Question: Question 1 a) Explain the term Industry average. b) In performing cross-sectional analysis, firms are more likely to use Industry Average Ratios rather than ratios

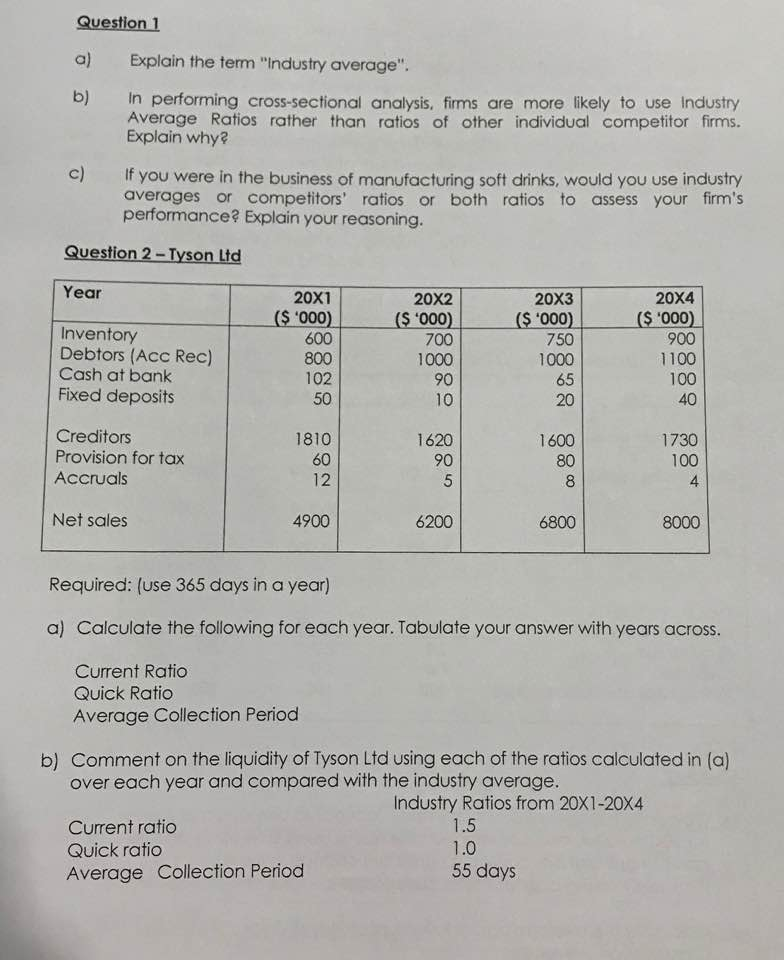

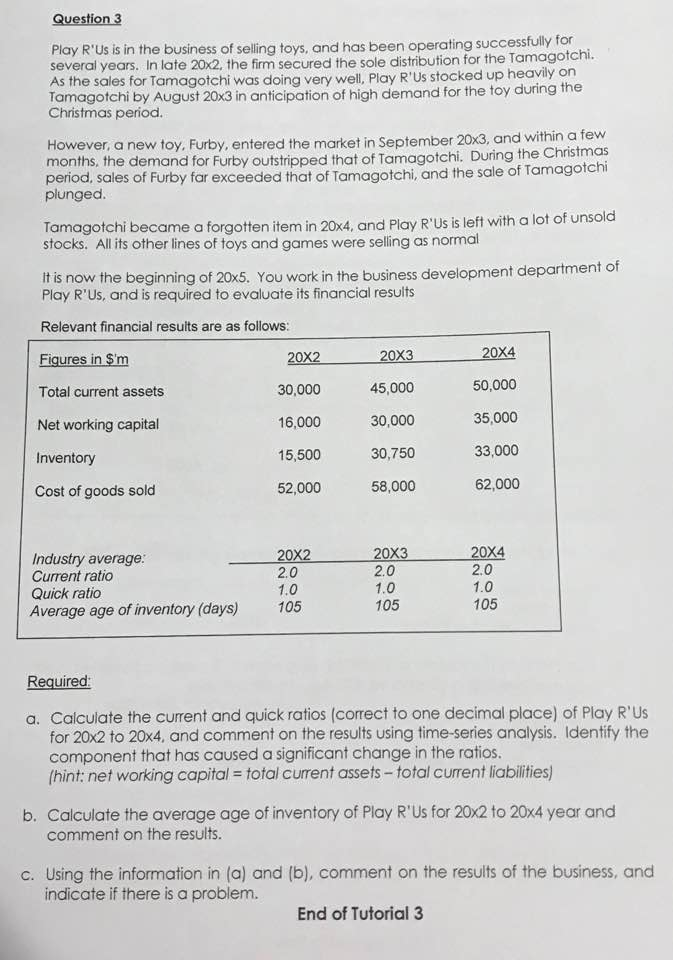

Question 1 a) Explain the term "Industry average". b) In performing cross-sectional analysis, firms are more likely to use Industry Average Ratios rather than ratios of other individual competitor firms. Explain why? c) If you were in the business of manufacturing soft drinks, would you use industry averages or competitors' ratios or both ratios to assess your firm's performance? Explain your reasoning. Question 2-Tyson Ltd Year 20x1 (S '000) 600 800 102 50 20X2 ($ '000) 700 1000 90 10 20X3 ($ '000) 750 1000 65 20 20X4 Inventory Debtors (Acc Rec) Cash at bank Fixed deposits 900 1100 100 40 Creditors Provision for tax Accruals 1810 12 4900 1620 90 1600 1730 100 Net sales 6200 6800 8000 Required: (use 365 days in a year) a) Calculate the following for each year. Tabulate your answer with years across. Current Ratio Quick Ratio Average Collection Period b) Comment on the liquidity of Tyson Ltd using each of the ratios calculated in (a) over each year and compared with the industry average. Industry Ratios from 20X1-20X4 Current ratio Quick ratico Average Collection Period 1.0 55 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts