Question: QUESTION 1 A 36-year maturity bond with par value $1,000 makes semiannual coupon payments at a coupon rate of 14%. What is the EFFECTIVE annual

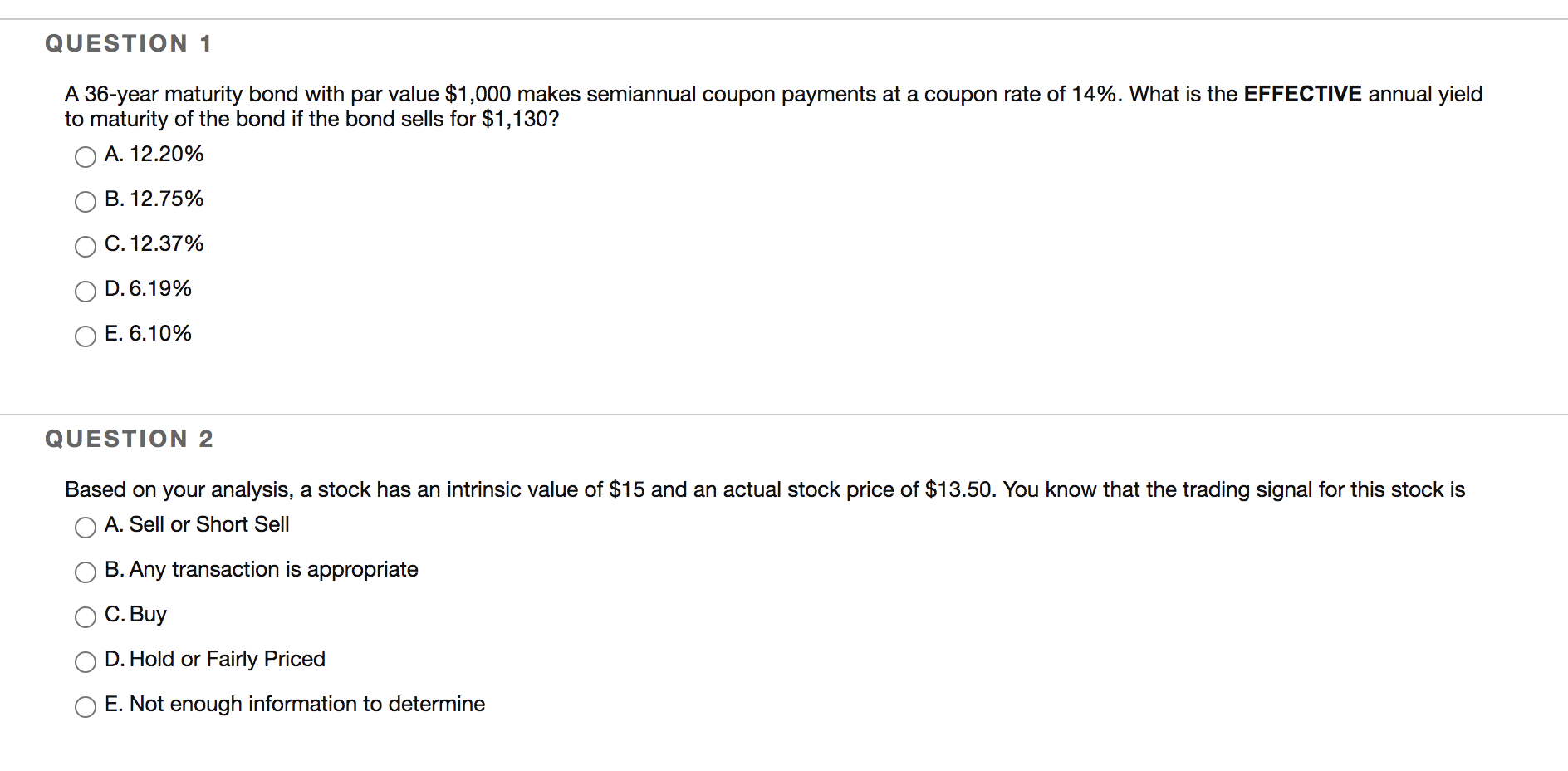

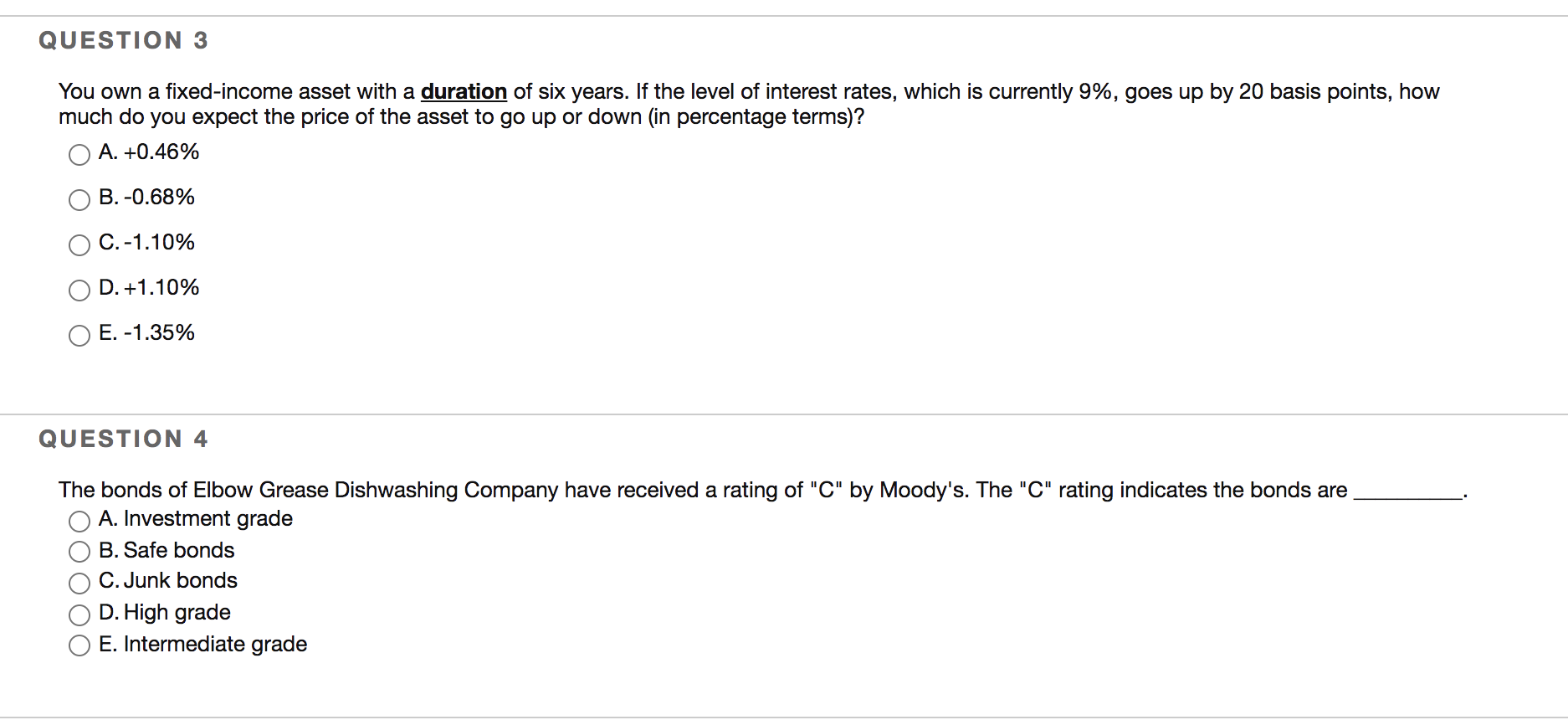

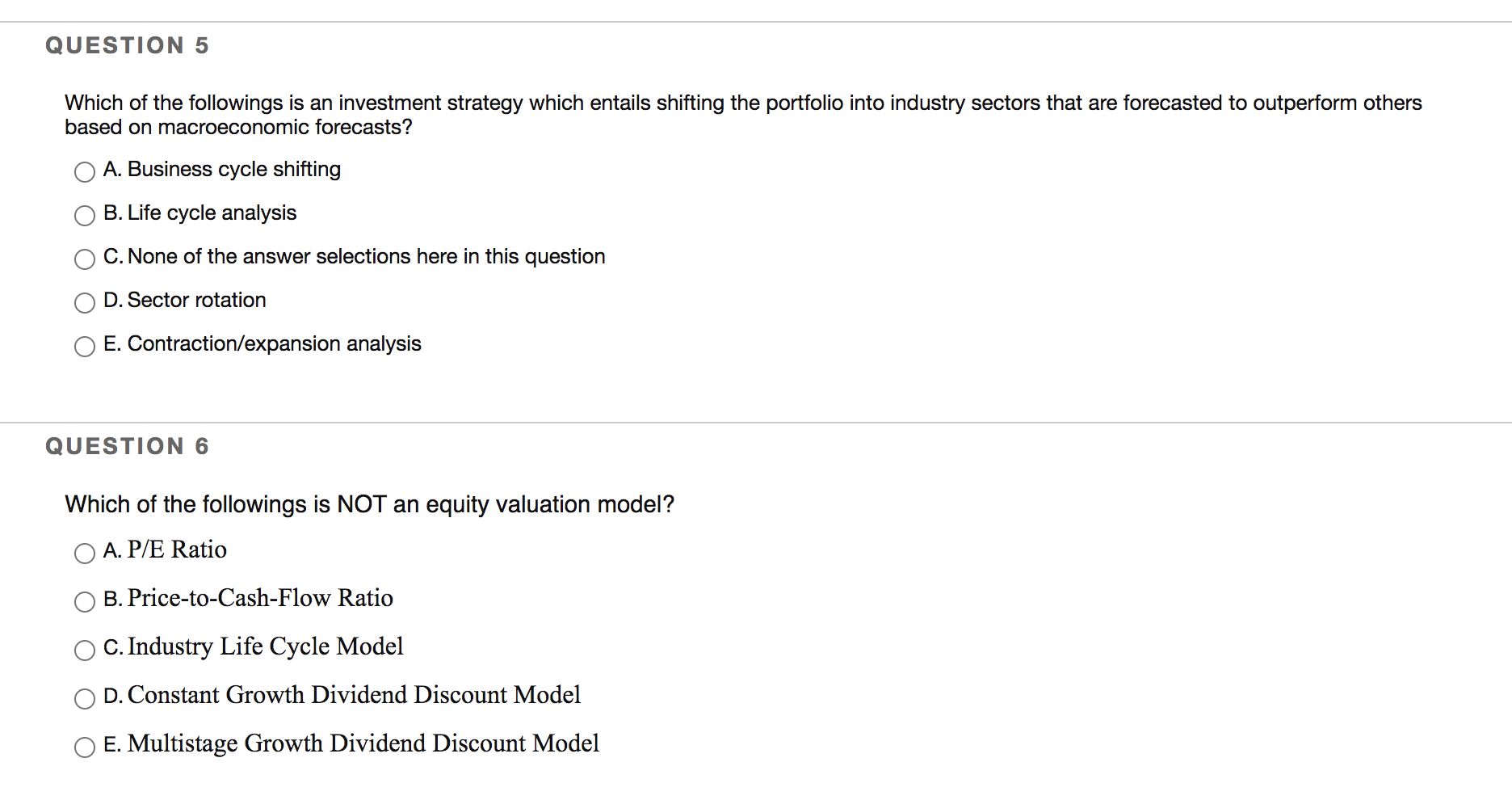

QUESTION 1 A 36-year maturity bond with par value $1,000 makes semiannual coupon payments at a coupon rate of 14%. What is the EFFECTIVE annual yield to maturity of the bond if the bond sells for $1,130? A. 12.20% B. 12.75% C. 12.37% D. 6.19% E. 6.10% QUESTION 2 Based on your analysis, a stock has an intrinsic value of $15 and an actual stock price of $13.50. You know that the trading signal for this stock is A. Sell or Short Sell B. Any transaction is appropriate C. Buy D. Hold or Fairly Priced E. Not enough information to determine QUESTION 3 You own a fixed-income asset with a duration of six years. If the level of interest rates, which is currently 9%, goes up by 20 basis points, how much do you expect the price of the asset to go up or down (in percentage terms)? A. +0.46% B. -0.68% C.-1.10% D. +1.10% E. -1.35% QUESTION 4 The bonds of Elbow Grease Dishwashing Company have received a rating of "C" by Moody's. The "C" rating indicates the bonds are A. Investment grade B. Safe bonds C. Junk bonds D. High grade E. Intermediate grade QUESTION 5 Which of the followings is an investment strategy which entails shifting the portfolio into industry sectors that are forecasted to outperform others based on macroeconomic forecasts? A. Business cycle shifting B. Life cycle analysis C. None of the answer selections here in this question D. Sector rotation E. Contraction/expansion analysis QUESTION 6 Which of the followings is NOT an equity valuation model? A. P/E Ratio B. Price-to-Cash-Flow Ratio C. Industry Life Cycle Model D. Constant Growth Dividend Discount Model E. Multistage Growth Dividend Discount Model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts