Question: Question 1 (9 points) The Bean Co. has 28 million shares of stock outstanding. The stock currently sells for $25 per share. The firm 's

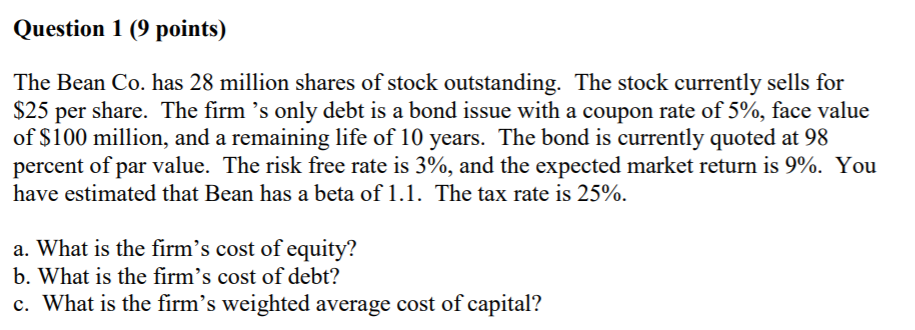

Question 1 (9 points) The Bean Co. has 28 million shares of stock outstanding. The stock currently sells for $25 per share. The firm 's only debt is a bond issue with a coupon rate of 5%, face value of $100 million, and a remaining life of 10 years. The bond is currently quoted at 98 percent of par value. The risk free rate is 3%, and the expected market return is 9%. You have estimated that Bean has a beta of 1.1. The tax rate is 25%. a. What is the firm's cost of equity? b. What is the firm's cost of debt? c. What is the firm's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock