Question: Question 1 ( a ) The following are the draft statement of financial position and statement of profit and loss of P Co and S

Question

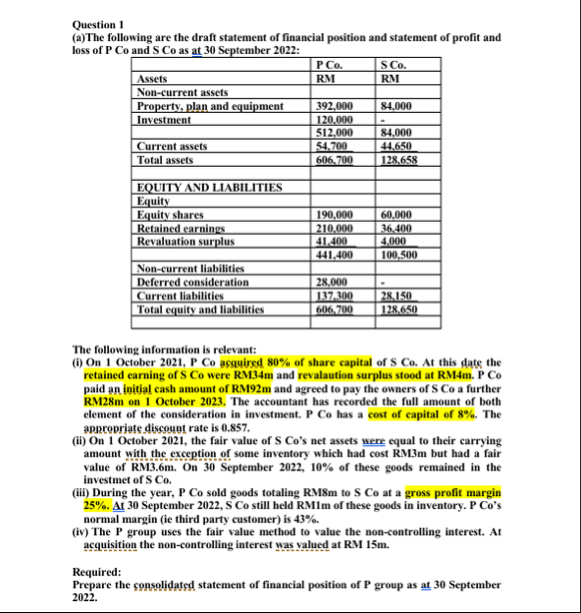

aThe following are the draft statement of financial position and statement of profit and loss of P Co and S Co as at September :

tablePCo.,S CoAssetsRMRMNoncurrent assets,,Property plan and equipment,InvestmentCurrent assets,Total assets,EQUITY AND LIABILITIES,,EquityEquity shares,Retained earnings,Revaluation surplus,Noncurrent liabilities,,Deferred consideration,Current liabilities,Total equity and liabilities,

The following information is relevant:

i On October P Co asquired of share capital of S Co At this date the retained carning of S Co were RMm and revalaution surplus stood at RMm P Co paid an initial cash amount of RMm and agreed to pay the owners of S Co a further RMm on October The accountant has recorded the full amount of both element of the consideration in investment. P Co has a cost of capital of The appropriate discount rate is

ii On October the fair value of S Co's net assets were equal to their carrying amount with the exception of some inventory which had cost RMm but had a fair value of RMm On September of these goods remained in the investmet of S Co

iii During the year, P Co sold goods totaling RM m to S Co at a gross profit margin At September S Costill held RMm of these goods in inventory. P Co's normal margin ie third party customer is

iv The group uses the fair value method to value the noncontrolling interest. At acquisition the noncontrolling interest was valued at RM m

Required:

Prepare the cnsolidated statement of financial position of P group as at September b Explain any TWO difference between accounting for subsidiaries and association companies

c X Bhd acquires of the issed shares capital of M Bhd on December These are no intragroup transaction. The statement of profit or loss of Bhd and Bhd for the year ended December are as follows:

tableX BhdM BhdRMRMSalesCost of sales,Gross profit,Operating expenses,Profit before tax,TaxProfit after tax,

Required:

Prepare the cnsolidated statement of profit or loss for Berhad for the year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock