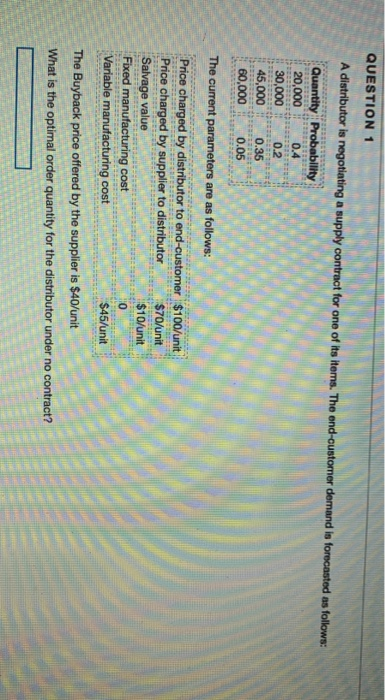

Question: QUESTION 1 A distributor is negotiating a supply contract for one of its items. The end-customer demand in forecasted as follows: Quantity Probability 20,000 0.4

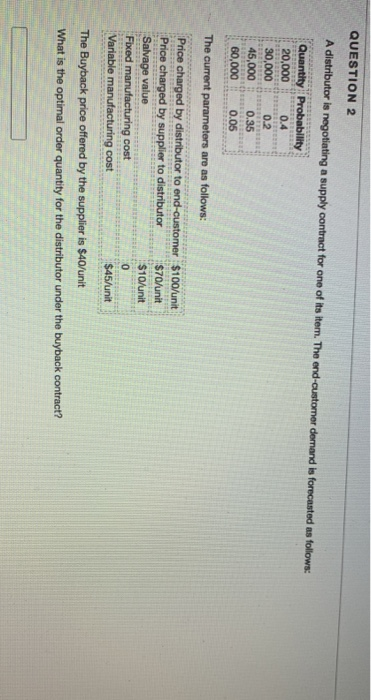

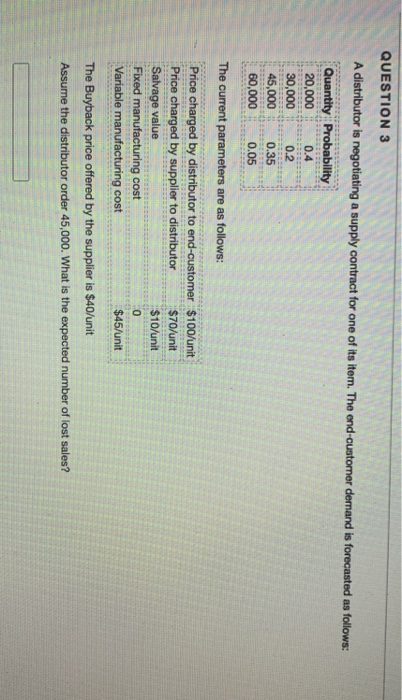

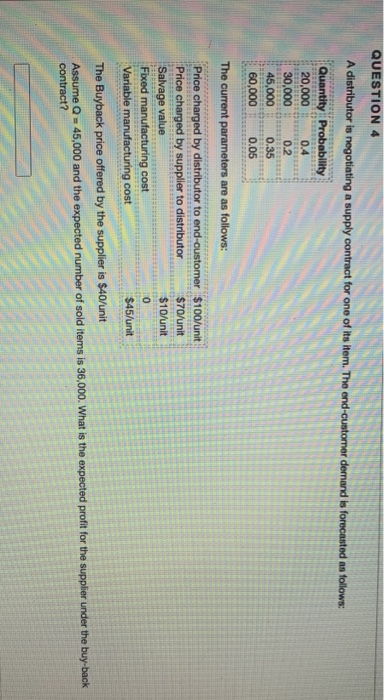

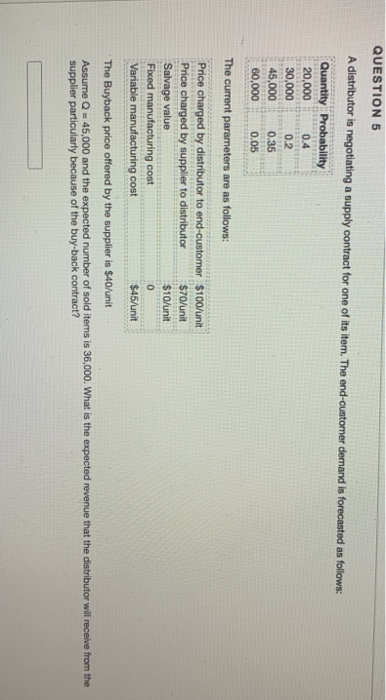

QUESTION 1 A distributor is negotiating a supply contract for one of its items. The end-customer demand in forecasted as follows: Quantity Probability 20,000 0.4 30,000 0.2 45,000 0.35 60,000 0.05 The current parameters are as follows: Price charged by distributor to end-customer $100/unit Price charged by supplier to distributor $70/unit Salvage value $10/unit Fixed manufacturing cost 0 Variable manufacturing cost $45/unit The Buyback price offered by the supplier is $40/unit What is the optimal order quantity for the distributor under no contract? QUESTION 2 A distributor is negotiating a supply contract for one of its item. The end-customer demand is forecasted as follows: Quantity Probability 20,000 0.4 30,000 0.2 45,000 0.35 60,000 0.05 The current parameters are as follows: Price charged by distributor to end-customer $100/unit Price charged by supplier to distributor $70/unit Salvage value $10/unit Fixed manufacturing cost 0 Variable manufacturing cost $45/unit The Buyback price offered by the supplier is $40/unit What is the optimal order quantity for the distributor under the buyback contract? QUESTION 3 A distributor is negotiating a supply contract for one of its item. The end-customer demand is forecasted as follows: Quantity Probability 20,000 0.4 30,000 0.2 45,000 0.35 60,000 0.05 The current parameters are as follows: Price charged by distributor to end-customer $100/unit Price charged by supplier to distributor $70/unit Salvage value $10/unit Fixed manufacturing cost 0 Variable manufacturing cost $45/unit The Buyback price offered by the supplier is $40/unit Assume the distributor order 45,000. What is the expected number of lost sales? QUESTION 4 A distributor is negotiating a supply contract for one of its item. The end-customer demnand is forecasted as follows: Quantity Probability 20,000 0.4 30,000 0.2 45,000 0.35 60,000 0.05 The current parameters are as follows: Price charged by distributor to end-customer $100/unit Price charged by supplier to distributor $70/unit Salvage value $10/unit Fixed manufacturing cost Variable manufacturing cost $45/unit The Buyback price offered by the supplier is $40/unit Assume Q = 45,000 and the expected number of sold items is 36,000. What is the expected profit for the supplier under the buy-back contract? 0 QUESTION 5 A distributor is negotiating a supply contract for one of its item. The end-customer demand is forecasted as follows: Quantity Probability 20,000 0.4 30,000 0.2 45,000 0.35 60,000 0.05 The current parameters are as follows: Price charged by distributor to end-customer S100/unit Price charged by supplier to distributor $70/unit Salvage value $10/unit Fixed manufacturing cost Variable manufacturing cost $45/unit The Buyback price offered by the supplier is $40/unit Assume Q = 45,000 and the expected number of sold items is 36,000. What is the expected revenue that the distributor will receive from the supplier particularly because of the buy-back contract? 0