Question: Question 1: (9 points): A1, D1, D3 Instructions: Read the following case and answer all of the following questions: At the end of the

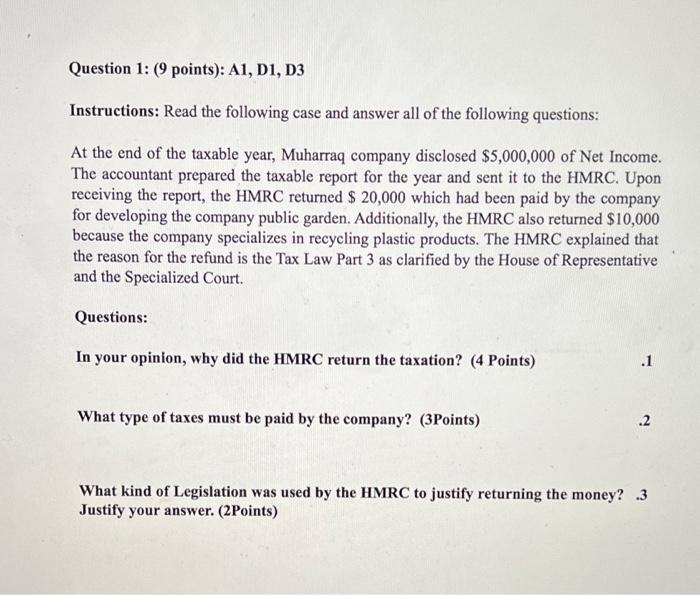

Question 1: (9 points): A1, D1, D3 Instructions: Read the following case and answer all of the following questions: At the end of the taxable year, Muharraq company disclosed $5,000,000 of Net Income. The accountant prepared the taxable report for the year and sent it to the HMRC. Upon receiving the report, the HMRC returned $ 20,000 which had been paid by the company for developing the company public garden. Additionally, the HMRC also returned $10,000 because the company specializes in recycling plastic products. The HMRC explained that the reason for the refund is the Tax Law Part 3 as clarified by the House of Representative and the Specialized Court. Questions: In your opinion, why did the HMRC return the taxation? (4 Points) .1 What type of taxes must be paid by the company? (3Points) .2 What kind of Legislation was used by the HMRC to justify returning the money? .3 Justify your answer. (2Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts