Question: QUESTION 1 A bond's coupon rate is equal to the annual interest divided by which one of the following? Call price Clean Price Face Value

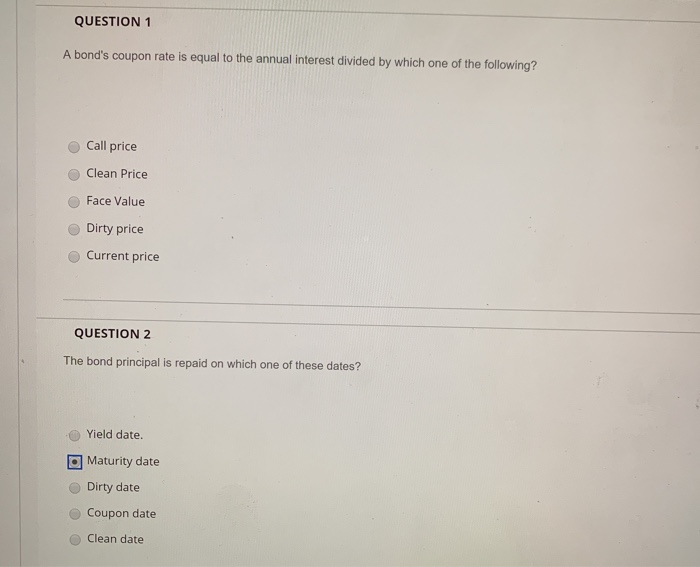

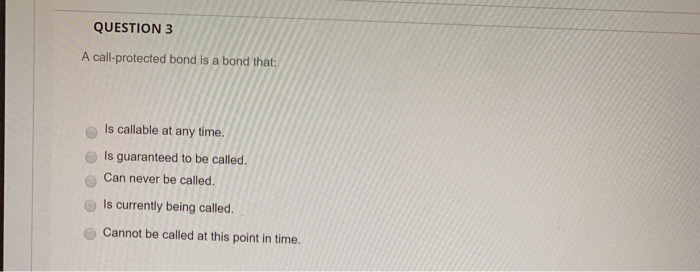

QUESTION 1 A bond's coupon rate is equal to the annual interest divided by which one of the following? Call price Clean Price Face Value Dirty price Current price QUESTION 2 The bond principal is repaid on which one of these dates? Yield date. O Maturity date Dirty date Coupon date Clean date QUESTION 3 A call-protected bond is a bond that: Is callable at any time. Is guaranteed to be called. Can never be called. Is currently being called. Cannot be called at this point in time

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock