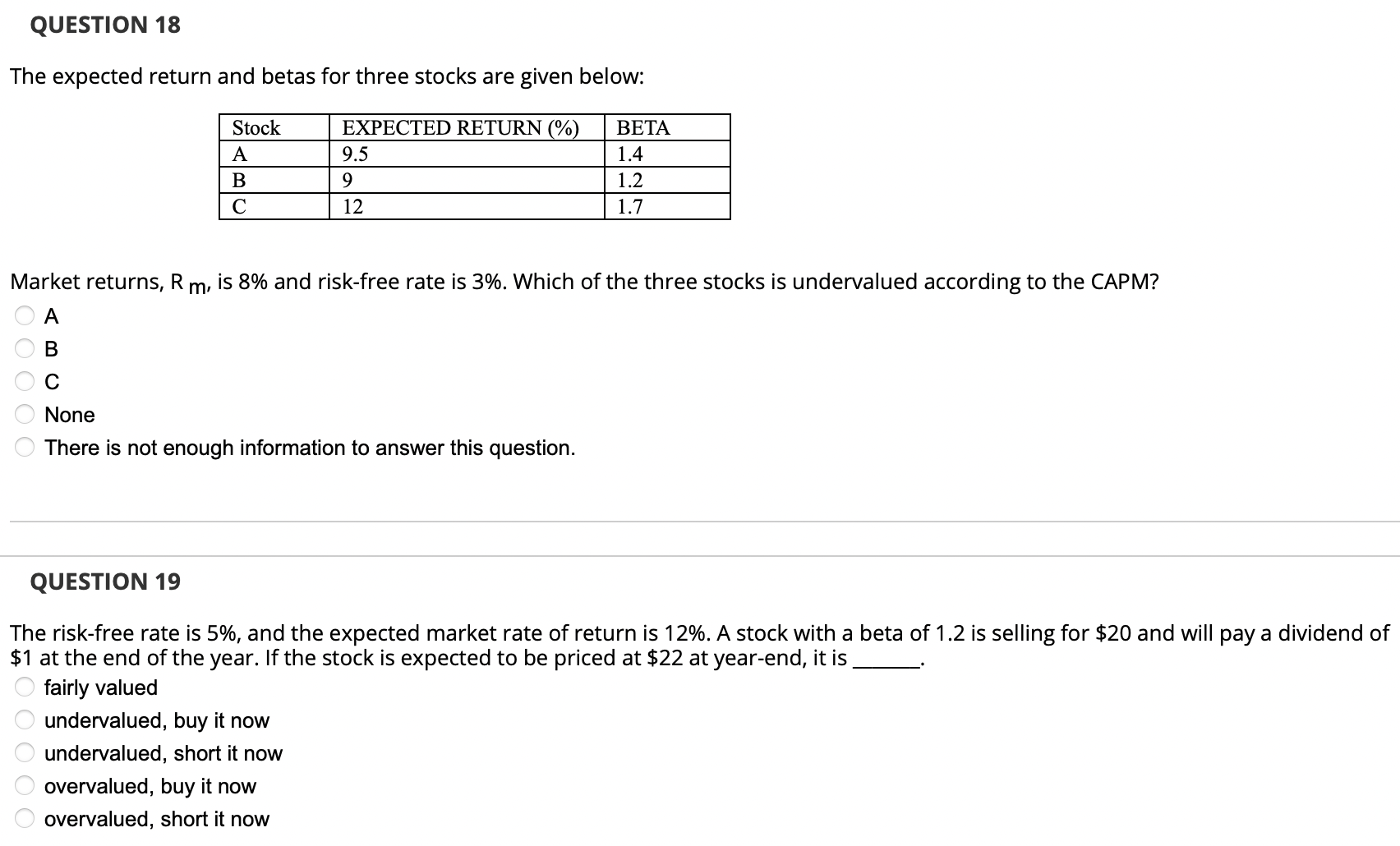

Question: QUESTION 1 8 The expected return and betas for three stocks are given below: A 9.5 1.4 C 12 1.7 Market returns, R m: is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts