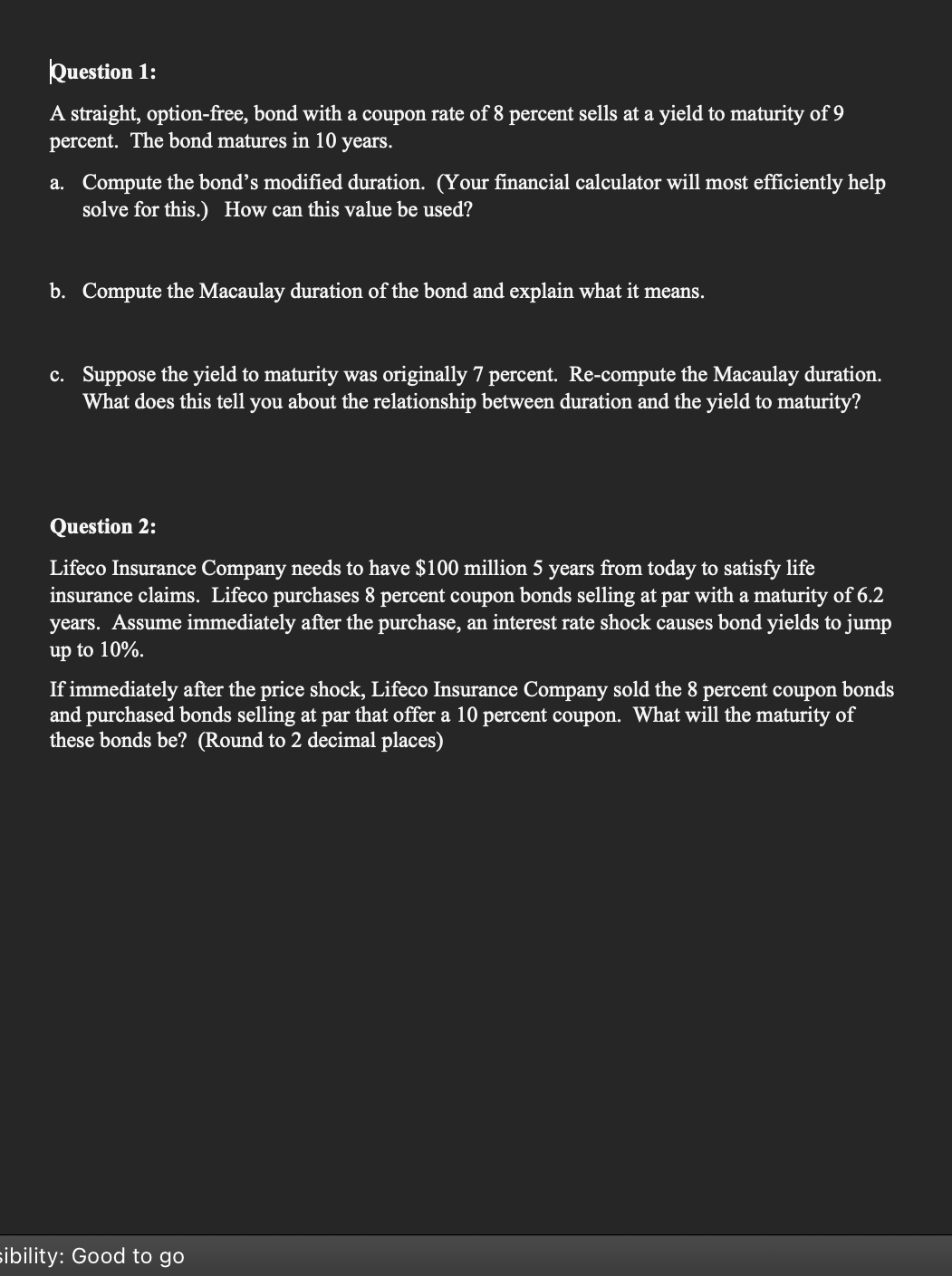

Question: Question 1 : A straight, option - free, bond with a coupon rate of 8 percent sells at a yield to maturity of 9 percent.

Question :

A straight, optionfree, bond with a coupon rate of percent sells at a yield to maturity of percent. The bond matures in years.

a Compute the bond's modified duration. Your financial calculator will most efficiently help solve for this. How can this value be used?

b Compute the Macaulay duration of the bond and explain what it means.

c Suppose the yield to maturity was originally percent. Recompute the Macaulay duration. What does this tell you about the relationship between duration and the yield to maturity?

Question :

Lifeco Insurance Company needs to have $ million years from today to satisfy life insurance claims. Lifeco purchases percent coupon bonds selling at par with a maturity of years. Assume immediately after the purchase, an interest rate shock causes bond yields to jump up to

If immediately after the price shock, Lifeco Insurance Company sold the percent coupon bonds and purchased bonds selling at par that offer a percent coupon. What will the maturity of these bonds beRound to decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock