Question: Question 1 (a) How much would I need to have invest today in order to have $1,850,000 in twenty years from today if interest is

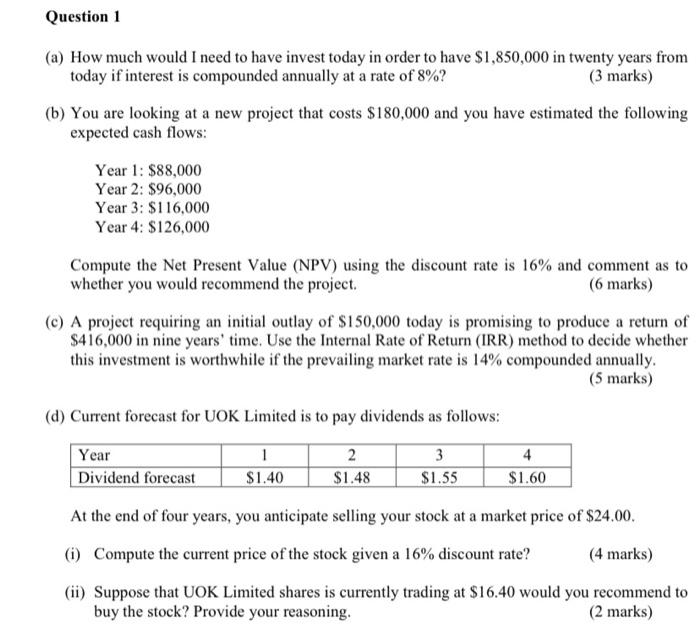

Question 1 (a) How much would I need to have invest today in order to have $1,850,000 in twenty years from today if interest is compounded annually at a rate of 8%? (3 marks) (b) You are looking at a new project that costs $180,000 and you have estimated the following expected cash flows: Year 1: $88,000 Year 2: $96,000 Year 3: $116,000 Year 4: $126,000 Compute the Net Present Value (NPV) using the discount rate is 16% and comment as to whether you would recommend the project. (6 marks) (c) A project requiring an initial outlay of $150,000 today is promising to produce a return of $416,000 in nine years' time. Use the Internal Rate of Return (IRR) method to decide whether this investment is worthwhile if the prevailing market rate is 14% compounded annually. (5 marks) (d) Current forecast for UOK Limited is to pay dividends as follows: Year Dividend forecast 1 $1.40 2 $1.48 3 $1.55 4 $1.60 At the end of four years, you anticipate selling your stock at a market price of $24.00 (1) Compute the current price of the stock given a 16% discount rate? (4 marks) (ii) Suppose that UOK Limited shares is currently trading at $16.40 would you recommend to buy the stock? Provide your reasoning. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts