Question: Question 1 a) An employee is choosing between two possible company car options both of which have a list price of 19,500. Car A has

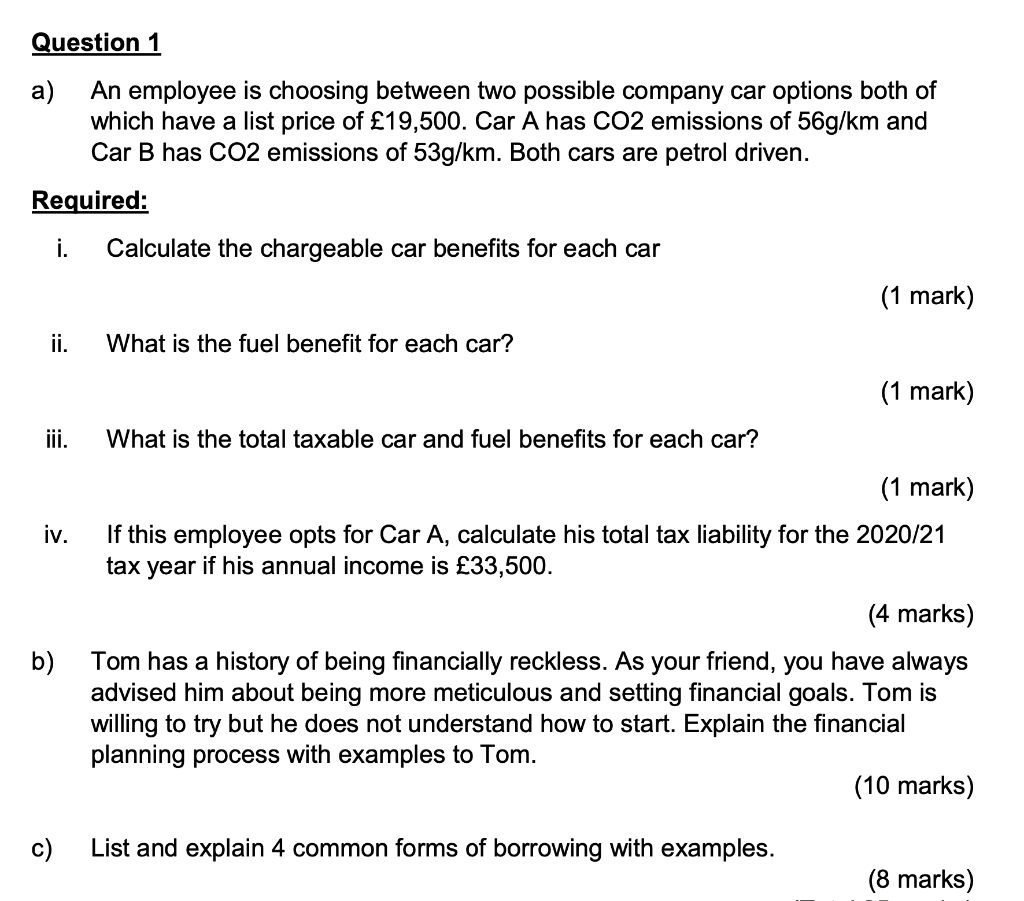

Question 1 a) An employee is choosing between two possible company car options both of which have a list price of 19,500. Car A has CO2 emissions of 56g/km and Car B has CO2 emissions of 53g/km. Both cars are petrol driven. Required: i. Calculate the chargeable car benefits for each car (1 mark) ii. What is the fuel benefit for each car? (1 mark) iii. What is the total taxable car and fuel benefits for each car? (1 mark) iv. If this employee opts for Car A, calculate his total tax liability for the 2020/21 tax year if his annual income is 33,500. (4 marks) b) Tom has a history of being financially reckless. As your friend, you have always advised him about being more meticulous and setting financial goals. Tom is willing to try but he does not understand how to start. Explain the financial planning process with examples to Tom. (10 marks) c) List and explain 4 common forms of borrowing with examples. (8 marks) Question 1 a) An employee is choosing between two possible company car options both of which have a list price of 19,500. Car A has CO2 emissions of 56g/km and Car B has CO2 emissions of 53g/km. Both cars are petrol driven. Required: i. Calculate the chargeable car benefits for each car (1 mark) ii. What is the fuel benefit for each car? (1 mark) iii. What is the total taxable car and fuel benefits for each car? (1 mark) iv. If this employee opts for Car A, calculate his total tax liability for the 2020/21 tax year if his annual income is 33,500. (4 marks) b) Tom has a history of being financially reckless. As your friend, you have always advised him about being more meticulous and setting financial goals. Tom is willing to try but he does not understand how to start. Explain the financial planning process with examples to Tom. (10 marks) c) List and explain 4 common forms of borrowing with examples. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts