Question: Question 1 a. Risk of project A is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that

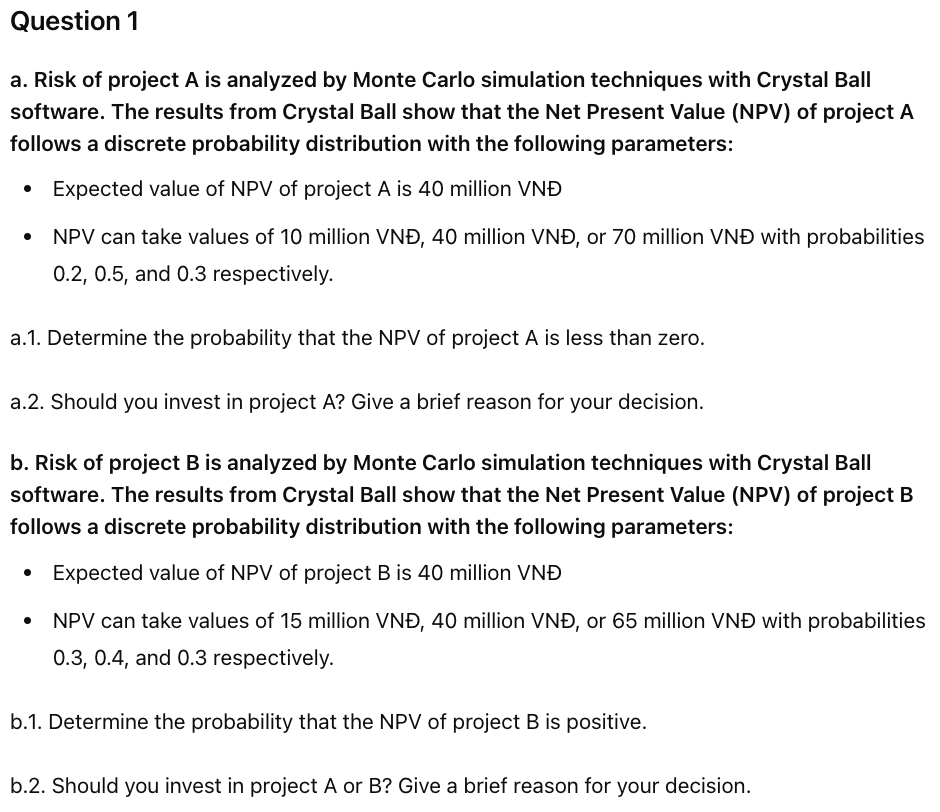

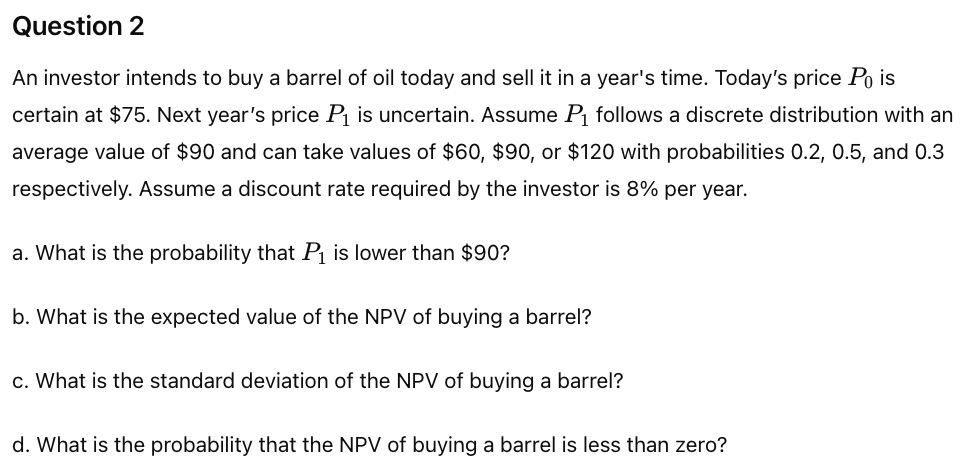

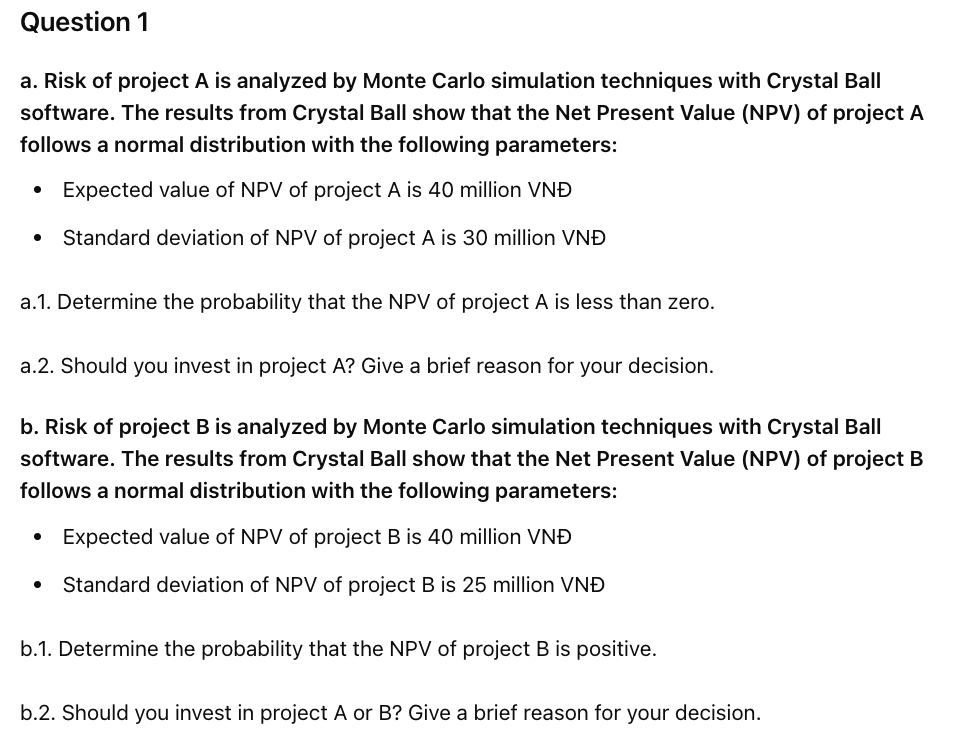

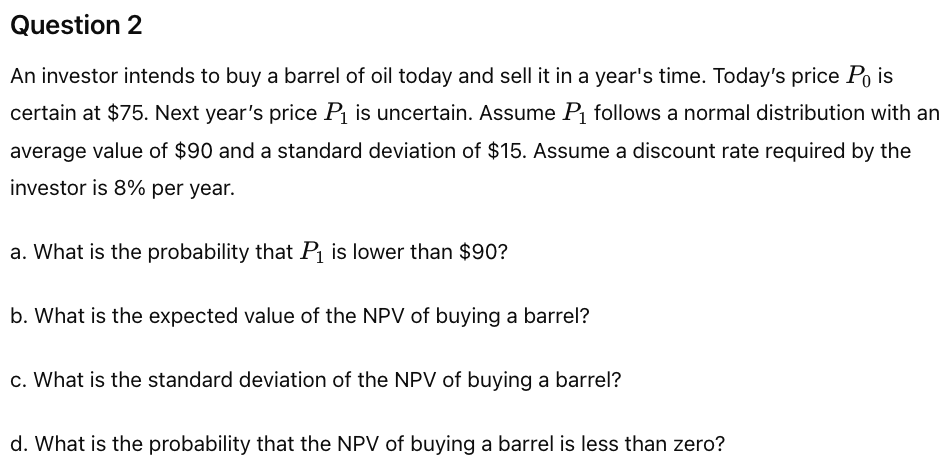

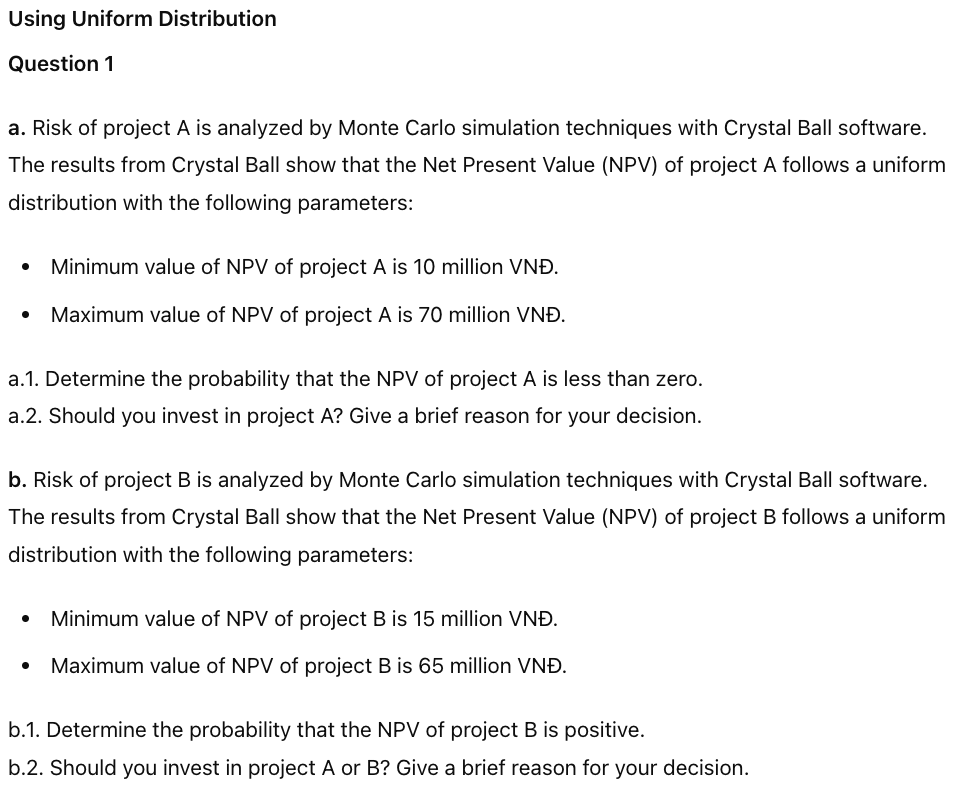

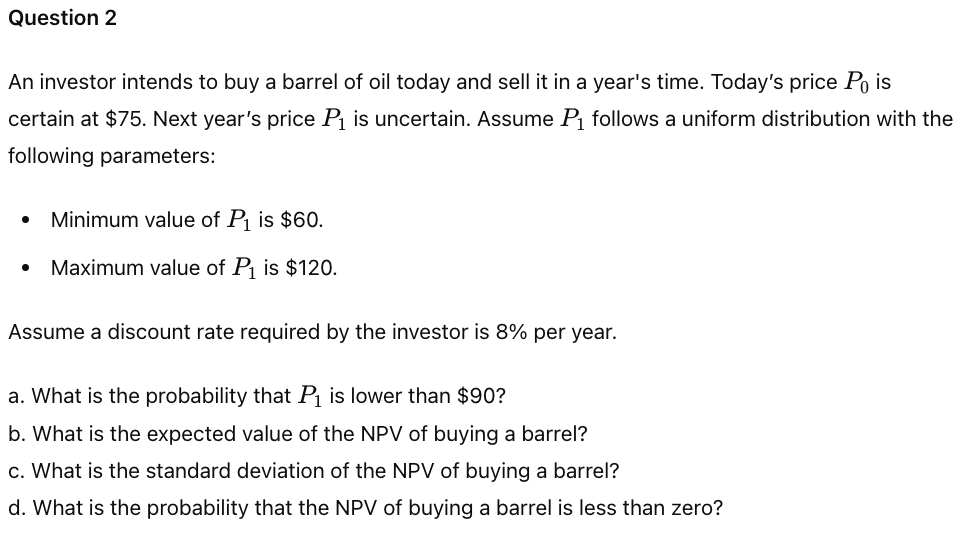

Question 1 a. Risk of project A is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that the Net Present Value (NPV) of project A follows a discrete probability distribution with the following parameters: e Expected value of NPV of project A is 40 million VND NPV can take values of 10 million VND, 40 million VND, or 70 million VND with probabilities 0.2, 0.5, and 0.3 respectively. a.1. Determine the probability that the NPV of project A is less than zero. a.2. Should you invest in project A? Give a brief reason for your decision. b. Risk of project B is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that the Net Present Value (NPV) of project B follows a discrete probability distribution with the following parameters: e Expected value of NPV of project B is 40 million VND e NPV can take values of 15 million VND, 40 million VNB, or 65 million VND with probabilities 0.3, 0.4, and 0.3 respectively. b.1. Determine the probability that the NPV of project B is positive. b.2. Should you invest in project A or B? Give a brief reason for your decision. Question 2 An investor intends to buy a barrel of oil today and sell it in a year's time. Today's price Py is certain at $75. Next year's price P, is uncertain. Assume P; follows a discrete distribution with an average value of $90 and can take values of $60, $90, or $120 with probabilities 0.2, 0.5, and 0.3 respectively. Assume a discount rate required by the investor is 8% per year. a. What is the probability that P is lower than $907? b. What is the expected value of the NPV of buying a barrel? c. What is the standard deviation of the NPV of buying a barrel? d. What is the probability that the NPV of buying a barrel is less than zero? Question 1 a. Risk of project A is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that the Net Present Value (NPV) of project A follows a normal distribution with the following parameters: e Expected value of NPV of project A is 40 million VND e Standard deviation of NPV of project A is 30 million VND a.1. Determine the probability that the NPV of project A is less than zero. a.2. Should you invest in project A? Give a brief reason for your decision. b. Risk of project B is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that the Net Present Value (NPV) of project B follows a normal distribution with the following parameters: Expected value of NPV of project B is 40 million VND Standard deviation of NPV of project B is 25 million VND b.1. Determine the probability that the NPV of project B is positive. b.2. Should you invest in project A or B? Give a brief reason for your decision. Question 2 An investor intends to buy a barrel of oil today and sell it in a year's time. Today's price P is certain at $75. Next year's price P, is uncertain. Assume P, follows a normal distribution with an average value of $90 and a standard deviation of $15. Assume a discount rate required by the investor is 8% per year. a. What is the probability that P, is lower than $90? b. What is the expected value of the NPV of buying a barrel? c. What is the standard deviation of the NPV of buying a barrel? d. What is the probability that the NPV of buying a barrel is less than zero? Using Uniform Distribution Question 1 a. Risk of project A is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that the Net Present Value (NPV) of project A follows a uniform distribution with the following parameters: Minimum value of NPV of project A is 10 million VND. Maximum value of NPV of project A is 70 million VND. a.1. Determine the probability that the NPV of project A is less than zero. a.2. Should you invest in project A? Give a brief reason for your decision. b. Risk of project B is analyzed by Monte Carlo simulation techniques with Crystal Ball software. The results from Crystal Ball show that the Net Present Value (NPV) of project B follows a uniform distribution with the following parameters: Minimum value of NPV of project B is 15 million VND. Maximum value of NPV of project B is 65 million VND. b.1. Determine the probability that the NPV of project B is positive. b.2. Should you invest in project A or B? Give a brief reason for your decision. Question 2 An investor intends to buy a barrel of oil today and sell it in a year's time. Today's price P is certain at $75. Next year's price P is uncertain. Assume P; follows a uniform distribution with the following parameters: e Minimum value of P, is $60. e Maximum value of Pj is $120. Assume a discount rate required by the investor is 8% per year. a. What is the probability that P; is lower than $90? b. What is the expected value of the NPV of buying a barrel? c. What is the standard deviation of the NPV of buying a barrel? d. What is the probability that the NPV of buying a barrel is less than zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts