Question: Question 1 A B C D E Question2 A B C D E Question3 A B C D E Question4 A B C D E

Question 1

Question 1

A

B

C

D

E

Question2

A

B

C

D

E

Question3

A

B

C

D

E

Question4

A

B

C

D

E

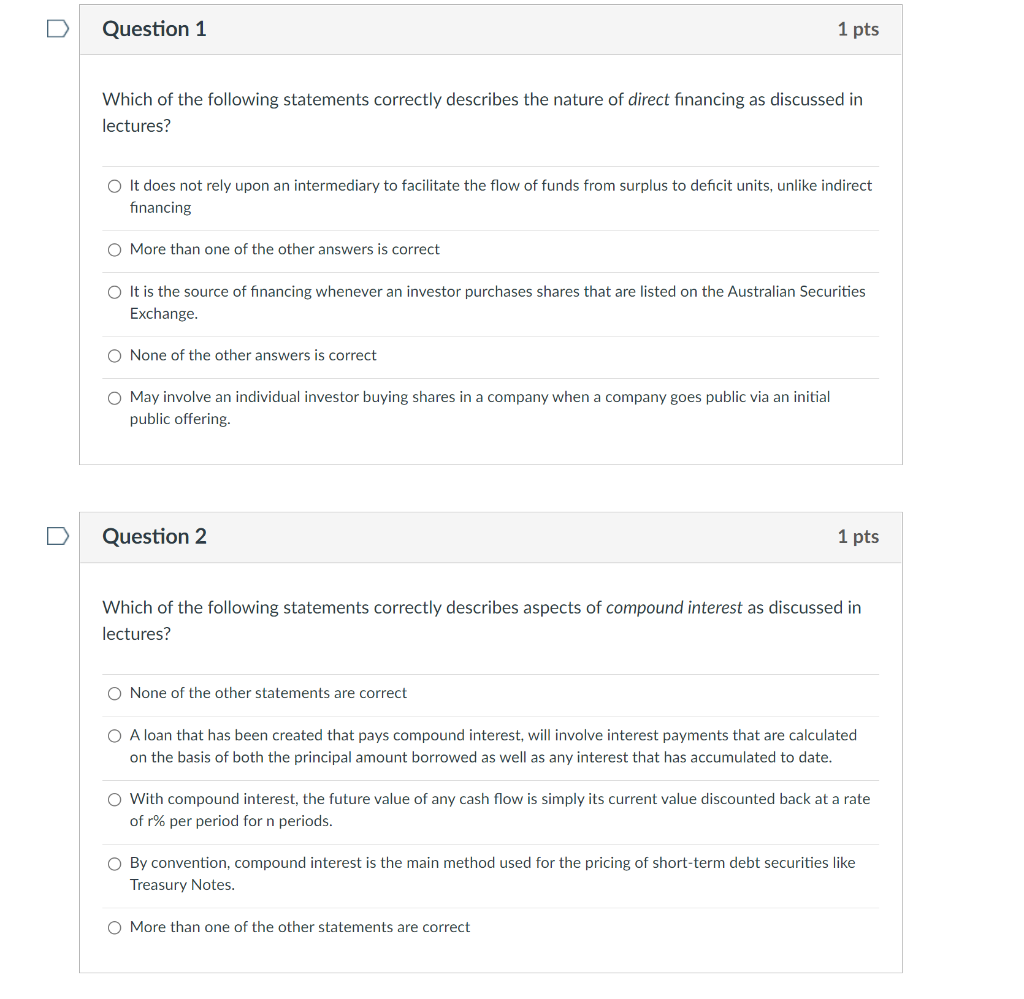

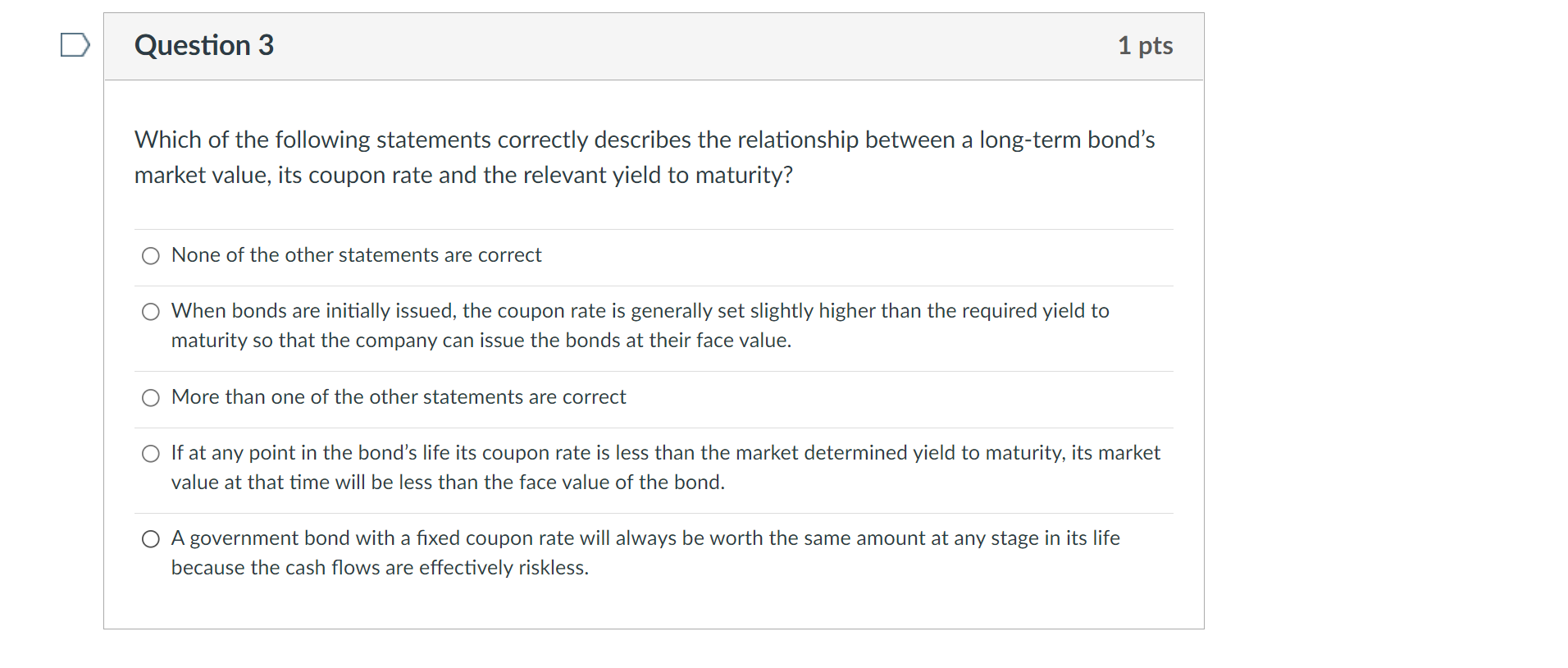

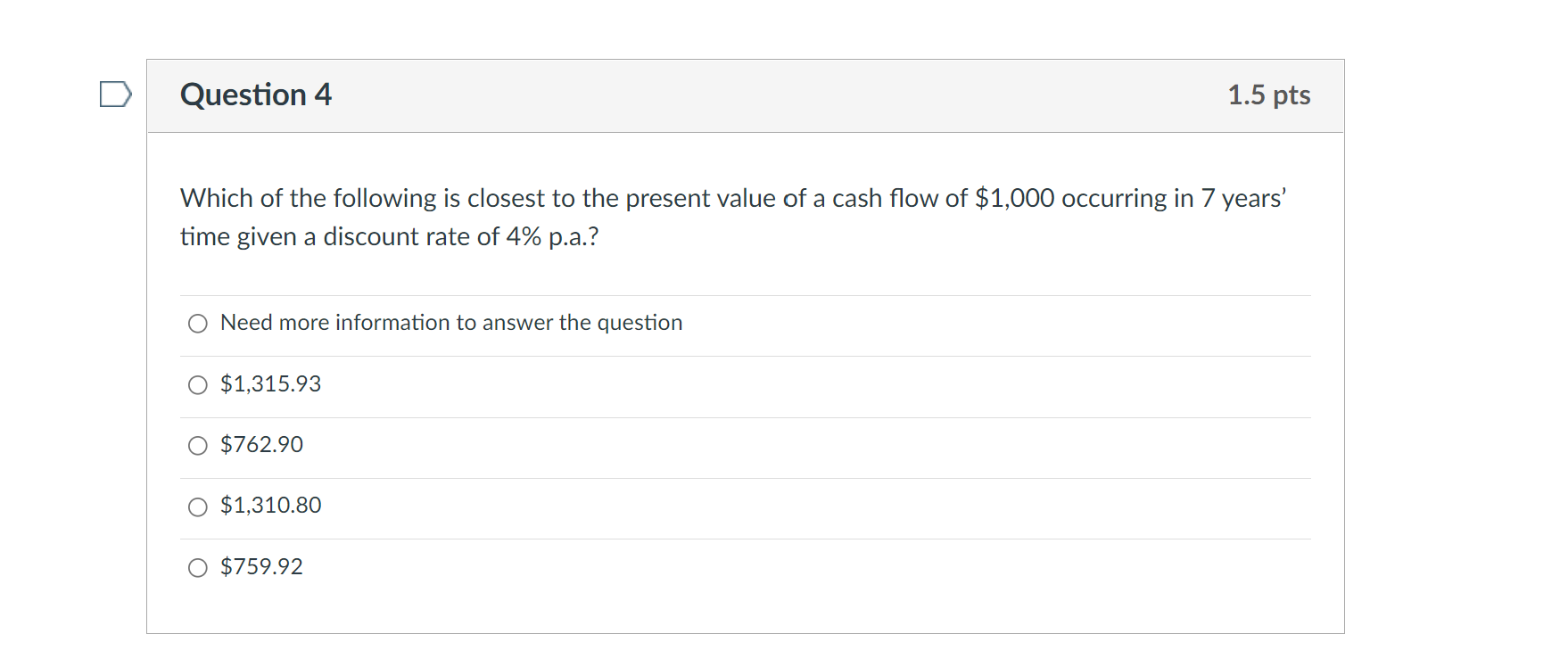

U Question 1 1 pts Which of the following statements correctly describes the nature of direct financing as discussed in lectures? It does not rely upon an intermediary to facilitate the flow of funds from surplus to deficit units, unlike indirect financing O More than one of the other answers is correct O It is the source of financing whenever an investor purchases shares that are listed on the Australian Securities Exchange. O None of the other answers is correct O May involve an individual investor buying shares in a company when a company goes public via an initial public offering. n Question 2 1 pts Which of the following statements correctly describes aspects of compound interest as discussed in lectures? O None of the other statements are correct O A loan that has been created that pays compound interest, will involve interest payments that are calculated on the basis of both the principal amount borrowed as well as any interest that has accumulated to date. O With compound interest, the future value of any cash flow is simply its current value discounted back at a rate of r% per period for n periods. By convention, compound interest is the main method used for the pricing of short-term debt securities like Treasury Notes. O More than one of the other statements are correct Question 3 1 pts Which of the following statements correctly describes the relationship between a long-term bond's market value, its coupon rate and the relevant yield to maturity? O None of the other statements are correct O When bonds are initially issued, the coupon rate is generally set slightly higher than the required yield to maturity so that the company can issue the bonds at their face value. More than one of the other statements are correct O If at any point in the bond's life its coupon rate is less than the market determined yield to maturity, its market value at that time will be less than the face value of the bond. A government bond with a fixed coupon rate will always be worth the same amount at any stage in its life because the cash flows are effectively riskless. Question 4 1.5 pts Which of the following is closest to the present value of a cash flow of $1,000 occurring in 7 years' time given a discount rate of 4% p.a.? O Need more information to answer the question $1,315.93 $762.90 $1,310.80 $759.92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts