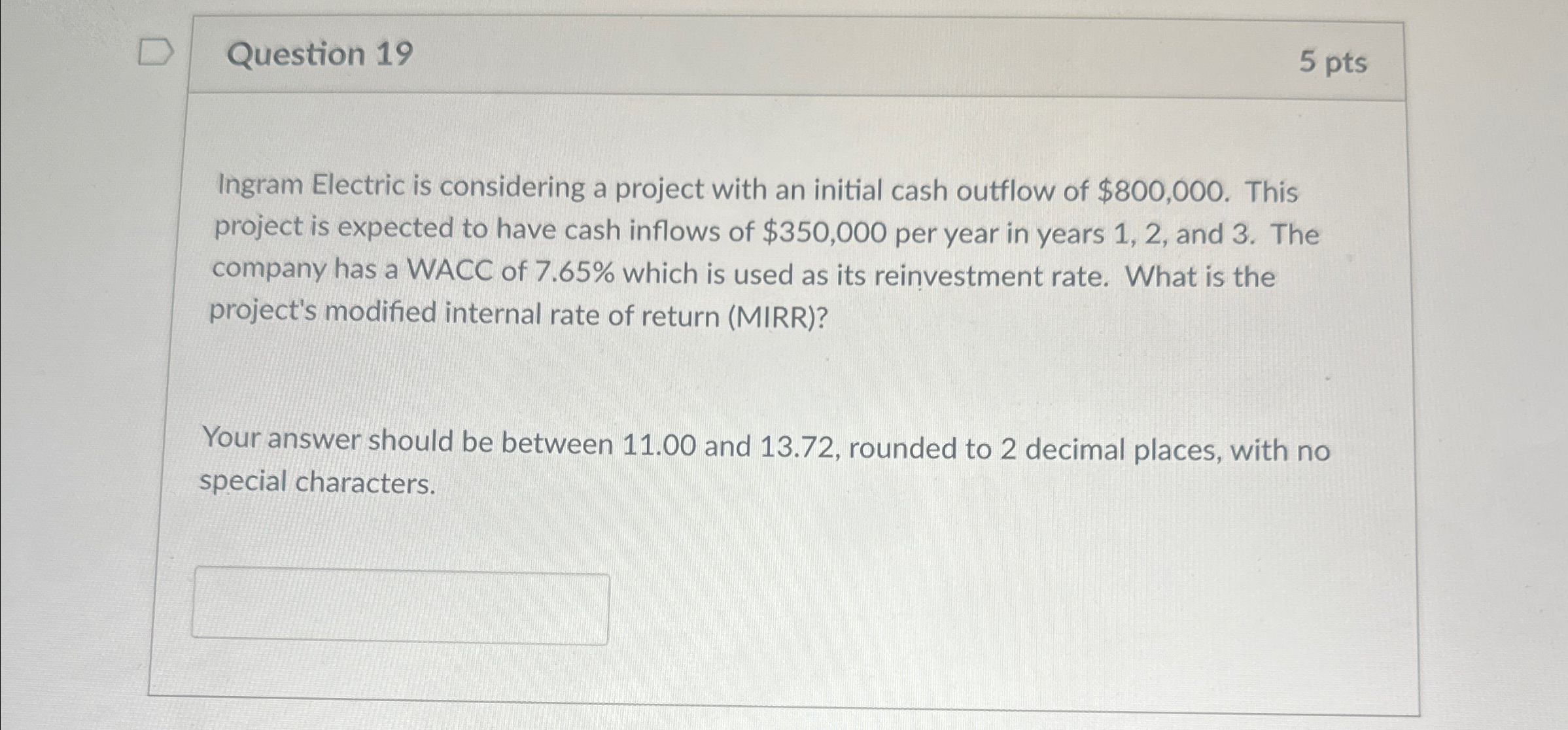

Question: Question 1 9 5 pts Ingram Electric is considering a project with an initial cash outflow of $ 8 0 0 , 0 0 0

Question

pts

Ingram Electric is considering a project with an initial cash outflow of $ This project is expected to have cash inflows of $ per year in years and The company has a WACC of which is used as its reinvestment rate. What is the project's modified internal rate of return MIRR

Your answer should be between and rounded to decimal places, with no special characters.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock