Question: Question 1 (a) (25 points) Describe the 'leverage effect' first noted in Black (1976) and explain whether a GARCH(1,1) model of stock returns can or

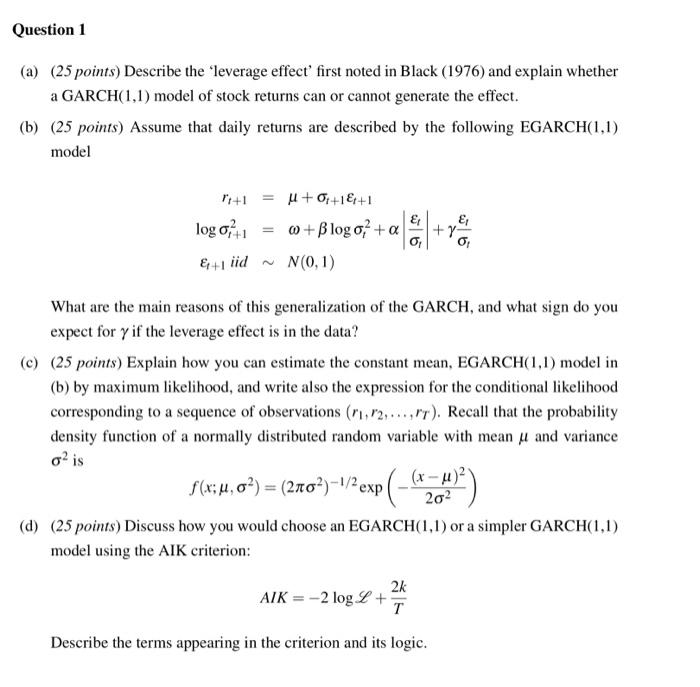

Question 1 (a) (25 points) Describe the leverage effect' first noted in Black (1976) and explain whether a GARCH(1,1) model of stock returns can or cannot generate the effect. (b) (25 points) Assume that daily returns are described by the following EGARCH(1,1) model P1+1 E! = 4 + 0 ++1 logo = w+Blog o + a 10+ &+1 iid ~ N(0,1) What are the main reasons of this generalization of the GARCH, and what sign do you expect for y if the leverage effect is in the data? (c) (25 points) Explain how you can estimate the constant mean, EGARCH(1,1) model in (b) by maximum likelihood, and write also the expression for the conditional likelihood corresponding to a sequence of observations (1, 12,...,"T). Recall that the probability density function of a normally distributed random variable with mean and variance ol is $(

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts