Question: Question 1 - A Simple Market Model - Let us consider the one-step binomial model to represent the stock market. In this regard, we know

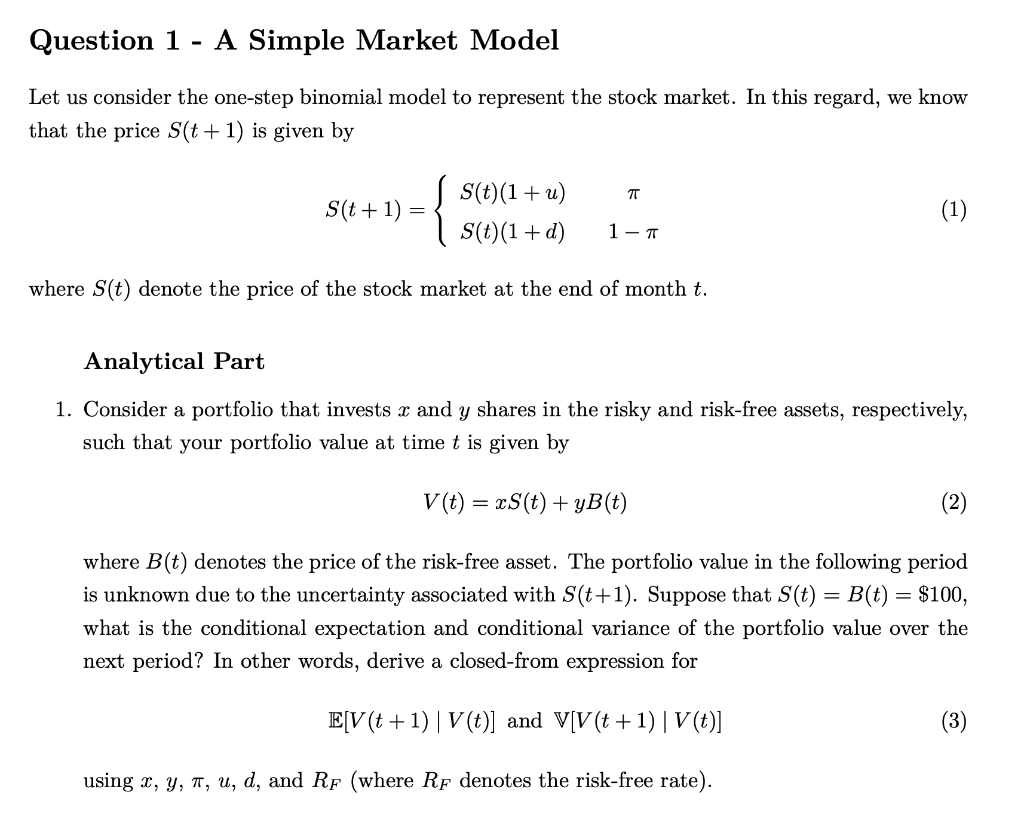

Question 1 - A Simple Market Model - Let us consider the one-step binomial model to represent the stock market. In this regard, we know that the price S(t+1) is given by 7T S(t + 1) = { S(t)(1+u) S(t)(1+d) (1) 1-7 where S(t) denote the price of the stock market at the end of month t. Analytical Part 1. Consider a portfolio that invests x and y shares in the risky and risk-free assets, respectively, such that your portfolio value at time t is given by V(t) = xS(t) +yB(t) (2) = = where B(t) denotes the price of the risk-free asset. The portfolio value in the following period is unknown due to the uncertainty associated with S(t+1). Suppose that S(t) = B(t) = $100, what is the conditional expectation and conditional variance of the portfolio value over the next period? In other words, derive a closed-from expression for E[V(t+1)|V(t)] and V[V(t+1)|V(t)] (3) using x, y, at, u, d, and RF (where Rf denotes the risk-free rate). Question 1 - A Simple Market Model - Let us consider the one-step binomial model to represent the stock market. In this regard, we know that the price S(t+1) is given by 7T S(t + 1) = { S(t)(1+u) S(t)(1+d) (1) 1-7 where S(t) denote the price of the stock market at the end of month t. Analytical Part 1. Consider a portfolio that invests x and y shares in the risky and risk-free assets, respectively, such that your portfolio value at time t is given by V(t) = xS(t) +yB(t) (2) = = where B(t) denotes the price of the risk-free asset. The portfolio value in the following period is unknown due to the uncertainty associated with S(t+1). Suppose that S(t) = B(t) = $100, what is the conditional expectation and conditional variance of the portfolio value over the next period? In other words, derive a closed-from expression for E[V(t+1)|V(t)] and V[V(t+1)|V(t)] (3) using x, y, at, u, d, and RF (where Rf denotes the risk-free rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts