Question: Question 1 A one year long forward contract on a non-dividend-paying stock is entered into when the stock price is $45 and the risk free

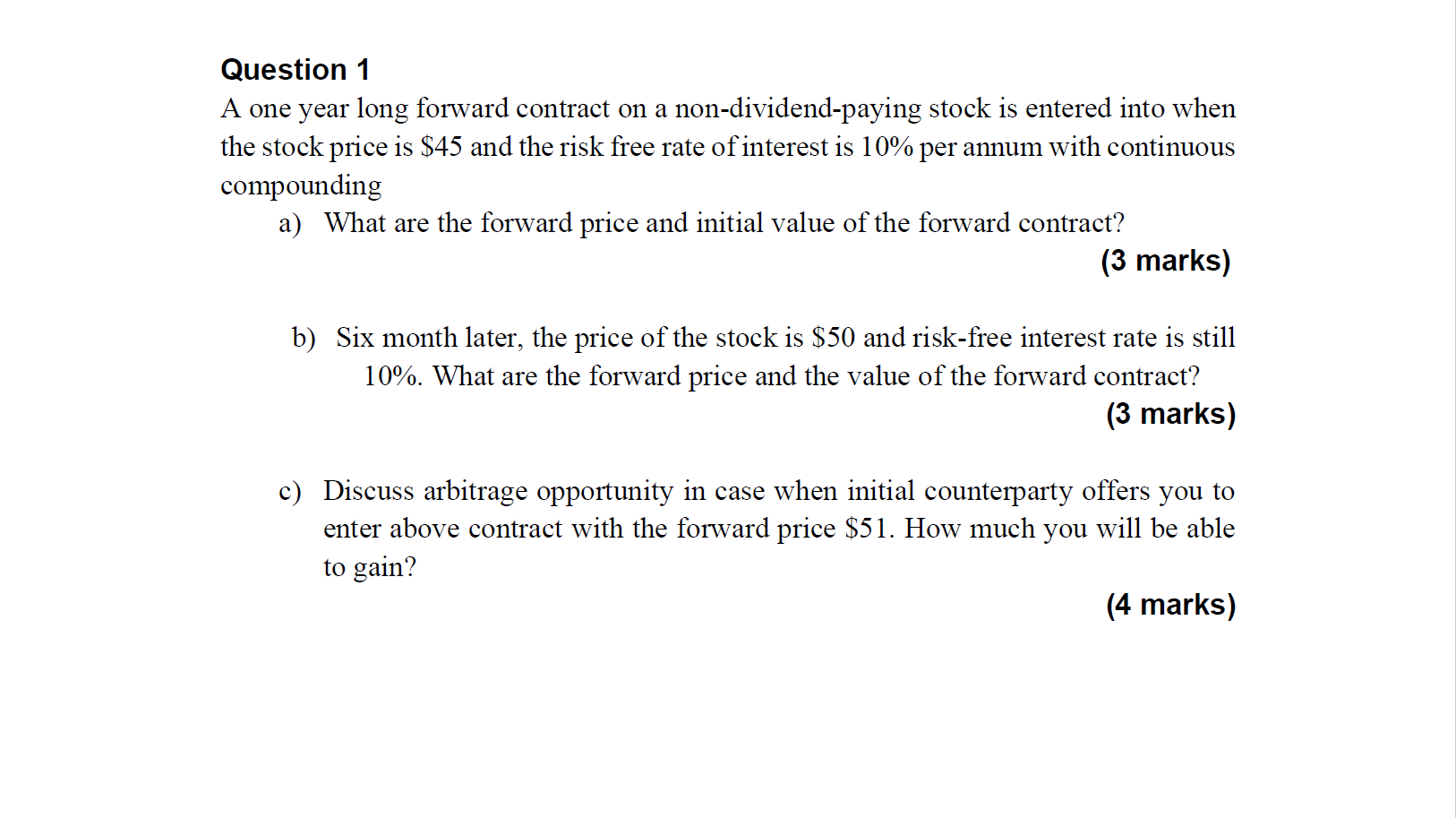

Question 1 A one year long forward contract on a non-dividend-paying stock is entered into when the stock price is $45 and the risk free rate of interest is 10% per annum with continuous compounding a) What are the forward price and initial value of the forward contract? (3 marks) b) Six month later, the price of the stock is $50 and risk-free interest rate is still 10%. What are the forward price and the value of the forward contract? (3 marks) c) Discuss arbitrage opportunity in case when initial counterparty offers you to enter above contract with the forward price $51. How much you will be able to gain? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts