Question: Question 1 a) a) Explain the concept of diversification b) Zimbat and Mobilot Inc. have the following distribution of rates of return. State of the

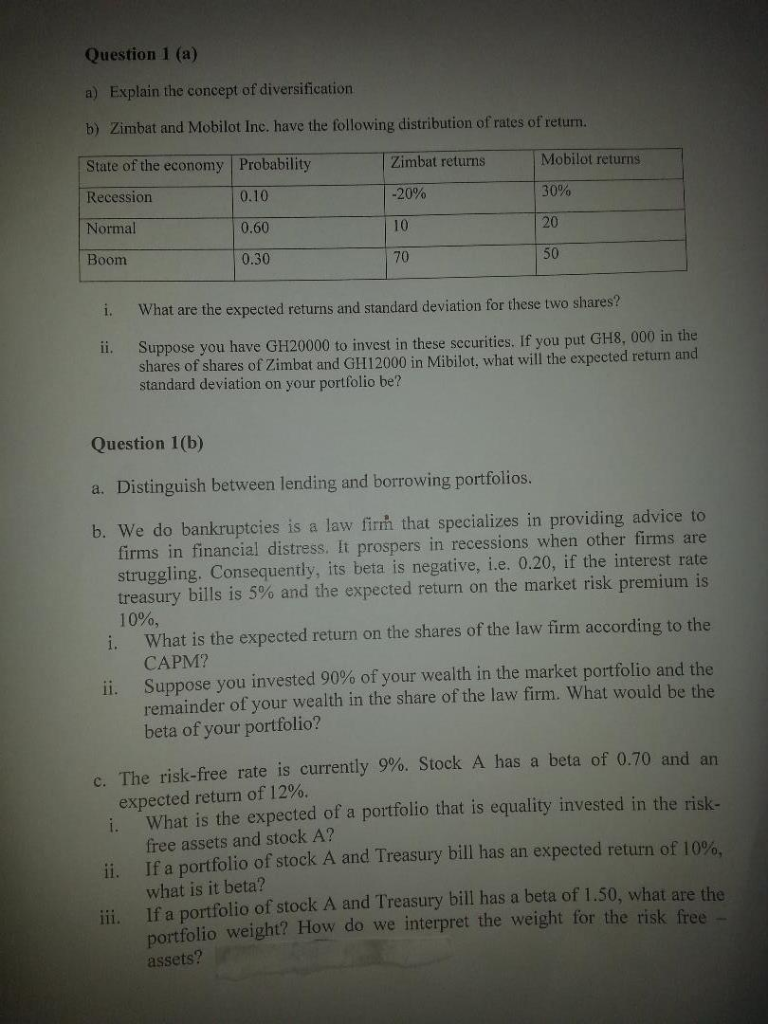

Question 1 a) a) Explain the concept of diversification b) Zimbat and Mobilot Inc. have the following distribution of rates of return. State of the economy Probability Recession Normal Boom 0.10 0.60 0.30 Zimbat returns -20% 10 70 Mobilot returns 30% 20 50 i. What are the expected returns and standard deviation for these two shares? ii. Suppose you have GH20000 to invest in these securities. If you put GH8, 000 in the shares of shares of Zimbat and GH12000 in Mibilot, what will the expected return and standard deviation on your portfolio be? Question 1(b) a. Distinguish between lending and borrowing portfolios b. We do bankruptcies is a law firn that specializes in providing advice to firms in financial distress. It prospers in recessions when other firms are struggling, Consequently, its beta is negative, i.e. 0.20, if the interest rate treasury bills is 5% and the expected return on the market risk premium is 10%, i. What is the expected return on the shares of the law firm according to the CAPM? Suppose you invested 90% of your wealth in the market portfolio and the remainder of your wealth in the share of the law firm. What would be the 11. beta of your portfolio? C. The risk-free rate is currently 9%. Stock A has a beta of 0.70 and an i. What is the expected of a portfolio that is equality invested in the risk- ii. If a portfolio of stock A and Treasury bill has an expected return of 10%, iti. If a portfolio of stock A and Treasury bill has a beta of 1.50, what are the expected return of 12%. free assets and stock A? what is it beta? portfolio weight? How do we interpret the weight for the risk free assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts