Question: Question 1: A company using the allowance method for bad debts comes to the end of an accounting period with a $400 credit balance in

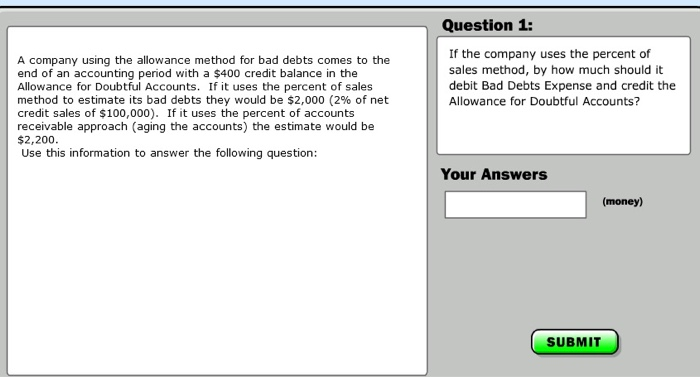

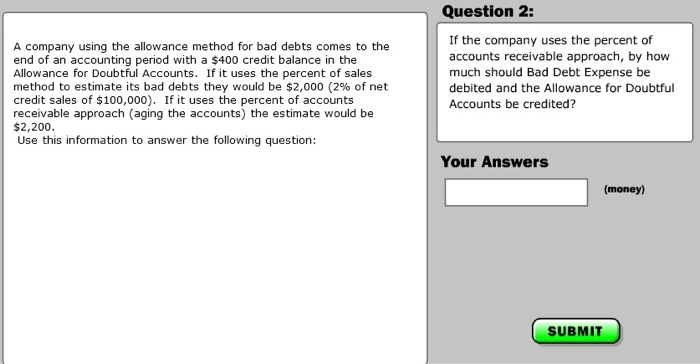

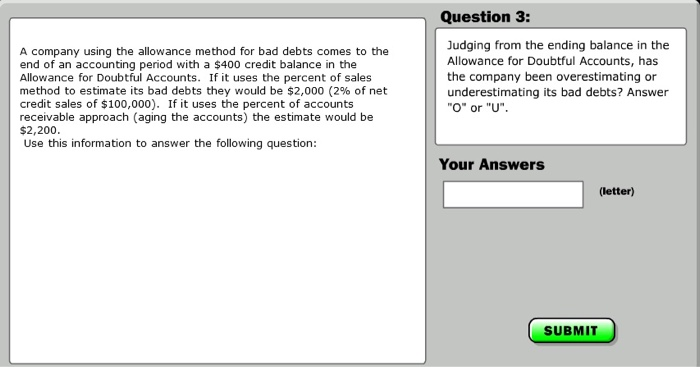

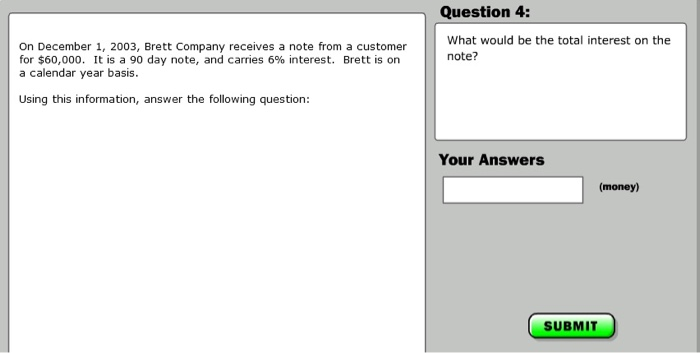

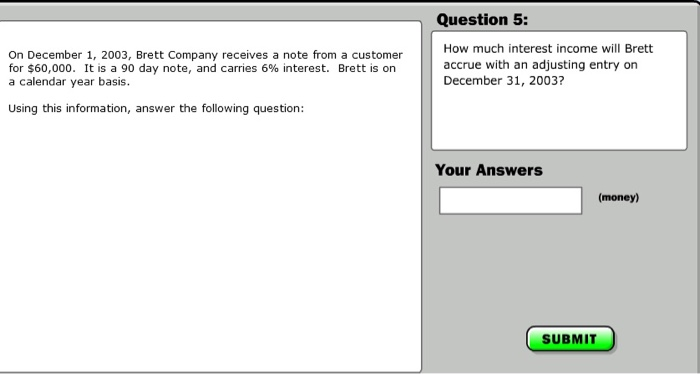

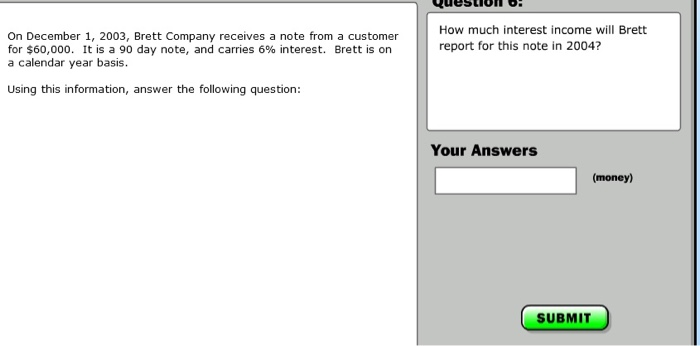

Question 1: A company using the allowance method for bad debts comes to the end of an accounting period with a $400 credit balance in the Allowance for Doubtful Accounts. If it uses the percent of sales method to estimate its bad debts they would be $2,000 (2% of net credit sales of $100,000). If it uses the percent of accounts receivable approach (aging the accounts) the estimate would be $2,200. Use this information to answer the following question: If the company uses the percent of sales method, by how much should it debit Bad Debts Expense and credit the Allowance for Doubtful Accounts? Your Answers (money) SUBMIT Question 2: A company using the allowance method for bad debts comes to the end of an accounting period with a $400 credit balance in the Allowance for Doubtful Accounts. If it uses the percent of sales method to estimate its bad debts they would be $2,000 (2% of net credit sales of $100,000). If it uses the percent of accounts receivable approach (aging the accounts) the estimate would be $2,200. Use this information to answer the following question: If the company uses the percent of accounts receivable approach, by how much should Bad Debt Expense be debited and the Allowance for Doubtful Accounts be credited? Your Answers (money) SUBMIT Question 3: A company using the allowance method for bad debts comes to the end of an accounting period with a $400 credit balance in the Allowance for Doubtful Accounts. If it uses the percent of sales method to estimate its bad debts they would be $2,000 (2% of net credit sales of $100,000). If it uses the percent of accounts receivable approach (aging the accounts) the estimate would be $2,200. Use this information to answer the following question: Judging from the ending balance in the Allowance for Doubtful Accounts, has the company been overestimating or underestimating its bad debts? Answer "O" or "U". Your Answers (letter) SUBMIT Question 4: On December 1, 2003, Brett Company receives a note from a customer for $60,000. It is a 90 day note, and carries 6% interest. Brett is on a calendar year basis. What would be the total interest on the note? Using this information, answer the following question: Your Answers (money) ( SUBMIT Question 5: On December 1, 2003, Brett Company receives a note from a customer for $60,000. It is a 90 day note, and carries 6% interest. Brett is on a calendar year basis. How much interest income will Brett accrue with an adjusting entry on December 31, 2003? Using this information, answer the following question: Your Answers (money) SUBMIT usum On December 1, 2003, Brett Company receives a note from a customer for $60,000. It is a 90 day note, and carries 6% interest. Brett is on a calendar year basis. How much interest income will Brett report for this note in 2004? Using this information, answer the following question: Your Answers (money) SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts