Question: Question 1 a) Consider a 6 year 8% coupon bond with a face value of 1000. It pays semi-annual coupons and is issued today.A call

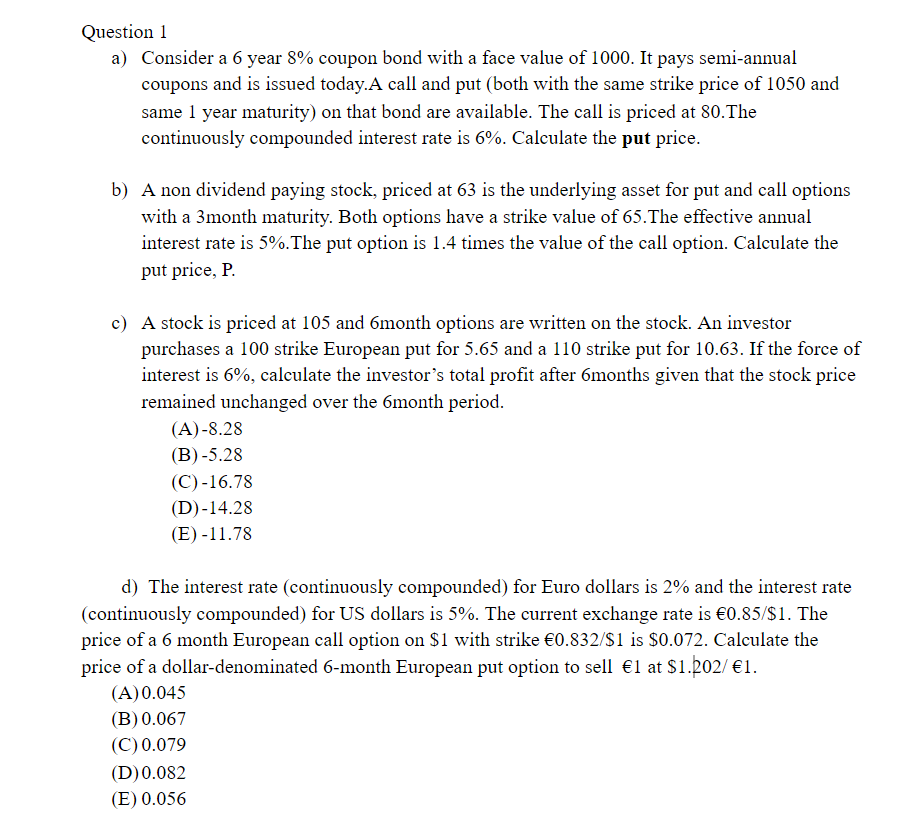

Question 1 a) Consider a 6 year 8% coupon bond with a face value of 1000. It pays semi-annual coupons and is issued today.A call and put (both with the same strike price of 1050 and same 1 year maturity) on that bond are available. The call is priced at 80. The continuously compounded interest rate is 6%. Calculate the put price. b) A non dividend paying stock, priced at 63 is the underlying asset for put and call options with a 3month maturity. Both options have a strike value of 65.The effective annual interest rate is 5%. The put option is 1.4 times the value of the call option. Calculate the put price, P. c) A stock is priced at 105 and 6month options are written on the stock. An investor purchases a 100 strike European put for 5.65 and a 110 strike put for 10.63. If the force of interest is 6%, calculate the investor's total profit after 6months given that the stock price remained unchanged over the month period. (A)-8.28 (B)-5.28 (C)-16.78 (D) -14.28 (E)-11.78 d) The interest rate (continuously compounded) for Euro dollars is 2% and the interest rate (continuously compounded) for US dollars is 5%. The current exchange rate is 0.85/$1. The price of a 6 month European call option on $1 with strike 0.832/$1 is $0.072. Calculate the price of a dollar-denominated 6-month European put option to sell 1 at $1.202/ 1. (A)0.045 (B) 0.067 (C) 0.079 (D) 0.082 (E) 0.056 Question 1 a) Consider a 6 year 8% coupon bond with a face value of 1000. It pays semi-annual coupons and is issued today.A call and put (both with the same strike price of 1050 and same 1 year maturity) on that bond are available. The call is priced at 80. The continuously compounded interest rate is 6%. Calculate the put price. b) A non dividend paying stock, priced at 63 is the underlying asset for put and call options with a 3month maturity. Both options have a strike value of 65.The effective annual interest rate is 5%. The put option is 1.4 times the value of the call option. Calculate the put price, P. c) A stock is priced at 105 and 6month options are written on the stock. An investor purchases a 100 strike European put for 5.65 and a 110 strike put for 10.63. If the force of interest is 6%, calculate the investor's total profit after 6months given that the stock price remained unchanged over the month period. (A)-8.28 (B)-5.28 (C)-16.78 (D) -14.28 (E)-11.78 d) The interest rate (continuously compounded) for Euro dollars is 2% and the interest rate (continuously compounded) for US dollars is 5%. The current exchange rate is 0.85/$1. The price of a 6 month European call option on $1 with strike 0.832/$1 is $0.072. Calculate the price of a dollar-denominated 6-month European put option to sell 1 at $1.202/ 1. (A)0.045 (B) 0.067 (C) 0.079 (D) 0.082 (E) 0.056

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts