Question: Question 1 . A Private Equity Fund A and an Investment Bank B entered a 3-year interest rate swap on April 1st, 2022. The Notional

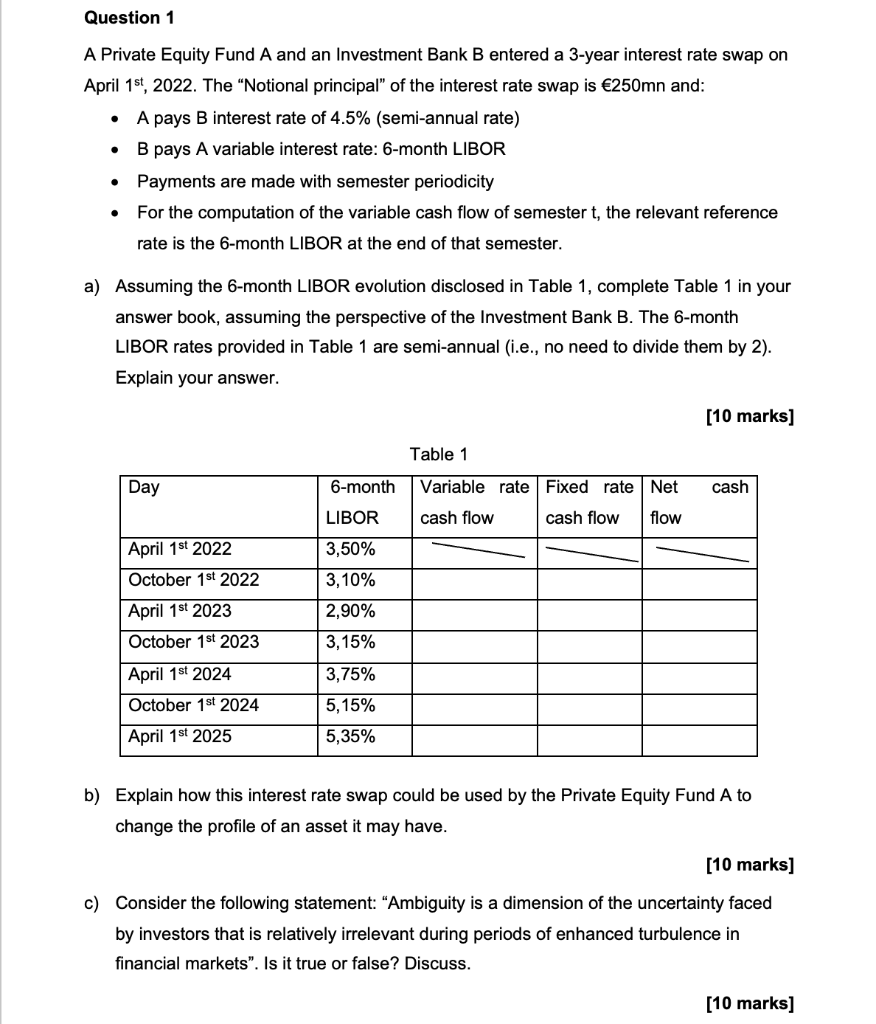

Question 1 . A Private Equity Fund A and an Investment Bank B entered a 3-year interest rate swap on April 1st, 2022. The "Notional principal" of the interest rate swap is 250mn and: A pays B interest rate of 4.5% (semi-annual rate) B pays A variable interest rate: 6-month LIBOR Payments are made with semester periodicity For the computation of the variable cash flow of semester t, the relevant reference rate is the 6-month LIBOR at the end of that semester. . . . a) Assuming the 6-month LIBOR evolution disclosed in Table 1, complete Table 1 in your answer book, assuming the perspective of the Investment Bank B. The 6-month LIBOR rates provided in Table 1 are semi-annual (i.e., no need to divide them by 2). Explain your answer. [10 marks] Table 1 Day 6-month Variable rate Fixed rate Net cash cash flow cash flow flow April 1st 2022 October 1st 2022 LIBOR 3,50% 3,10% 2,90% 3,15% April 1st 2023 October 1st 2023 April 1st 2024 3,75% October 1st 2024 5,15% 5,35% April 1st 2025 b) Explain how this interest rate swap could be used by the Private Equity Fund A to change the profile of an asset it may have. [10 marks] c) Consider the following statement: "Ambiguity is a dimension of the uncertainty faced by investors that is relatively irrelevant during periods of enhanced turbulence in financial markets". Is it true or false? Discuss. [10 marks] Question 1 . A Private Equity Fund A and an Investment Bank B entered a 3-year interest rate swap on April 1st, 2022. The "Notional principal" of the interest rate swap is 250mn and: A pays B interest rate of 4.5% (semi-annual rate) B pays A variable interest rate: 6-month LIBOR Payments are made with semester periodicity For the computation of the variable cash flow of semester t, the relevant reference rate is the 6-month LIBOR at the end of that semester. . . . a) Assuming the 6-month LIBOR evolution disclosed in Table 1, complete Table 1 in your answer book, assuming the perspective of the Investment Bank B. The 6-month LIBOR rates provided in Table 1 are semi-annual (i.e., no need to divide them by 2). Explain your answer. [10 marks] Table 1 Day 6-month Variable rate Fixed rate Net cash cash flow cash flow flow April 1st 2022 October 1st 2022 LIBOR 3,50% 3,10% 2,90% 3,15% April 1st 2023 October 1st 2023 April 1st 2024 3,75% October 1st 2024 5,15% 5,35% April 1st 2025 b) Explain how this interest rate swap could be used by the Private Equity Fund A to change the profile of an asset it may have. [10 marks] c) Consider the following statement: "Ambiguity is a dimension of the uncertainty faced by investors that is relatively irrelevant during periods of enhanced turbulence in financial markets". Is it true or false? Discuss. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts